A policy win, Albanese's inflation challenge, and Housing's silver lining

Before getting into today’s post, I just want to thank everyone who filled out last week’s reader survey. Your comments were all informative and certainly gave me a lot to think about. Most of all, I’m glad that so many of you are enjoying what I write!

Building on that, I also have some news. Going forward, there will be no more Fodder. In fact, the general structure and timing of most posts will change in the sense that there won’t be one: instead of a Mon/Wed/Fri schedule, I’m just going to hit “publish” when I’m done writing. On occasion, I might even send a few shorter posts over multiple days to deal with an emerging issue. Sometimes I’ll cover multiple issues in a single post, as I’m going to do today.

Furthermore, regular readers have probably noticed that I’m generally supportive of open source, where it be software or AI. I want to take a similar approach to my writing by ensuring that it’s available to all.

So, as of today all pay-walled posts will be available to all logged-in members after 30 days, regardless of whether you have an active subscription. Paid supporters will continue to get timely insights first, but eventually the content will be opened for everyone. You’ll still need a paid subscription to comment on posts, and next year I plan to start adding bonus analysis that will never be made public.

Phew. With all of that out of the way, on to today’s post.

A bad bill was defeated

I wish I could write titles like this more often. For as Labor and the Coalition look set to slug Australians with two truly awful bills in the form of social media age restrictions and new limits on political donations – which will help reduce criticism and consolidate the power of the two major parties – at least we’ll be spared a third:

“The government’s plan to restrict the number of international students able to enrol from the start of next year appears doomed, with the Coalition and the Greens set to vote against the contentious bill.

Labor hoped to bring temporary migration numbers back to pre-pandemic levels and crack down on dodgy education providers by limiting the number of international students able to start study in Australia to 270,000 next year.

But with just two weeks of parliament left before the January 1 start date, the Coalition said it would oppose the ‘chaotic and confused’ bill that would give the education minister the power to set international student caps.”

I’ve written about why the proposed cap was a bad idea before, so I’m happy to see it defeated. At the time I also provided an alternative that was more likely to be efficient, effective at reducing student numbers, and equitable:

“Higher fees will do the job without a quota. Done properly, they can render a quota useless: all you have to do is set the fee high enough to reduce demand to whatever you consider ‘appropriate’, and the number of applications will fall to that level. The government then collects a bit of extra revenue it can use to offset some of what the public perceives to be the worst consequences of international students, which mostly seems to be housing-related, and we can all get on with our lives.

But there are even more benefits of using a fee over a quota. The first is it’s more equitable: our universities earn rents by attracting international students and charging them significantly more than domestic students. By increasing the fee for international students, the government can tax away some of those rents and ensure a more equitable distribution of them. Perhaps vice Chancellors will have to take a bit of a pay cut, and universities will have to scale back some of their more ambitious want-to-haves, rather than need-to-haves to educate society, but everyone else benefits.”

The economics answer to how big the tax should be is “it depends”. Specifically, it depends on the elasticities. But given that the Albanese government has already raised visa fees, and yet student visa numbers are at all-time highs, it’s probably relatively inelastic. Of course, some of that demand might have been ‘pulled forward’ due to the uncertainty about future quotas. Nevertheless, it certainly appears that foreign students like studying in Australia (or at least their parents do).

Given that immigration is still a hot topic, hopefully one of the major parties eventually listens to their economists and regulates international student numbers by price rather than quantity. Alas, that doesn’t seem likely to happen under an Albanese or Dutton government.

Money illusion could cost Albo

Anthony Albanese let it slip last week that there will be no early election:

“In an exclusive interview from the APEC 2024 summit in Peru, Sky News Political Editor Andrew Clennell asked Mr Albanese about the possibility of a March election.

The Prime Minister’s response gave the impression that the election would in fact be held in May.

‘We’ll go to an election sometime between May and I don’t talk with any state premiers or journalists about when those options might be,’ Mr Albanese told Clennell.

‘But we have a budget scheduled for March and the election will be in May,’ Mr Albanese said.”

The question was motivated by comments from Western Australia’s Premier Roger Cook, who had recently “sought legal advice” as to what he could do if the federal election clashed with the WA election scheduled for 8 March 2025 (if you want to know, a federal election would take precedent and force the WA election to be pushed back).

So, we’re probably not going to get an election until May. That gives Albo around six months to right the ship and convince voters to give him a second chance, instead of condemning him to being the first Prime Minister since James Scullin (1929-1931) to be voted out after a single term.

Albo’s problem is that Australia has one of the highest rates of inflation in the developed world, and voters have been punishing incumbents for it all year. And earlier this week, the Reserve Bank of Australia (RBA) indicated that it wasn’t exactly confident of that changing any time soon:

“Inflation had been declining over the prior year, driven most recently by lower fuel prices and the expected fall in electricity prices. However, members observed that underlying inflation – as indicated by the ’trimmed mean’ measure – remained too high and that the staff forecasts did not see inflation returning sustainably to target until 2026.

…

Members noted that the staff forecasts were conditioned on a technical assumption – derived from market pricing – that the cash rate target would remain at its current level for a number of months before being lowered several times in 2025 and 2026.”

Not only will Albo have to contend with persistent inflation, but he’ll somehow need to overcome what economists call money illusion. Specifically, that most people aren’t economically literate and tend to think of money in nominal, rather than real terms.

Stated differently, people tend to compare their nominal incomes today with prices from a few years ago, and when you do that the situation looks bad. I’m not kidding; you can find examples like this all over social media:

In terms of the literature:

“Cummings and Mahoney (2023b), two coauthors of this piece, examine this question using data on the historical relationship between inflation and sentiment. They find that the effect of inflation ‘decays’ at a rate of about 50% per year, meaning that an inflationary shock’s impact on sentiment will be roughly half the size after one year, one-quarter the size after two years, and one-eighth the size the year after. An implication is that the post-COVID-19 inflation surge, which peaked in July 2022, should just now be passing through the system.”

Even if Australia had inflation sustainably back to within the RBA’s 2-3% target, i.e. had stabilised the rate at which prices are increasing, people would still be pissed about the higher price level for years to come. If you’re the incumbent federal government that does not bode well for your re-election prospects, which is perhaps why Albo is trailing in the polls and on betting markets.

The grass is always greener

When inflation first hit in 2021-22, many Australians were certainly jealous of Americans sitting pretty with their fixed 30-year mortgages. In fact, I wrote a whole post about it. The long and the short of it is that there’s a trade-off. In the US, government entities (taxpayers) assume most of the maturity mismatch risk that makes the system possible, and the economy takes a productivity hit from the ‘golden handcuffs’ that prevent people from moving.

By contrast, the Australian model continues to clear, avoiding the lock-in in the US market. Variable rate mortgages also tend to be cheaper at the start, making it easier to get on the property ladder. The downside is that when rates rise, Australian households suffer a greater hit to their disposable incomes.

So I was curious when I saw a post from Moses Sternstein suggested a solution to America’s housing “crisis” was… the Australian model:

“The simplest way to ‘unstick’ the housing market would be to eliminate the 30-year fixed rate mortgage, and convert everything to a floating rate mortgage instead.

That would free banks from ‘mortgage rate lock-in’ (and their ‘unrealised losses’), and it would force existing homeowners to carry the real cost of their debt. That would create an actual ’lock-in’ effect—locked-in with the reality of higher-for-longer-for-now.

Suddenly, selling one’s home would become more attractive—either because the carrying costs are too high, or because the tradeoff for a new home is not quite so steep.

Naturally, at that point, owners would lower their asking prices to match the bids, and transactions would start clearing again.

‘Unfixing’ mortgage rates is the solution that makes sense, when the ‘fixed’ rate is the only (or primary) thing that’s ‘broken’ in the housing market right now. It’s really pretty simple. If you got a mortgage before 2022, then banks are subsidising the massive increase in borrowing costs. If you’re trying to get one after 2022, they will not.

That’s it.”

The grass is always greener in some other place, until you get up and close and start to see the weeds.

Fun fact

Why Europe stagnates, in one image:

Further thoughts

- The Albanese government has given the Future Fund a new mandate that will force it to invest more heavily in domestic “priority areas” such as “the energy transition, the supply of residential housing, and infrastructure”, rather than overseas where returns are greater. They’re not even pretending any more; all the more reason for it to be abolished.

- Indiana University’s Ahmad Lashkaripour wrote a good X thread on what economists think about tariffs. One in particular stood out: if Trump kicks off a full-scale tariff/trade war, it could cost the “equivalent to erasing South Korea from the world economy”.

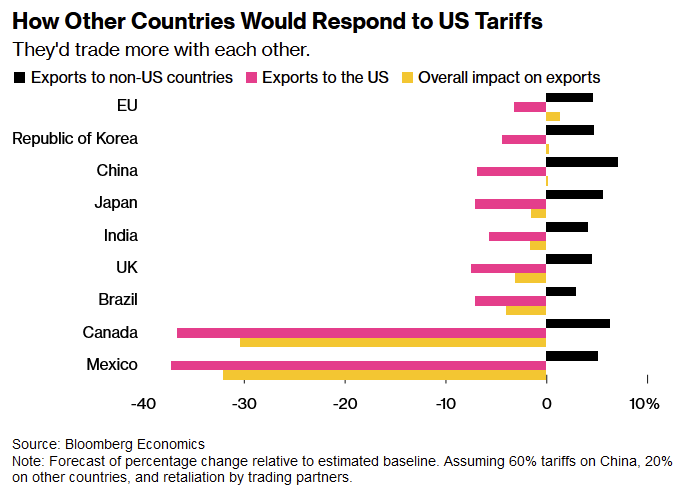

- Bloomberg takes the more optimistic view that trade after Trump could “keep on humming — just without the US at its centre”. Any loss of trade with the US would just be offset by “simply by trading more with each other”. Unless you’re Canadian or Mexican, that is:

- Elon Musk spent something like $200 million on Donald Trump’s 2024 campaign. Since the election, Tesla stock – of which Elon owns 22.3% – is up more than 40%, netting him a cool $74 billion. Those are just paper gains, of course; but given that for tax purposes American billionaires generally fund their lifestyles by borrowing against their assets, rather than selling them (“buy, borrow, die”, Elon’s return on investment is looking pretty darn good.

- How might Trump help Elon? By pulling up the ladder: he’ll scrap the EV tax credit, which Tesla supports because it will do more harm to competitors by pulling up the ladder behind it. The second piece of that puzzle are tariffs – Trump might even tax cars made in Mexico, effectively eliminating the only real threat of foreign EV manufacturers (China-made cars are already tariffed at 100%). Finally, a Trump administration may deregulate the autonomous driving space, which would be good for Tesla given its… less reliable methods.

- Russia’s invasion of Ukraine looks to have changed war forever through the innovation of mass-produced, automated drones. Yep, you can’t even jam them any more – they now come with an autopilot mode. “One pilot told Auterion that flying the drone and striking Russian targets was so easy that it was boring.”

- Russia’s economy – propped up with stimulus, debt and money printing – is crumbling, and “could soon take a toll on his [Putin’s] ability to fight”. The official statistics are likely smoke and mirrors, and even without a crisis Russia’s economy will stagnate for many years, as I predicted back in August. But as for the war effort, never underestimate the Russian government’s ability to punish its own citizens, and for those citizens to simply suck it up and carry on.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!