Albanese's future, making housing less affordable, King Dollar, the demise of Britain, and there is no AI moat

An Australia-wide long weekend kicks off tomorrow, and between the Perth Rugby Sevens tournament and Australia Day festivities I’m not going to have all that much time for the usual reading and writing. So the next time you’ll hear from me will probably be in the form of a Hot Take on the all-important December quarter inflation figures (Wednesday).

This is Albanese’s future

I once had the privilege to drive around Iceland and was rather shocked when I came across a large aluminium smelter in the middle of nowhere. Iceland has no bauxite (or much of anything), after all.

After a bit of digging, it turned out that Alcoa built the Fjarðaál smelter in 2007 to take advantage of Iceland’s cheap, reliable hydroelectric and geothermal power. Alcoa imports alumina, then smelts it into aluminium for re-export. Despite the extra shipping, it’s worthwhile because the smelting process is extremely energy-intensive:

“On average it takes about 15.7 kWh of electricity to produce 1 kg of aluminium. This is what makes aluminium smelting such an energy intensive process.

Due to the nature of the process, power outages have the potential to cause damage to production cells as the molten liquids could solidify in absence of adequate current. For this reason, production facilities need to be near secure and reliable sources of energy.”

So, I was a bit surprised when Albanese announced that a Future Made in Australia – the stated aim of which is to “support Australia’s transition to a net zero economy” – would be pumping another $2 billion into aluminium smelting in NSW in the name of… jobs:

Ignoring the fact that unemployment is currently 3.8% in NSW, so a make-work scheme seems inadvisable (to put it politely), the main problem with this is that renewable energy is the least reliable form of energy. To power the Tomago aluminium smelter you’re not only going to need to build an awful lot of solar and/or wind infrastructure and associated transmission, but you’re also going to need either a large backup gas generator, a completely unproven and uneconomic large green hydrogen facility, or a vast – and very expensive – array of batteries.

That’s… not going to be cheap, and would almost certainly fail even the most generous cost benefit analysis. Australia might have a comparative advantage in solar power, but aluminium smelting must surely be one of the worst possible uses for that power – which is why it needs such huge subsidies.

Meanwhile, another Future Made in Australia “investment”, the billion-dollar PsiQuantum quantum computer in Brisbane, may struggle to ever find a practical use:

“Quantum computing stocks — some of which soared more than 1,000% last year — have tumbled after Nvidia Corp.’s chief executive officer last week said that strong use cases for the technology are probably more than a decade away. The reckoning was the latest sign that the euphoria had become overblown, after some in the sector lost more than half their value in recent trading days.

The current trading action ‘rhymes with the dot-com bubble’, said Bill Stone, chief investment officer at Glenview Trust Co. ‘It’s hard to make any kind of long-term investment case for quantum right now’.”

Albanese is right that he’s building Australia’s future. The problem is what he’s building is junk that’s sucking up scarce labour and capital, crowding out productive private investments in the process. Australia’s future will be worse because of decisions like these.

How to make housing less affordable

Frustrated with on-street parking congestion, South Australia’s Premier Peter Malinauskas plans to introduce a new bill to “require developers of new dwellings to provide a minimum number of car parks based on the number of bedrooms”.

If passed, the bill will increase house prices and won’t do much to ease street parking congestion:

“Because cars must park somewhere, many people think parking behaves like a liquid. If the parking supply is squeezed in one place, cars will park somewhere else. But parking behaves more like a gas; the number of cars expands and contracts to fill the available space. More parking leads to more cars. Nevertheless, planners base parking requirements on the assumption that cars and people come in fixed proportions, and they often state the requirements in parking spaces per person: per beautician, dentist, mechanic, nun, student, teacher, or tennis player. This assumed ratio between cars and people is in turn based on the assumption that all parking is free. If parking were priced to cover its cost, the ratio of cars to people would be lower.”

Street parking congestion is a classic solution to a problem created by government failure, namely underpriced on-street parking:

“Excessive parking requirements eliminate the possibility of a price signal. They distort travel choices, promote low-density development, increase the cost of housing, thus harming low-income households, and blight the built landscape. This has relevance not only to the USA but also everywhere there are parking requirements and/or underpriced on-street parking.”

One reason for the proliferation of low-density sprawl in Australian cities was because the solution to the parking commons problem – where developers would provide too little on-site parking because on-street parking is a ‘free’ resource, creating a free-rider problem – has been to insert on-side parking requirements into zoning laws. That has had consequences:

“Underpriced on-street parking delays private investment in off-street parking by undercutting the potential market and depriving it of price information. With no relief in sight from parking saturation and its associated congestion, municipalities then often come under pressure to supply or require off-street parking. The fear of the return of such impacts (as ‘spillover’) also makes reversing any existing off-street parking requirements politically difficult in the absence of efficient on-street pricing.”

Parking requirements make housing more uniform and expensive and reduce productivity. They also undermine the state government’s own efforts to expand the uptake of public transport. If there was a market for parking then it would create incentives for people to make other choices, like riding the bus, providing the state with the additional revenue needed to support public transport improvements.

Instead, we get angry Premiers blaming “greedy” developers for making completely rational decisions given the incentives they face, and another layer of bad policy whacked on top of the existing one.

Fun fact

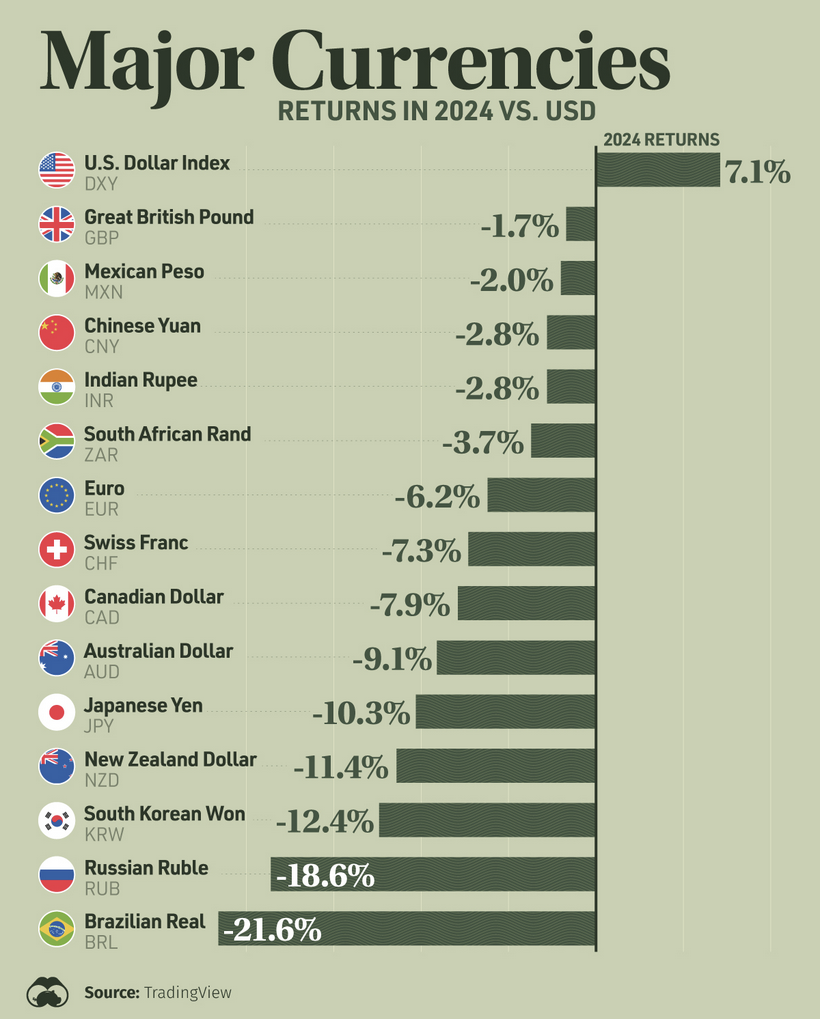

The US dollar went on a tear in 2024:

How much it appreciates or depreciates in 2025 will largely depend on two forces: whether the US economy will continue to outpace the rest of the world in terms of growth and productivity; and how crazy Trump goes with tariffs, given that they will be offset by the floating exchange rate.

The demise of Great Britain

Speaking of growth and productivity, one place where those are non-existent these days is in Great Britain:

“Britain’s problem is that almost everyone names growth as their priority, and almost no one means it. There is always another consideration that takes precedence, whether geopolitical, ecological, cultural or egalitarian. The result is the worst of all worlds: no serious drive for economic success, but also no tacit national agreement that we should bed down for a life of low-drama stagnation. Either of these would be a grown-up choice, with its own merits and costs. It is the fudge — which holds growth to be desirable in the abstract but in no specific form — that has Britain in its gelatinous grip.”

That’s from FT journalist Janan Ganesh, who notes that while the US has never had a “growth strategy” and has done very well for itself, Britain is inundated with plans yet goes nowhere. Take AI:

“This week, Sir Keir Starmer set out a plan to exploit artificial intelligence to enrich the UK. The moment it was clear that he wasn’t serious was when he said he would make AI ‘work for everyone’. Almost no government reform that is worth a damn works for everyone. His line all but concedes that, once AI upsets an interest group, he is liable to cave.”

And the view is bipartisan:

“Tories want growth, but not if it means building things, aligning with Europe, or much exposure to China. Labour wants growth, but not if it incommodes the unions, or ’leaves people behind’ or some such NGO press release inanity. What growth policy is left over, then?”

If Australia wasn’t endowed with natural resources that help to paper over our own policy failures, we would be having a similar conversation right now.

There is no moat

A Chinese company called DeepSeek released a new AI model called r1 that’s comparable to OpenAI’s o1. The main difference? It’s actually open (source), the chain of thought isn’t hidden (really cool), and it can run queries at 3% of OpenAI’s cost. That’s… potentially a big deal:

“It’s essentially as if someone had released a mobile on par with the iPhone but was selling it for $30 instead of $1000. It’s this dramatic. What’s more, they’re releasing it open-source so you even have the option - which OpenAI doesn’t offer - of not using their API at all and running the model for ‘free’ yourself.

If you’re an OpenAI customer today you’re obviously going to start asking yourself some questions, like “wait, why exactly should I be paying 30X more?”. This is pretty transformational stuff, it fundamentally challenges the economics of the market.”

Policies have unintended consequences. In this case, the US government’s decision to block the sale of advanced chips to China created a scarcity. Like the Italians after WWII who – when faced with a cocoa shortage – invented Nutella using hazelnuts, Chinese entrepreneurs have designed an AI model to run on bare-bones rigs.

There truly is no moat for these AI companies, which is great news for consumers.

Further reading

- Fertility has declined in 90% of countries over the past 25 years.

- Widespread zoning changes to enable medium- and high-density housing in New Zealand led to a rapid increase in supply that “reduced rents by around 21%”.

- Clustering and diffusion are very important (AI’s productivity impact might take a long time to be fully felt in Australia): “56% of the most economically impactful technologies come from just two US locations… [the diffusion] process is very slow, taking around 50 years to disperse fully”.

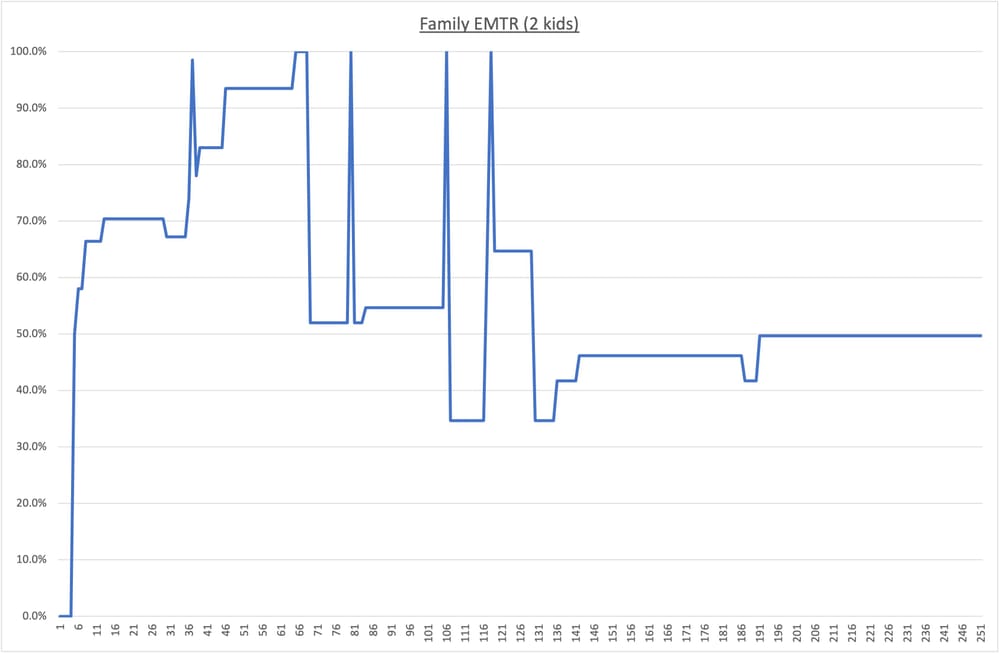

- Australia’s tax system is badly in need of reform. “[T]here are four (!!) different situations where a family can face effective tax rates well over 100%, creating warped incentives for families to pro-actively shrink their income.”

- Forced relocations, sterilisations, and “social experiments”. The Danes haven’t been all that nice to Greenlanders.

- Vietnam is taking a leaf out of Javier Milei’s book: “Under the banner of “administrative reform”, the Vietnamese government has announced its intention to reduce approximately 20% of government ministries and agencies, as well as the number of public employees. This historical measure seeks to radically transform a system that many consider obsolete and increasingly complicated.” Where is Australia’s Milei?

- Growth is a policy choice: “If the government can make a clear and credible commitment to a genuinely pro-growth plan it could rapidly improve the UK’s cost of borrowing, as markets change their expectations of the future of UK growth. And once the policies come into effect, the growth uplift could change the government’s – and the country’s – fortunes for the better.”

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!