Another costly bailout, Medicare's funding boost, 13 ideas to fix housing, why the WA GST deal is fair, and the decline of German trains

This update has become something of a weekly policy analysis wrap, given the flurry of announcements we’re getting ahead of a federal election that now looks like it’ll be held on or before 12 April (today is the deadline for a 29 March election to be called).

So, let’s kick off with the latest egregious waste of your tax dollars: the Whyalla steelworks bailout.

Throwing good money after bad

First Rex, now Whyalla. At this point, a Future Made in Australia should be renamed a Much More Expensive Future Made in Australia.

And yes, you will be poorer because of it. Here’s Albo:

“My Government is building Australia’s future. And to do that, we need Whyalla steel.”

These sorts of antics are precisely what I warned about when a Future Made in Australia was announced:

“[W]hen political discretion is involved, interest groups will spend up to their expected benefit on lobbying (known as rent seeking), even if the costs to society are considerably greater than those benefits; that time and money spent lobbying are resources that could have been spent creating value instead of destroying it.”

Or in the words of the Productivity Commission a few months later:

“Industry supports come with costs. These include direct costs (spending taxpayers’ money) and the diversion of workforce and resources from other activities.

There are also dynamic costs – even the promise of money on the table will see a raft of firms and lobby groups spend time and resources pushing for taxpayer support. And once the taps are on, they can be hard to turn off.”

I’m sorry Albo, but “we” don’t need Whyalla’s steel, just as “we” no longer need the pens, toasters, and toothbrushes that are no longer manufactured in Australia. Steel is durable and almost fully recyclable; if there was a national security argument for Whyalla (which I have not seen), a strategic stockpile would likely cost considerably less and cause far fewer distortions than bottomless bailouts (this isn’t the first bailout and probably won’t be the last).

The direct cost per job “saved” is $2.4 billion divided by the 1,100 workers, or around $2.2 million. Even if you include the dubious 2,000 “indirect” jobs, that’s $775,000 per job – an exorbitant sum.

And that doesn’t include the losses to consumers in the form of higher prices and lost efficiency (e.g. deadweight losses from additional taxes, misallocated labour and capital), which can be greater than the direct cost to taxpayers.

Yes, if Whyalla closes the steelworkers will lose their jobs, and many of them will probably only be able to find new jobs that pay less than what they currently earn, or are less desirable for whatever reason (e.g. FiFo). But the cost to support those workers find new opportunities would be a fraction of the cost the entire country is going to bear to keep them where they’re at.

Perhaps the only good news to come out of this debacle is that it forced the SA government to shelve its plans to spend $593 million to build a green hydrogen plant at Whyalla.

Someone has to pay

On Sunday, Anthony Albanese announced if re-elected, his government would pump another ~$2 billion into Medicare each year to reduce the amount people have to pay upfront:

“Labor will spend $8.5 billion across four years to commit to universal bulk-billing, which would make nine out of 10 GP visits free… Under the plan, Labor would incentivise doctors and clinics to bulk-bill all their patients with extra funding and boost the GP workforce. Labor is also promising 400 nursing scholarships and 2000 new GP trainees a year by 2028.”

The leader of the opposition, Peter Dutton, immediately matched it. So no matter who is elected, Medicare will receive a large ongoing cash injection.

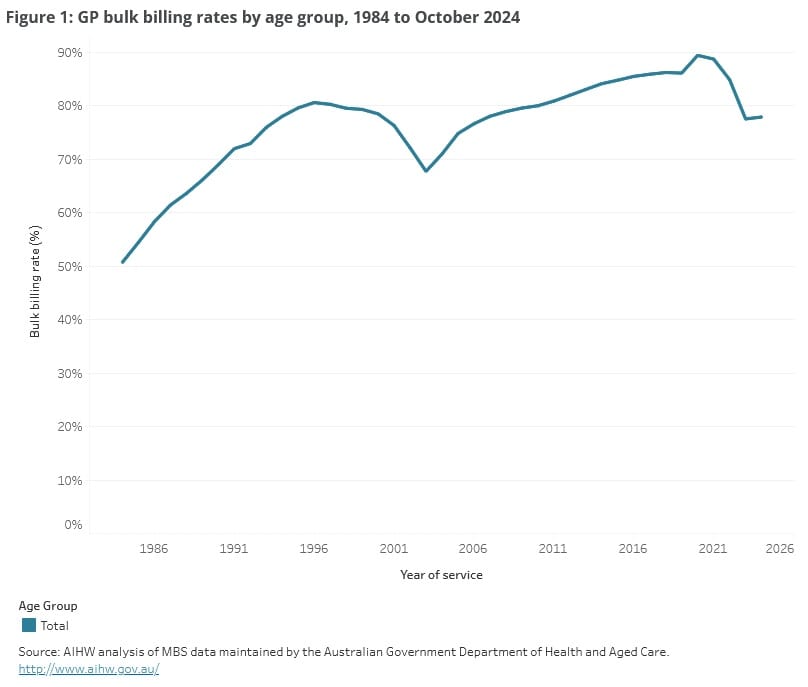

But is it a good idea? There are a few forces at play here. As a society, we’ve decided that we want a publicly funded healthcare system. Both sides are arguing that it has swung too far in the other direction, with the number of bulk-billing (i.e. no-fee) GP clinics falling as the rate of inflation pushed up the cost of running a medical practice (wages, rent, electricity, insurance) above the government’s payment:

So, there’s probably a case for additional funding if your goal is to maintain the bulk-billing model. Addressing supply through nurses and GP trainees also looks like a good idea, given the profession is artificially supply constrained by the medical cartel – and most students, understandably, self-select into more lucrative specialities – yet demand is expected to grow rapidly as we age.

However, there’s also a case to be made that the bulk-billing model is not one that should be continued. Hiding the cost of a visit to your GP doesn’t make that cost go away. In fact, if patents had to bear a higher proportion of the cost of their visits, they would be more careful when choosing to buy them (controlling for moral hazard, or the tendency to use more of something when other people are paying for it).

But there’s a hidden trade-off there: you don’t want GP visits to be so expensive that people will avoid getting a mole looked at, or a nasty cough investigated. Catching ailments early can save not only the patient but also the taxpayer – which pays for expensive specialist treatments, too – in the long-run.

That’s assuming you have enough GPs to provide those “free” visits, of course. If not, then they need to be rationed by some other means, usually through long wait times for an appointment, which may offset some of the benefits of “free” visits. Hence why the boost to GP training is a good accompaniment to this funding.

I’m not going to weigh in on what the right balance is here, or what’s the best way to improve health care for those on low incomes; I don’t know, and neither does the government or opposition, or they probably would have done something other than pump more money into the existing system.

I’ll only say that there’s no such thing as a free medical visit. So, when Albo says people will “only need their Medicare card, not their credit card, to receive the healthcare they need”, what he really means is your grandchildren will be paying, as this funding boost will be financed entirely with new debt that will need to be repaid with a productivity miracle, spending cuts, higher taxes, or inflation.

13 ideas to fix housing

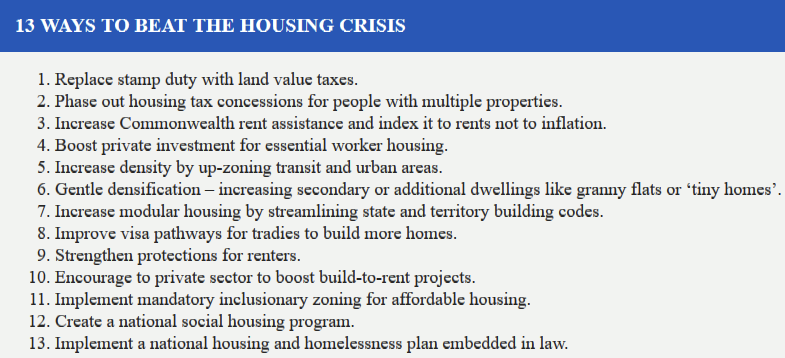

A philanthropic company called Amplify went out and polled 100 Australians, asking them for ideas to fix the housing sector. At first, I was worried – polling the public usually isn’t a great way to get good policy, given the amount of economic illiteracy out there – but I was pleasantly surprised by what they came up with.

Here were their ideas:

The good news is that we’re already doing some of the items on the list that are likely to be beneficial. For example, granny flats are starting to be legalised (6), and some states are really lifting their density game around transit and urban zones (5), even if they continuously get watered down as local interest groups organise. But both of those address the root cause of housing affordability—the lack of supply—through market-driven mechanisms, with minimal distortions. Good stuff.

As for the other ideas, political barriers render some of them borderline impossible. For example, replacing stamp duty with land value taxes on unimproved land (1) would hugely improve the efficiency of the housing market by increasing property sales, incentivising development, and improving labour mobility.

But unless it was done properly – revenue neutral, with a credible mechanism to prevent state governments from ratcheting it up in the future – people may see it as a tax hike and (rightly) object. State politicians also tend to be wary to roll it out because stamp duty is such a major source of their revenue; one misjudged forecast and they’d be left with a huge budgetary hole to fill (NSW’s half-hearted attempt didn’t survive a single election).

Other good ideas include improving visa pathways (8) and streamlining building codes (7; I wrote about this last week!). There’s no reason why the federal government can’t get on and implement these two, other than due to ineptitude or union pressure (e.g. the Albanese government excluding various construction occupation groups from its skilled visa overhaul).

But after that we really start getting into the weeds, because all the remaining ideas involve some form of unintended consequence, governments giving out free stuff, or subsidising demand against fixed supply:

- Mandatory inclusionary zoning for affordable housing (11) makes development less profitable, reducing the supply of housing.

- The effectiveness of “encouraging” the privacy sector to build-to-rent (10) depends entirely on the incentives (i.e. funding) and doesn’t address broader affordability.

- The same applies to (8), boosting private investment for essential worker housing, which would eventually result in only the very rich and very poor being able to live in our cities (not to mention the disincentive effects it creates, e.g. the inevitable income caps).

- I’ve written about renter protections (9) before. It requires a careful balance; if the pendulum swings too far in their favour it will discourage investment in rental properties, reducing supply. The same applies to (2), phasing out tax concessions.

- In a supply-constrained market, linking Commonwealth Rent Assistance to rents (3) will only see rents increase, with the benefits captured almost entirely by landlords rather than tenants. You really need to address supply before even considering an expense like this.

- One of the worst on the list is the idea for a national social housing program (12). While no doubt music to the Greens’ ears, it’s likely to involve considerable expenditure, does nothing to address the actual causes of the housing crisis, and has large welfare implications as the benefits would be concentrated among specific groups.

- Last but by no means least, a national housing and homelessness plan embedded in law (13) is unlikely to do much good at all. If done improperly it also risks creating an inflexible policy environment, locking in bad policies well beyond their use-by dates, or being captured by vested interests.

All up, it could have been much worse. Hopefully some of the better ideas actually get some political traction!

The Western Australia GST deal is fair

Like a broken record, economists Saul Eslake and Chris Richardson have again attacked the federal government’s deal with WA over the GST:

“Money is being shovelled over to the government of the richest state in the country,” Mr Eslake, formerly the chief economist of ANZ Bank and Merrill Lynch, told this masthead.

“By not spending that $32bn you could have lower deficits.”

…

“It is just an outstandingly stupid policy,” [Richardson] said. “It exists because of politics. WA has been very central to federal election outcomes in recent years.

“The rest of Australia would be just as well off if we got $100 notes and smoked them,” Mr Richardson said.

“I don’t see much prospect of a change, but there will be even less prospect if people don’t know about it, and the vast bulk of Australians don’t know.”

In Australia, horizontal fiscal equalisation is achieved by redistributing GST revenue to states and territories. The ‘WA deal’ ensures that no state will receive less than 75 cents on the dollar of GST it generates. No state is worse off because of the deal, with the federal government making up any shortfall.

What Eslake and Richardson don’t like is that latter part: the deal means that when commodity prices are high and states like WA are rolling in revenue, the federal government – which, through the corporate tax, benefits much more than WA from high commodity prices – has less to spend than if WA had to send all the GST it generated across the Nullarbor.

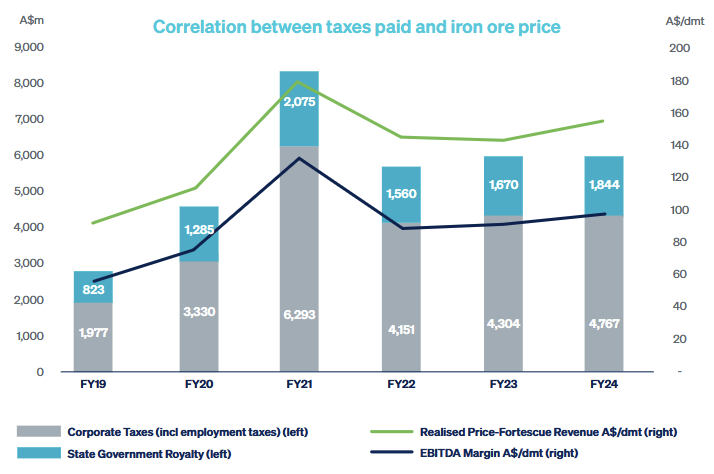

You can see that the federal government also benefits greatly from high commodity prices in this chart courtesy of FMG, which is about as close to a pure iron ore play that Australia has:

Basically, every jurisdiction is better off when commodity prices like iron ore rise, not just WA.

But what Eslake and Richardson really neglect are the incentives. The GST is the first or second largest source of revenue for state governments. If a politician in WA knew that most of the royalty revenue they collected from a mining project would simply flow to Canberra a couple of years later (the GST calculation is lagged), they might be inclined to weigh other factors more heavily and do the wrong thing by blocking the project:

“I do not believe that the solution to our problem is simply to elect the right people. The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing. Unless it is politically profitable for the wrong people to do the right thing, the right people will not do the right thing either, or it they try, they will shortly be out of office.”

Do we really want to turn WA into another Victoria? What would that do to the federal government’s revenue? There’s a reason why WA’s politicians are often the lone voice advocating for the federal government to slash red and green tape.

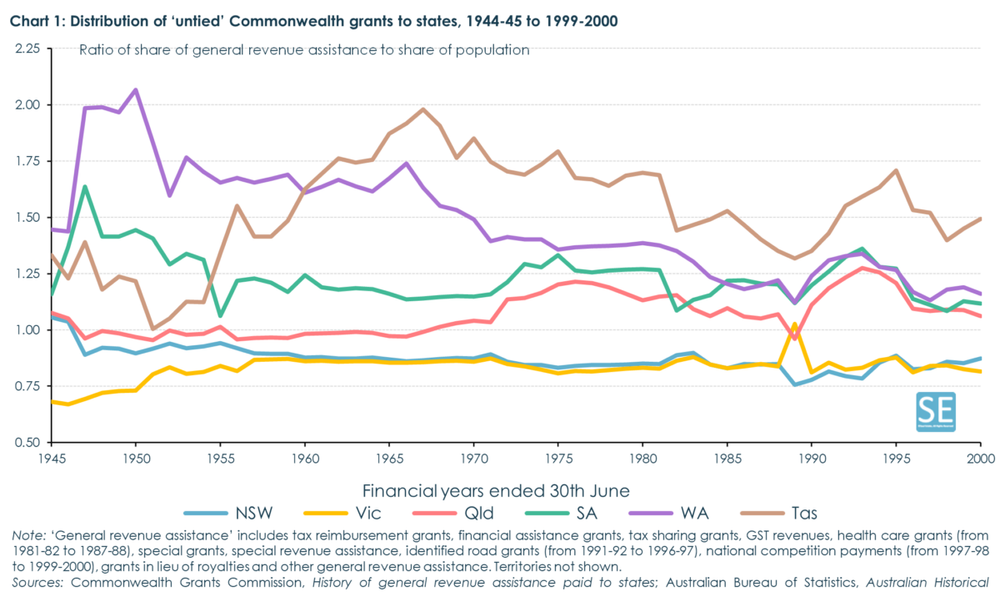

Finally, Eslake and Richardson also don’t appear to understand the full history of horizontal fiscal equalisation. For example, Eslake likes to trot out this chart in defence of his position that “for more than seventy years Western Australia received a larger share of ‘untied’ Commonwealth grants than it would have done had they been distributed on the basis of population shares, a more favourable outcome (from Western Australia’s standpoint) than for any other state except Tasmania”:

Eslake is looking at a single item in the Commonwealth’s budget. What he neglects is that WA was also paying considerably more revenue than its population share to the federal government through national customs and excise, which used to be a much more significant tax in the bad-old protectionist days. Indeed, one reason why the Commonwealth Grants Commission – which implements horizontal fiscal equalisation – was established in the first place was to keep WA from seceding because of its perceived “unfair financial treatment”.

My advice to Eslake and Richardson would be to stop obsessing over how to slice the pie and instead show some appreciation for the fact that, since at least 1968, WA’s pro-development attitude has grown—and continues to grow—the national pie, for the benefit of all Australians!

Fun fact

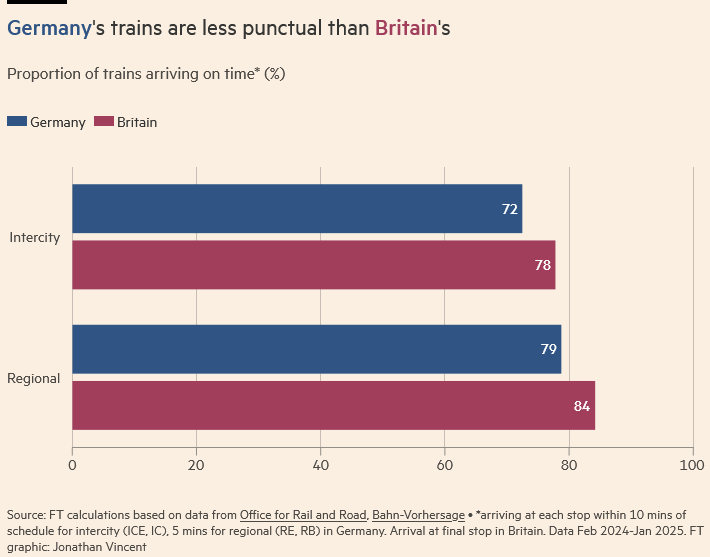

Once the envy of Europe, German trains are now less punctual than… Britain’s:

Germany’s failure is having consequences for the rest of Europe, too:

“Any interaction with the German rail network is also one of the biggest factors affecting the punctuality of long-distance rail travel in central Europe.

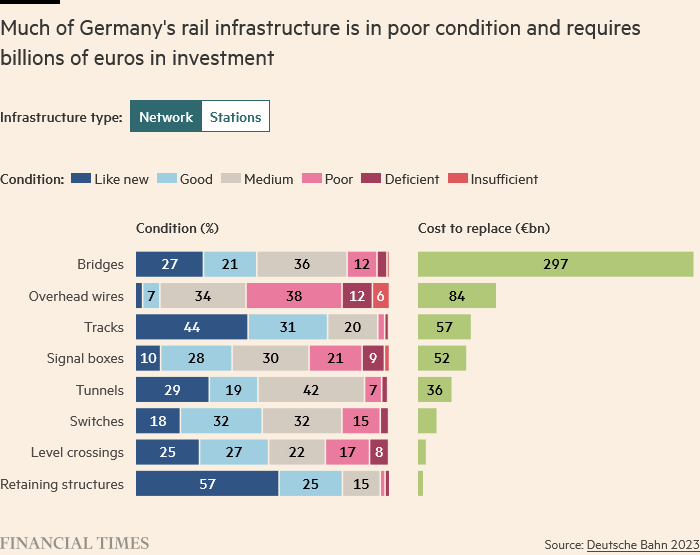

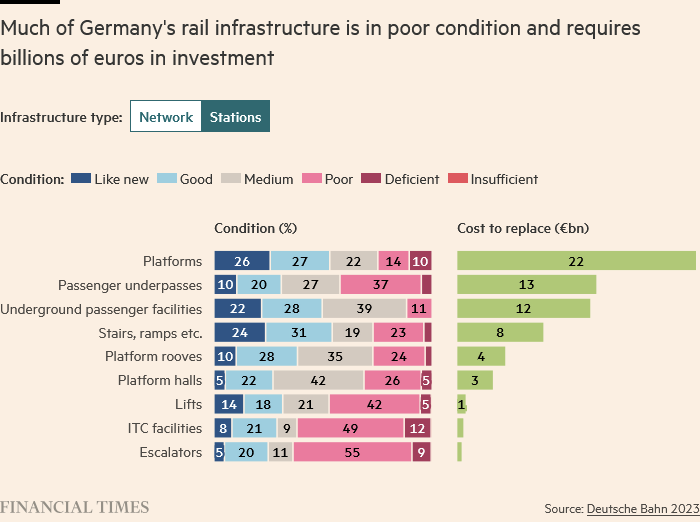

The cause is the culmination of decades of “skimping on maintenance and infrastructure upgrades”:

Not all the blame can be levied at Angela Merkel, but the rot certainly looks to have started with her. As Matt Yglesias wrote back in 2010, Merkel is “lucky the bar for ‘Worst German Leader’ is very high”.

Further reading

- Australian businesses are now on Trump’s map courtesy of the despicable (and bipartisan) media bargaining code. “If your country imposes undue burdens on American companies, you get tariffs.”

- Former Treasury Secretary Ken Henry accused successive governments of “reckless indifference [or] wilful acts of bastardry”, for failing “to do these three things: one, manage financial risks arising from erosion of the tax base; two, maintain the integrity of the tax system; and three, have regard to intergenerational equity”. He’s right.

- Worried about becoming one of the many companies that “lost a lot of money” during the industrial revolution, Microsoft is pulling back from the AI investment game. “Satya [Nadella] is calling the bubble in buildout. The crazy people like govts are entering the game. He’s happy to lease from them when they overbuild. His own capex spend is capped.”

- Always check your AI: “I always call AI ‘infinite interns’, and there are a lot of teachable moments in what I’ve just written for any intern, but there’s also Steve Jobs’ line that a computer is ‘a bicycle for the mind’ - it lets you go further and faster for much less effort, but it can’t go anywhere by itself.”

- A nuclear reconnaissance:

- “Spain’s Congress has approved a non-law proposal calling for the government to implement a series of measures that would reverse the country’s nuclear phase out policy”

- “The Japanese government said Tuesday that the country will make maximum use of nuclear power, which does not emit carbon dioxide, as it is preparing for a surge in electricity demand from data centres.”

- Sweden is paying migrants to leave.

- Yes, and Canada should do the same for its inter-provincial rules: “Trump’s game of chicken may, in fact, provide EU policymakers with an excuse to back down from their regulatory agenda without needing to admit failure.”

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!