Dumb and dumber housing policy

“No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems—of which getting elected and re-elected are number one and number two. Whatever is number three is far behind.” – Thomas Sowell

There are times when you suspect that politicians are only acting in their own interests. Then there are times when it’s just so clear that there’s really no other possible explanation.

Last weekend was one of those latter times, as we were treated to not one, but two big new housing policies to coincide with the official campaign launches of the federal Labor and Liberal parties. First came Labor’s plan:

“A re-elected Albanese government would allow all Australian first home buyers to purchase with a 5 per cent deposit, avoiding lenders mortgage insurance… The government will also commit $10 billion to build 100,000 new homes exclusively for first homebuyers.”

That was quickly followed by the Liberals:

“Coalition Leader Peter Dutton will… allow first-time buyers of newly built homes to be able to deduct mortgage payments from income taxes if he is elected on May 3.”

Australia’s housing market is supply constrained—strangled by zoning laws and red tape—so the primary effect of throwing cash at first home buyers will be to bid up prices. Indeed, neither of these policies would likely pass a cost benefit analysis, and the consequences are entirely predictable.

This is truly dumb and dumber economics—politics is another matter—with both sides trying to out-compete each other in the race to buy marginal votes and drive up house prices, all at the expense of Australia’s future prosperity.

Labor’s proposal was announced first, so let’s start with that.

Labor’s 5% deposits and no lenders insurance

This policy will work the same way first home buyer grants do—i.e., pull forward demand and raise house prices. This meme is, sadly, appropriate yet again:

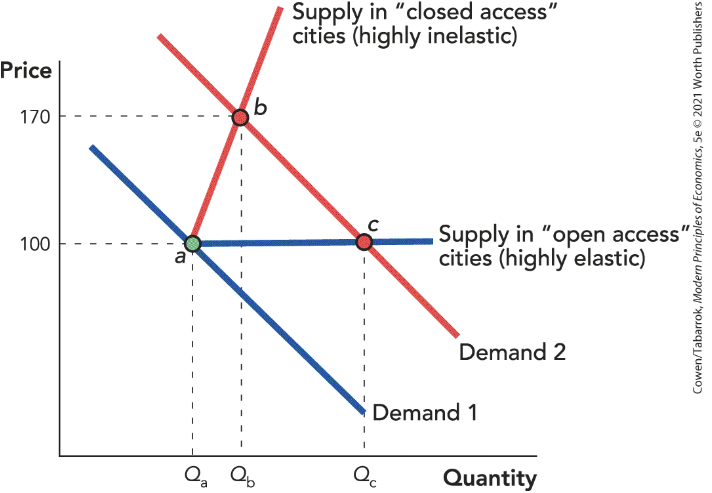

This isn’t a controversial view. There is strong empirical evidence of this happening every time a government tries to stimulate housing demand in Australia’s supply-constrained (inelastic) market. It’s also in any introductory economics textbook—equilibrium will move from point a to point b:

It’s also inequitable. Because supply is inelastic, most of the higher prices (the subsidy incidence) will flow to existing owners looking to cash out, and of course the banks that will benefit from having more home owners saddled with perpetual debt—with a 5% deposit, you’re almost certainly not paying that off before you retire.

Society as a whole will be worse off due to the higher prices, and because there are likely plenty of other areas where this money could be used to improve well-being by considerably greater amounts, including not being borrowed in the first place.

Finally, it risks adding considerable public debt to the federal balance sheet (guaranteeing loans isn’t free) and effectively forces banks to give loans to people who can’t afford them, putting them—and Australia’s financial system—at higher risk of default.

As for the second part of the plan—100,000 new homes—how does Labor propose to build those? The constraint to housing supply isn’t a lack of money: given where prices are at, people would be building more if they were able. To the extent that any are built, they will likely crowd out private development because the $10 billion is borrowed (raising interest rates), and the housing construction sector is at or close to capacity—so house production will simply be redistributed from the private to the public sector.

All up, these policies are—at best—a pricey, temporary sugar hit that screws everyone over in the long-run.

The Liberals’ mortgage tax deduction

This isn’t a new policy in the sense that it has existed in the US (and probably other countries) for a long time. For a politician desperately trying to distance himself from the chaos happening over there, it’s certainly a head-scratcher from Liberal leader Peter Dutton.

But as with Labor’s policy, this one will also drive up house prices and worsen affordability, even though it only applies to new builds (there’s a lag between construction and supply). And supply may never even catch up, given that the constraint in Australia isn’t a lack of capital or people willing to build, but things like land-use zoning and the various impediments to construction productivity.

It’s also a deeply regressive policy—high earners will save big on taxes, while low-income buyers barely benefit—and creates wasteful distortions: if you’re a high earner (or expect to be) in a position to buy your first home, you’ll want to maximise your mortgage to minimise your taxable income for five years.

Under this scheme overall indebtedness will increase, benefiting the wealthy for whom taxpayers will pay up to half of their mortgage interest, and of course the banks, which get to clip their ticket along the way.

As with Labor’s policy it will also add to the national debt and, by putting the financial system that much closer to the edge of fragility, raise default risks for both owners and the country as a whole.

Dumb and dumber

Both policies are political theatre, packed full of unintended consequences—if, with the mountains of evidence now out there, I can still call them “unintended”—designed to win votes rather than fix the housing crisis.

Unless these policies are accompanied with a heavy dose of yet-to-be-announced plans to navigate Australia’s decentralised political system to ease restrictive zoning, fast-track approvals, overhaul onerous building codes, and tackle local government obstructionism, then they’re only going to raise prices, reduce affordability for all but a lucky few, add to the nation’s rapidly-growing debt, and increase risks to the nation’s financial system.

Something tells me no such plans are in the works, so last weekend was a hard fail for both major parties, which have once again proved the timeless wisdom of Thomas Sowell—all they really care about is getting elected and re-elected. But this will be a hefty price to pay to swing a few marginal voters looking to buy their first homes.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!