Fix land use regulations and you'll fix construction productivity

The Committee for Economic Development of Australia (CEDA) recently published a new report on construction productivity in Australia, exploring “the factors driving the three-decade long decline in the productivity of Australia’s construction sector”.

The report builds on work done by the Productivity Commission (PC) back in February, which I wrote about here, which itself flows from work by Harvard’s Ed Glaeser and his team that found:

- local land-use controls limit the size of projects; which

- also reduces “both scale economies and incentives to invest in innovation”; so

- you end up with a bunch of smaller, less productive builders.

The CEDA report confirms that the same is happening in Australia, with construction productivity underperforming other sectors largely because it’s now dominated by small firms, which has a huge impact on the economy:

“If firms in the Australian construction industry matched the size distribution of firms in the manufacturing industry, the construction industry would produce 12 per cent, or $54 billion, more revenue per year without requiring any additional labour. This is equivalent to gaining an extra 150,000 construction workers. In a sector currently suffering from labour shortages that are holding back progress, this sort of increase would make substantial inroads in the ability to deliver on critical infrastructure and housing works.”

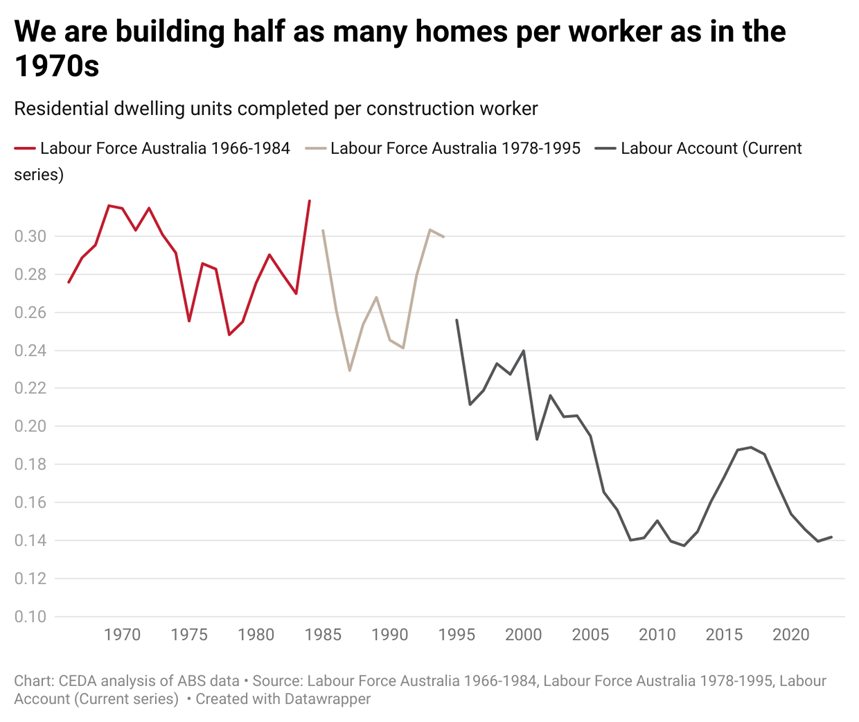

Here’s a visual of the effect:

According to the authors, there are two main reasons why the sector shifted from many larger firms to one dominated by an ocean of microbusinesses that are “less able to achieve economies of scale and scope”: tax and regulations.

On the tax front, going smaller allowed workers to maximise their take-home pay. Here’s just one example (yes there’s more in the report, and what matters for behaviour is the tax system as a whole, not a single item):

“A high-income construction worker earning $148,000 per year would pay 26 per cent tax as a salaried worker. As a contractor, they could structure their income with a discretionary trust and a ‘bucket’ company and pay just 18 per cent tax – a difference of $12,400 in annual-take home pay after tax. Additionally, in trust structures, a high-income individual can distribute income across household members, who may pay even lower tax rates. Or, in rare cases, contractors can simply misrepresent their income and avoid tax altogether.”

On regulations, Australia’s “complex combination of local, state and federal rules around land-use” makes it difficult for firms to grow—it’s just too costly to operate across multiple local government areas, let alone states, because of the compliance requirements:

“Over time, the work required to lodge development applications and comply with planning and construction rules has increased significantly. For example, the development application to build a three-storey block of apartments in Sydney in 1967 was 12 pages long. Today an equivalent building would require extensive structural, environmental, traffic and often heritage assessment, meaning applications are many hundreds if not thousands of pages long.

This can prevent new firms from entering the local market and prevent productive firms from growing. Where there is more regulation or it adds greater uncertainty to large housing projects, firms are more likely to prefer smaller projects that are better suited to smaller, less productive firms. This exacerbates geographic segmentation, makes it harder for firms to grow and reduces the incentive to invest in technology.”

They also note that state-based occupational licensing has become more stringent in recent years, adding to the compliance burden imposed by land-use regulations—it’s just too costly for productive businesses to grow too big in the construction industry!

Anyway, if you’re at all interested in learning a bit about why housing in Australia is so messed up, this report helps to fill in at least one piece of the puzzle. It’s honestly getting to the point where I don’t see any way out of this quagmire without a large dose of top-down housing coercion—essentially ripping up the mess and starting fresh with streamlined, consistent, country-wide rules.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!