Friday Fodder (36/24)

It’s a long weekend in Western Australia on account of one of the King’s many birthdays, so there will be no Aussienomics on Monday. This coming Friday is also the day before Grand Final day holiday in Victoria, so I’ll send the next Fodder out on Thursday instead.

With that out of the way there’s plenty to discuss, starting with Albo’s threat of a double dissolution election!

Are we headed for an early election?

Anthony Albanese (Albo), annoyed that his Help to Buy and Build to Rent housing schemes – along with an environment law overhaul – were held up in the Senate, threatened a double dissolution election:

“Well, we’ll wait and see. I’ll tell you one way to avoid a [double dissolution] is for the Coalition and the Greens to vote for legislation that they support. We’re always open to sensible discussions … but what we won’t do is undermine our own legislation with amendments when it stands on its merits.”

There are a couple issues with that statement. The first is that it’s basically impossible for Albo to trigger a double dissolution election this late in his term. As the ABC’s election analyst Antony Green put it:

“For there to be a DD election, the dissolution of the House and full Senate must take place by 25 January. The election would be in March. How you can meet the 3 months delay requirement of Section 57 to get a DD trigger between now and January is beyond me.”

Green was referring to the rule that for a double dissolution to be called, parliament must reject a bill twice and allow at least three months between those votes. Given that these bills haven’t been voted on even once – the Senate delayed making a final decision – the only way to trigger a double dissolution would be to force a vote now, and call parliament back in December for a second vote.

So, a double dissolution election is all but out of the question. But there’s nothing stopping Albo from simply calling an election and making it known that these bills are the reason why.

Will he? I doubt it; the latest Freshwater Poll has the Coalition marginally in front, so Albo will be hoping not only for the recent Budget’s goodies to fully flow through to households, but also for a big pre-election Budget early next year. He might also be hoping for interest rates to start coming down, which based on current market pricing could happen as soon as February.

As for the policies themselves, they’re pretty rubbish: Help to Buy is a demand subsidy that will benefit a chosen few but make overall housing affordability worse. Build to Rent is better in that it’s on the supply side, but it’s not clear why it’s even needed: the reason supply isn’t responding to demand isn’t because of a lack of developer capital, but because of regulatory barriers. If it gets up, I see it doing little more than padding the bottom line of developers who were going to build anyway.

Not that the Coalition’s policies are much better, mind you. Given that supply is constrained, its super-for-housing plan will boost demand and raise prices. As with Labor’s Help to Buy plan, some people would see their access to housing improve, but the people on the margin of ownership would be pushed out.

All in all, neither major party at the federal level has much of an idea of how to solve the housing crisis. And don’t let the Greens let you believe they’re any better: while they publicly call for more housing supply, back in their own electorates they’re busy doing the opposite, helping to prevent “projects or rezonings for several thousand new dwellings”.

In defence of Qantas

Regular readers know that I’m no fan of the government-protected oligopoly that Qantas and Virgin have over domestic air travel. But Paul Murray went too far when he insinuated that they were gouging fans:

“Sky News host Paul Murray has blasted the rising costs of airfares as people from North Queensland who hope to travel to Sydney for the NRL finals match between the Sharks and Cowboys are set to be hit with expensive plane tickets.

Surprise, surprise, flights $1,500, Mr Murray said.

If your footy team is ending up playing in any of the major capitals and they know there’s going to be flights on, the numbers go through the roof’.”

Yes, that’s how it’s supposed to work. There’s a sudden surge in demand. The airlines respond to that demand and by putting on additional flights where possible (quantity supplied), but their aircraft operate at close to full capacity – there’s only so much they can do without cancelling other flights, annoying a bunch of customers and damaging their core brand. With demand stronger than supply, prices rise to a new market-clearing equilibrium where the two intersect.

Does it suck that prices have risen? Absolutely. But the alternative is fixed prices, where seats are allocated by whomever was lucky enough to book first. There would also be no supply response under fixed pricing – the airlines aren’t going to schedule extra flights when there’s no price incentive to do so.

With dynamic pricing, there’s also an incentive for those not going to the game to look at other dates, freeing up seats for fans who are willing to pay a bit more. Oh look honey, it’s $500 cheaper to travel next week instead. Let’s do that!

Fans that are more flexible might also decide to travel earlier, or stay longer, ensuring there are still seats on the weekend flights for those with less free time on their hands. Some might even drive, bus or train: it’s about 2,000km by land between Townsville and Sydney.

Economics is about trade-offs. In this case, the alternative to dynamic pricing would be worse for everyone.

Reclaiming productivity

You may have seen the headlines covering Amazon CEO Andy Jassy’s recent letter, which demanded that staff return to the office full-time:

“To address the second issue of being better set up to invent, collaborate, and be connected enough to each other and our culture to deliver the absolute best for customers and the business, we’ve decided that we’re going to return to being in the office the way we were before the onset of COVID.”

Many employees enjoy working from home, so for them the removal of that benefit is the equivalent to a pay cut. If you were looking to shed staff – as Amazon is – and wanted to avoid redundancy payments, then I suppose that’s one way of getting people to quit.

But I suspect that Jassy is panicking a bit; under his watch Amazon has become rather bloated, and no doubt productivity has suffered. In his own words:

“As we have grown our teams as quickly and substantially as we have the last many years, we have understandably added a lot of managers. In that process, we have also added more layers than we had before. It’s created artifacts that we’d like to change (e.g., pre-meetings for the pre-meetings for the decision meetings, a longer line of managers feeling like they need to review a topic before it moves forward, owners of initiatives feeling less like they should make recommendations because the decision will be made elsewhere, etc.).”

Former CEO Jeff Bezos used to employ the “two pizza rule” to prevent bureaucratic creep: no team should be big enough that it would take more than two pizzas to feed them. Amazon under Jassy appears to have lost that nimbleness and has now transitioned into a “Day 2” company:

Jassy will be hoping that a return to the office and his other decision to “increase the ratio of individual contributors to managers by at least 15% by the end of Q1 2025” will move the company back towards Day 1. He has even created a “Bureaucracy Mailbox”:

“…for any examples any of you see where we might have bureaucracy or unnecessary process that’s crept in and we can root out…to be clear, companies need process to run effectively, and process does not equal bureaucracy, but unnecessary and excessive process or rules should be called out and extinguished.”

Amazon is now a large, hierarchical organisation that will perpetually fight a battle between bureaucratic bloat and profitability. Bezos’ pizza rule was an attempt to divide Amazon into silos, effectively keeping each team well below Dunbar’s number and avoiding too much bureaucracy. With Bezos and the pizza rule gone, it’s likely that the days of Amazon as an innovative force are gone, too.

Are job losses inevitable?

With every new technology there comes a chorus of people, colloquially known as Luddites, that oppose new technologies because of the alleged impacts on the labour market.

Now, don’t get me wrong; new technologies do displace labour. But they do it by creating new jobs elsewhere. Here’s Harvard’s David Deming on agriculture and manufacturing:

“Rising living standards are great for civilisation, but bad for farm employment. As we got richer and spent a higher share of our budgets on other things, agriculture became a smaller share of economic activity. Pair this with the rapid productivity growth we discussed last week, and the end result was a large-scale destruction of farm jobs.

…

The US, like many other countries, transitioned out of agriculture and into manufacturing, then out of manufacturing and into services. Herrendorf, Rogerson, and Valentinyi study income growth and employment of 10 different currently rich countries over the last 200 years and find a striking similar pattern across all of them. Poor countries start off in subsistence agriculture, then move to manufacturing, then transition to services.”

By trying to revive Australian manufacturing, a Future Made in Australia ignores this uncomfortable reality. Deming continues:

“Despite what both Presidential candidates would like you to believe, manufacturing jobs are probably not returning back to their prior levels. There will still be jobs in the manufacturing sector, but they will bifurcate into highly-skilled knowledge work and ’last mile’ jobs, as they have done in agriculture.

And yet, we aren’t running out of jobs! While manufacturing employment has steadily declined, every category of service sector employment – education, health care, professional services like legal and consulting, and hospitality and eating and drinking establishments – has grown steadily to make up the difference. We don’t have fewer jobs than we used to have, we’ve just had a massive shift away from ‘making things’ to ‘performing actions for other people’.”

As for AI, Deming notes that in a services economy the only way for AI to “eat the service sector” is if it gets better than humans at serving other humans. That seems unlikely, and even if it eventually came true (say, due to advancements in robotics), it will mostly “commoditised” jobs like personal assistants. But “because people don’t like to feel commoditised”, there will always be a role for humans to provide variety and higher-end, people-facing services.

As for the data, a recently published study found that to date while 27% firms that use AI are using it to displace labour tasks (so, a small share of a small sample), it has only resulted in a 5% change to employment among those firms – in both directions! Indeed, there was “little evidence that AI use is associated with a decline in firm employment”.

But even if AI did result in job losses, it will happen gradually, and many of those workers will probably find employment elsewhere thanks to the improvements in aggregate productivity, which lifts all wages, and the demand for variety.

Fun Fact

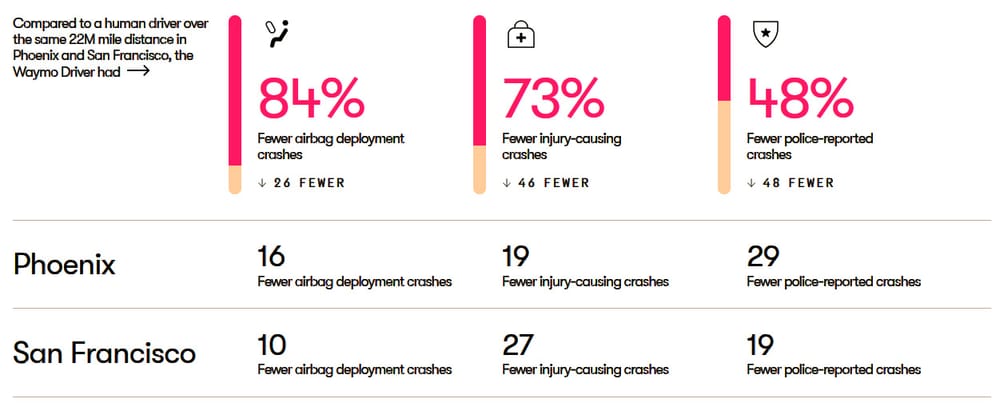

Self-driving cars are already much safer than human drivers:

These data likely underestimate how safe autonomous drivers are relative to humans, because they are reported regardless of fault and have a much lower reporting benchmark (humans don’t report many of their crashes).

Whether the likes of Waymo can scale beyond relatively dense cities remains to be seen, but it’s certainly promising nonetheless!

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!