Australia's narrowing path

I know it’s the day before Christmas and most of you are probably sitting on a beach somewhere in this fine country of ours, but the International Monetary Fund (IMF) released some commentary on the Australian economy this morning and I thought it was interesting enough to warrant a brief update.

So here we are. This will be the first of what I intend to become a regular feature of Aussienomics going forward: timely, concise ‘Hot Takes’ on the latest economic indicators and market-moving news.

After today’s update, the majority of these ‘Hot Takes’ will only be sent to paying subscribers. Free subscribers will continue to enjoy a selection of my long-form posts, all of which are also free to read on the website after 30 days. However, ‘Hot Takes’ will forever remain behind the pay-wall, so if it’s something that appeals to you, then you’ll need to upgrade.

With that out of the way, on to the IMF’s Article IV Consultation!

On a narrow path

The IMF conducts an annual ‘health check’ of its members’ economies, and for whatever reason decided to release its Australian consultation today. The report was based on meetings held in early December, and it certainly didn’t mince its words:

“Australia remains on a narrow path to a soft landing, but risks are tilted to the downside. Growth slowed in the first half of the year, with household consumption weak as real incomes remained soft. Despite rising unemployment, the labour market remains resilient. Growth is expected to pick up over the following quarters, supported by a gradual recovery in private demand and robust public demand. Downside risks to growth include persistent weakness in private demand or a further slowdown in key trading partners.”

By “a further slowdown in key trading partners”, it of course means China and a possible slowing of the river of commodity wealth that has flattered the balance sheets of governments across Australia since the pandemic, most notably in the West.

Getting the fiscal house in order

The IMF also offered up several policy tips – far too many to get into here – along the lines of prioritising productivity reforms, ensuring the labour market can adapt to AI, winding back a Future Made in Australia by confining it to “narrow objectives”, and making housing affordable by dismantling “persistent structural impediments such as planning, zoning, and building restrictions, high costs of land for development, and infrastructure gaps”.

But the real meat was in the monetary and fiscal space:

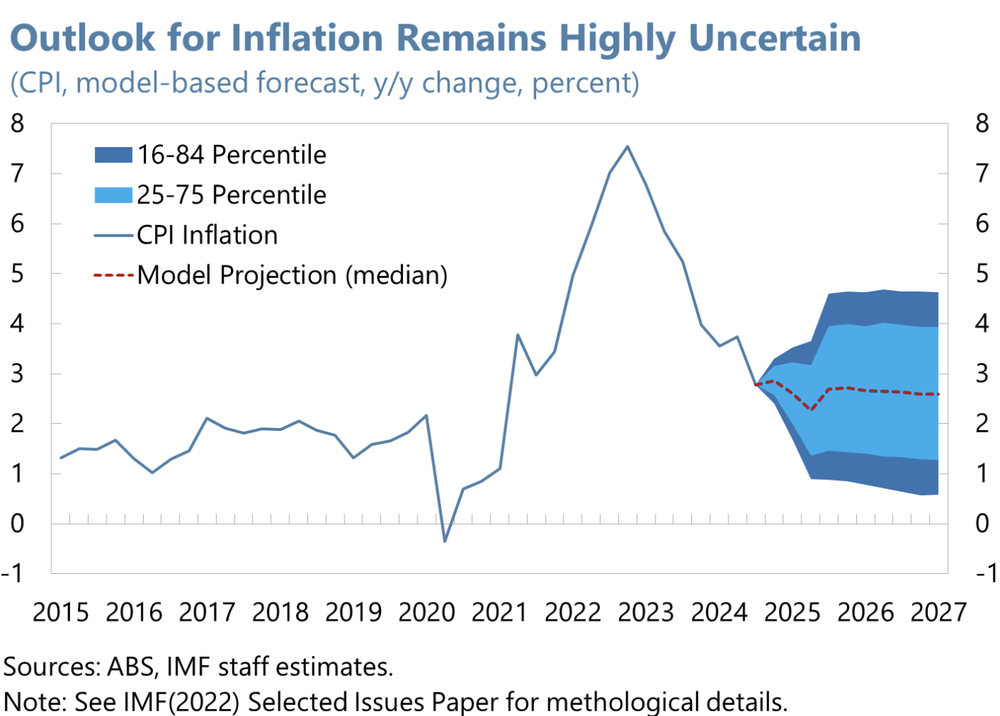

“Inflation is anticipated to sustainably return to the RBA’s target range only by the end of 2025, while a potential stall in disinflation poses a significant risk. In this context, the current restrictive monetary stance is appropriate, and needs to be supported by fiscal policy that avoids an expansionary stance and complements monetary policy’s disinflation objective.”

The IMF is more worried about a resurgence in inflation, and cautions the RBA to be “prepared to tighten further”, especially if “expenditure rationalisation at all levels of government” fails to materialise.

In other words, stop spending so much during a demand-induced inflationary episode! Not only is it making inflation worse, it’s also worsening “construction bottlenecks and crowd[ing] out residential construction projects, where existing capacity constraints have led to substantial supply-demand imbalances and persistent price pressures”.

The IMF also offered this chart, which shows how uncertain it thinks the outlook is (flip a coin!):

Tax reform is essential for future prosperity

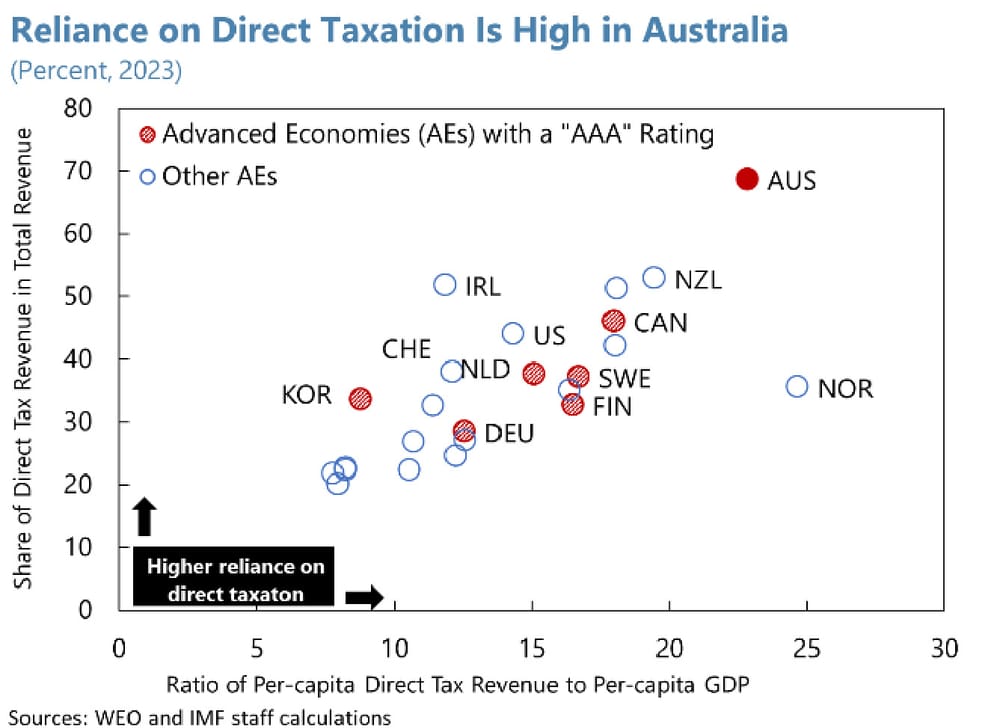

In the longer run, the IMF notes – as I have – that spending and tax reform is needed to reduce persistent structural deficits.

Specifically, “reducing dependence on direct taxes” like income and “stamp duty on housing”, and replacing some of the lost revenue with “property taxes in lieu of stamp duty”, and “a revenue neutral increase in Goods and Services Tax (GST) offset by Corporate Income Tax (CIT) reforms aimed at promoting investment and productivity growth”.

I agree, but such productivity-enhancing tax reforms are also extremely unlikely because they would require all state governments and the Commonwealth to come together to agree on it. Inevitably some states will feel they’re worse off in relative terms and obstruct the reforms, even if every state is better off in absolute terms.

Just as unlikely is the IMF’s desire for “containing structural spending growth at all levels of government”, specifically on infrastructure, which “remains a perennial issue”.

As with tax reform, in Australia the incentives seem to steer politicians in the other direction; to be in favour of large, debt-financed infrastructure projects with costs greater than benefits (yes, it infects Liberal governments too). All so they can claim to be “creating jobs” during a period of full employment, or have something on which they can hang their hat when they retire.

Anyway, I’m over my self-imposed word limit so that’s where I’ll leave it for today. Do read the whole thing if you’re interested in what economists in Washington DC think about us, and have a very Merry Christmas!

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!