The Aussie dollar's fresh lows

The Australian dollar fell below 62 cents to the US dollar earlier this week, its lowest level in more than two decades outside of a brief stint below that mark during the depths of the pandemic panic. What’s especially noteworthy is the recent trend, leading to posts like this on social media:

Many replies were of the doomsayer “it’s going to zero” types, although at least some were optimistic, hoping that there might be “a silver lining for local producers with cheaper exports”.

On both counts, my response is: unlikely!

Never reason from an exchange rate change

An exchange rate is the value of one currency relative to another. It’s a nominal rate, so tells us nothing about why these valuations change, nor about what they might mean for Australians.

Think of an exchange rate as a price. You wouldn’t discuss the price of bananas without first considering whether the price change was due to some new banana cake recipe on TikTok (demand), or a cyclone in Queensland (supply).

The same applies to an exchange rate: is the price changing due to demand or supply? Knowing the causal forces helps to understand not just the recent movement, but also potential future movements.

China, Trump and the trade wars

As is frequently the case, the current depreciation looks to be multi-causal, i.e. there are several demand and supply forces working to push the dollar’s price down.

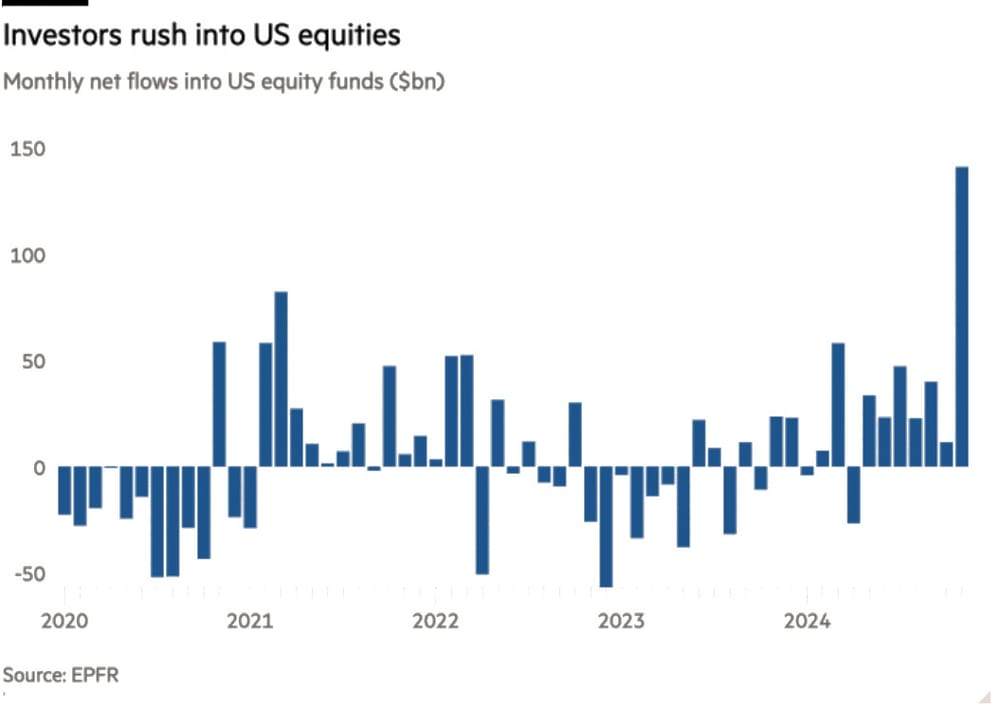

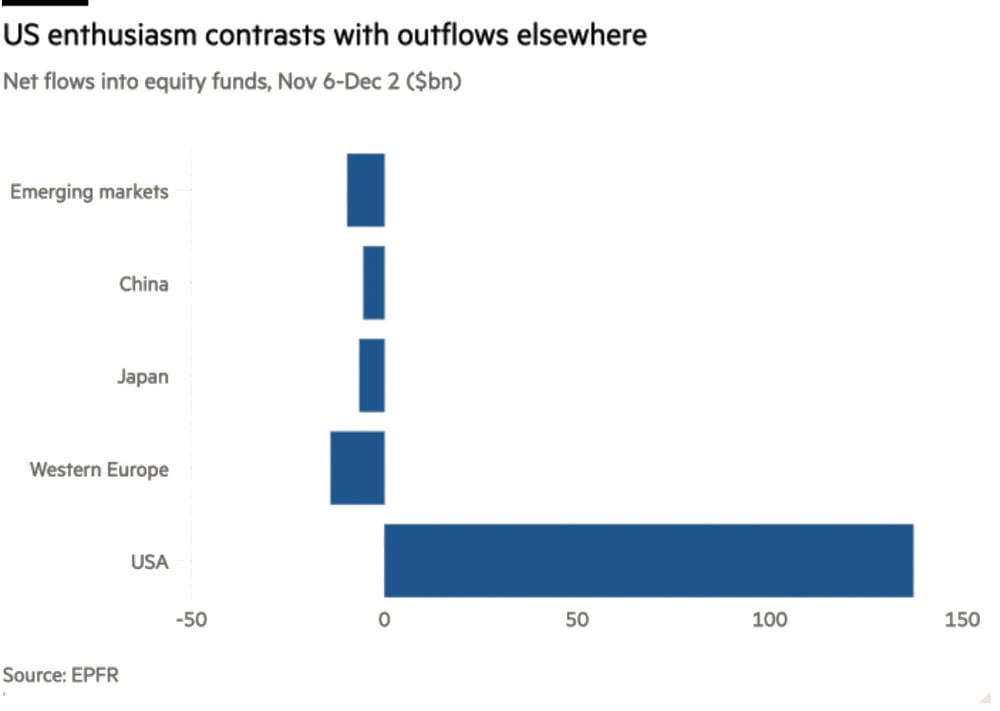

The first is the demand for US dollars: the relative strength of the US economy is increasingly appealing for foreign investors, who must buy dollars to facilitate those trades. That pushes up the value of the US dollar relative to other currencies, including the Aussie.

Source: Financial Times

Another demand force is Trump’s soon-to-be ascent to the US Presidency, which will see a continuation of the Biden government’s debt-financed spending spree. That will be met with tighter monetary policy to keep a lid on inflation, raising the interest rate differential between the US and other countries. Provided the US remains a “safe” place for capital (i.e. no debt crisis), higher nominal rates will increase the relative return on US assets, boosting demand for US dollars.

Then there’s the threat of a fresh wave of Trump tariffs, which will also cause the US dollar to appreciate because of the exchange rate adjustment.

It goes like this: when someone in the US buys goods from overseas, they also “sell” US dollars and “buy” the local currency. Raising the price of those goods with tariffs will reduce US demand for them, along with the currency of the exporting country. This adjustment cancels out some of the effect of the tariffs and leaves bilateral exchange rates permanently changed.

Then there’s China. The country is currently mired in deflation, with the economy weighed down with bad debts stemming from the bursting of its property bubble and low-productivity, state-directed investment. China is by far Australia’s largest trading partner, and the Aussie dollar " is seen to fluctuate closely with developments in the Asia region because of our close trade ties".

A weak China generally means a weak Aussie dollar, because it won’t need to buy as many tonnes of iron ore, or send as many of its kids to Australian universities. It’s perhaps telling that the Aussie dollar has uniformly depreciated against all but the Kiwi dollar (triple-dip recession) and Korean won (political uncertainty):

Source: RBA

Source: RBA

Fiscal follies and the narrow path

Then there’s the supply side. The Reserve Bank of Australia (RBA) has been relatively more dovish than its global advanced economy peers, as it walks the “narrow path” to inflation stabilisation. That has meant inflation – a sustained loss in the purchasing power of the Aussie dollar relative to goods and services – has persisted for longer than in other countries.

Remember that inflation pushes all prices higher, including the price of foreign exchange! More inflation means a weaker nominal exchange rate.

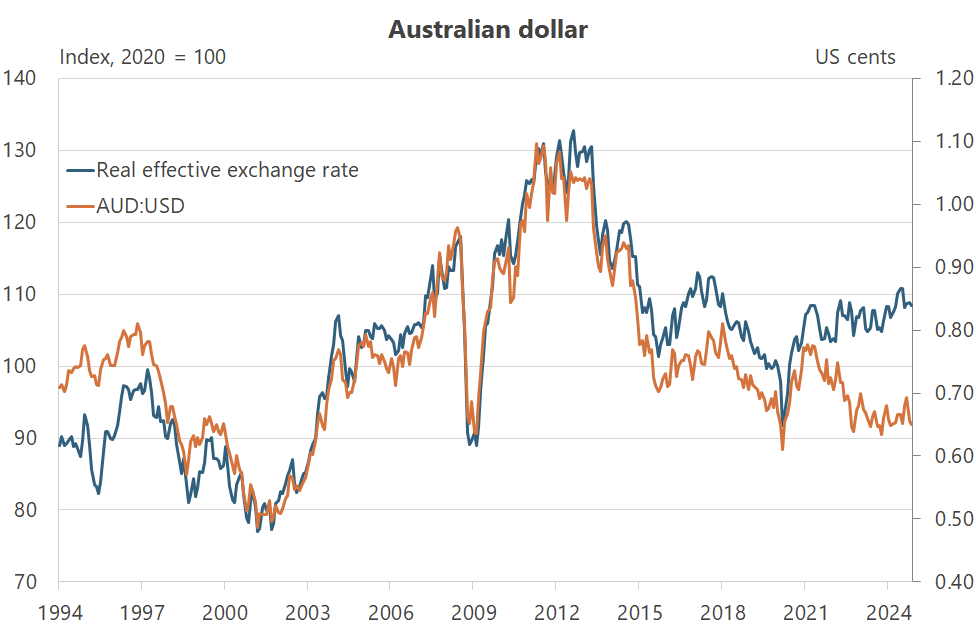

It’s also worth distinguishing between nominal and real exchange rates. While the nominal rate measures the value of one currency relative to another, the real rate reflects the relative cost of living between countries and their respective competitiveness.

To the extent that the fall in the nominal Aussie dollar exchange rate was caused by interest rate differentials, the depreciation would have been fully offset by higher domestic costs from inflation. And as it turns out, Australia’s real exchange rate has increased:

Source: Bank for International Settlements

Source: Bank for International Settlements

Australia’s real exchange rate is still among the highest in the world. So despite the nominal depreciation of the Aussie dollar against most currencies, Australia’s international competitiveness has fallen – it’s now a less attractive place for foreigners to invest in productive capacity – our trade-exposed industries are unlikely to benefit from the weaker Aussie dollar, and as holders of said dollars, we’re all now poorer.

The big money question is then: where to from here, and what can be done about it?

To the extent that the nominal depreciation and real appreciation is being driven by factors in other countries (and how that influences commodity prices, etc), there’s not much the government can do.

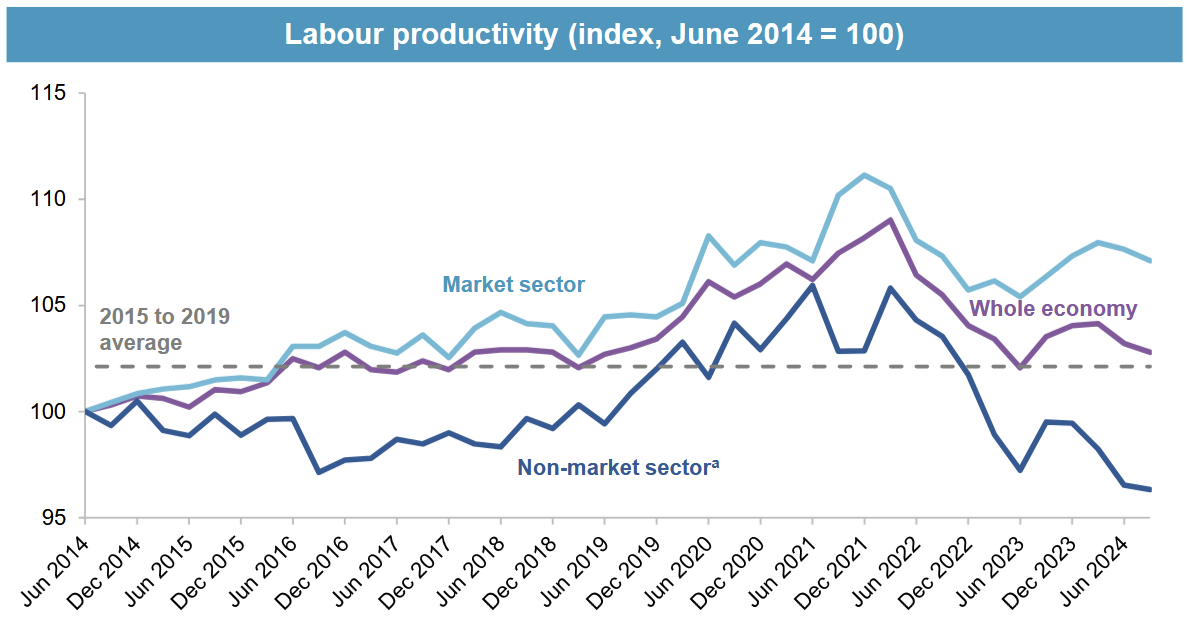

But the government can definitely do something about the domestically-driven forces pushing up the real exchange rate, which have roots in Australia’s persistent lack of productivity growth which " is now back to where it was during the stagnant 2015 to 2019 period leading up to the pandemic".

Quite simply, we need reform (e.g. a rebalancing from direct to indirect taxes) and for our governments to stop spending so much. Until that happens – or we are again saved by a positive real shock in some other country – the Aussie dollar is unlikely to regain its glory days.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!