Investment will suffer in the age of Trumpian uncertainty

A month ago I wrote that, regarding the current Trump administration, “[t]he only certainty is that the uncertainty and chaos will continue to reign, with damaging consequences for the world’s growth prospects”.

I think that was pretty accurate. I mean, we’re now only a little more than 24 hours away from Trump’s full ‘Liberation Day’ tariffs coming into effect, yet we still don’t know if it’s even going to happen— the best Treasury secretary Scott Bessent could offer this morning was:

“They are negotiable but not a negotiating tactic”.

Right—except that’s the opposite of what he said only a few months ago.

The only thing we do know at this late stage is that the universal 10% tariff on all imported goods (including from Australia) kicked in on 5 April, but the much more extreme—and completely arbitrary—country-specific tariffs aren’t due to begin until 2:01pm AEST tomorrow update: today.

Trump has a few options available to him. While no one can know for sure until it actually happens, he’s going to either:

- let the tariffs come into effect in their current form, crushing markets and the global economy;

- press pause to allow more time to “negotiate” deals with individual countries; or

- announce deals that roll back some of the more extreme tariff rates to something closer to 10% (with the exception of China and perhaps the EU, which have announced or are voting on retaliation).

The joke of the whole “deal” narrative is that the obstacle to trade agreements was never other countries, but the US itself. The EU offered Trump a zero-for-zero deal weeks ago. It was the US that pulled out of the Trans-Pacific Partnership.

But if that’s what it takes for Trump to save face, declare victory and move on, then so be it. My personal hunch is he’s going to stick with the 10% floor (remember, Trump loves tariffs) but wind back most of the country-specific ones which, while still bad, would be nowhere near the ‘Liberation Day’ carnage.

Now, I could be completely wrong—Elon Musk, who was joined at the hip to Trump for much of the past few months, appears to have been so blindsided by the tariffs that he started tweeting videos of Milton Friedman! The reality is that no one really knows what’s going to happen in advance, perhaps not even Trump himself, who is probably simply revelling in being showered with gifts and attention from world leaders.

Indeed, for those hoping for clearer air moving forward, this isn’t going to stop with the ‘Liberation Day’ tariffs because Trump just flat out detests trade. Later this month his administration is planning to levy large port call fees not just on ships made in China, but also on companies that even own a single ship made in China, a move “that will hamstring exporters [and] would be a true self-own”—and is no doubt still “negotiable”.

The Trump administration is truly embarking down the road to a Maoist-style autocracy and, as the NYT’s Michelle Goldberg wrote, people really shouldn’t have been so surprised:

“In his 2018 book ‘Fear,’ Bob Woodward reported that Trump scrawled ‘TRADE IS BAD’ in the margin of a speech he gave after the G20 summit. It makes sense that Trump would see things this way. When he makes sales, whether of Trump University courses or Trump-branded cryptocurrency, he is usually taking advantage of the buyer, and he views global trade through the same zero-sum lens.”

The difference between Trump 1.0 and 2.0 is the adults that were in the room the first time around are no longer present. As just one example of the shenanigans that took place during the first term, Gary Cohn – Trump’s former economic adviser – reportedly snuck into his office one night and stole a draft letter that would have terminated the United States-Korea Free Trade Agreement.

There’s zero chance that his current advisor, Peter Navarro, would do the same—if anything, he’d be pushing Trump to rip up every trade agreement ever signed by the US government.

But perhaps even more damaging than the ever-expanding list of bad policies (if you can call them that) being unleashed by an unchecked Trump 2.0 administration is the method by which they’re being rolled out, which is creating enormous uncertainty—anathema to investment.

Trumpian uncertainty reigns supreme

There is nothing certain about a Trump administration. He infamously makes policy decisions on the fly, even claiming to have come up with his no tax on tips idea after speaking to a waitress at his Las Vegas hotel, then quickly making it part of his election campaign.

Trump also “wants to be unpredictable”, believing it gives him an advantage in deal making:

“Trump wants to be unpredictable. By disposition or personality type, he enjoys being impulsive and difficult to deal with. But over the course of his life, and especially his first presidency, he came to realise that the less people know what he’s going to do, the better off he seems to do. Regardless of whether that’s better for the country as a whole, many advantages for him personally accrue from being this unpredictable force — inputs come in, and we don’t know what’s going to come out the other side.

He believes this gives him negotiating leverage. He believes that this makes his strategies more likely to succeed. There’s something self-serving about this, but he has taken this disposition and elevated it to an official philosophy.”

There’s some truth to that—revealing your plans to an adversary is never a good idea. But is Canada really an adversary? Cambodia? The penguins on the Heard and McDonald Islands?

What if you run a business? Not knowing which way the tariff winds will blow today, tomorrow, or a year from now is a huge problem. Firms make investment decisions for the long-term; factories last for decades.

Even if Trump pauses or rolls back his ‘Liberation Day’ tariffs, people are going to be apprehensive about committing funds to new investments anywhere that might have to deal with a sudden policy change—including in the US itself.

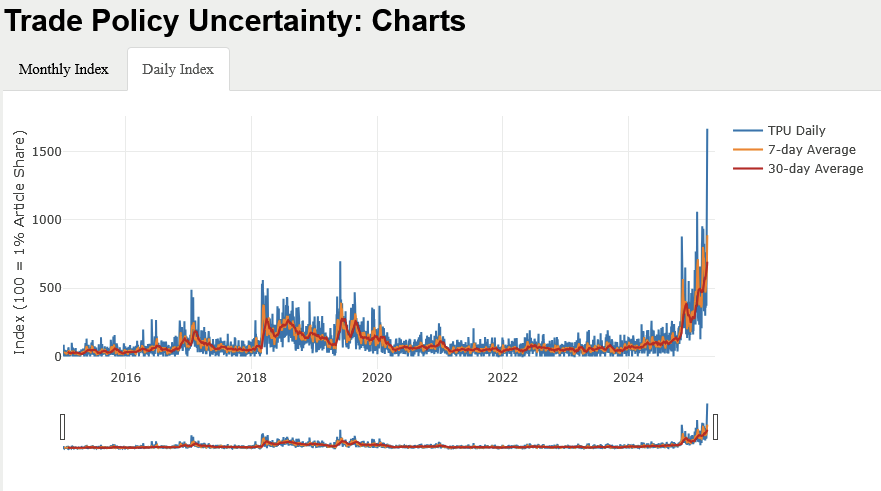

Charts like this are toxic for any kind of investment, but especially the kind of durable, long-term manufacturing that Trump says he wants to ‘bring back’ to America:

There’s a body of academic literature that shows how unpredictable legislation and unclear policy making means businesses can’t reliably forecast returns or risks, causing investment to collapse.

Trump’s “unpredictability” and discretionary tendencies also open the door for rent-seeking via lobbying, which is what economists call “the act of growing one’s existing wealth by manipulating the social or political environment without creating new wealth”.

As Dominic Pino wrote about Trump’s protectionism:

“[L]obbying isn’t an unfortunate side effect of protectionism. It’s an integral part. And sure enough, the new ‘golden age’ of protectionism that the Trump administration wants to inaugurate has spawned new lobbyists to take advantage of it.

…[T]ariffs encourage waste. They create entrepreneurship opportunities, not for pleasing customers but for evading the government.

Lobbying is one of the ways businesses waste money under protectionism. The firm with a competitive advantage is no longer the firm that makes the best products and markets them most effectively. It’s the firm that’s best connected to government.”

But it’s not just direct lobbying that’s costly. Firms will analyse every margin as they attempt to minimise the costs of the Trump tariffs. As the Financial Times reported:

“An example could be a spirits importer whose supplier not only sold them the drink, but also provided advertising and promotional help, said Mathew Mermigousis, BDO’s customs practice leader.

‘Under customs rules, generally advertising and promotion is not a dutiable cost,’ he said. ‘If you’re able to extract that and create a separate service payment for it, you lower the dutiable value to help mitigate the impact’ of tariffs.

In a webinar for clients on Friday, EY pitched a more intricate version that involved splitting out a royalty for using the intellectual property underlying a product. The royalty should ‘preferably’ be paid to a separate company from the product supplier, it advised.”

Taxes are costly, and a big part of that is because they change behaviour for the worse—e.g. more lawyers and consultants spending time and money trying to avoid taxes rather than doing something productive.

It’s all kryptonite for investment, which is bad for growth, even if Trump rolls back his tariffs tonight. As a business owner in Michigan recently put it:

“We can’t operate a business flying by the seat of our pants. The administration can organise itself in that fashion. But how do you realistically expect me to follow suit?”

Trump’s dangerous zero-sum thinking

So why is Trump doing it? Common among the young (most grow out of it by middle age), Trump possesses what’s called zero-sum thinking, which leads him to the belief that every exchange – including trade with other countries – has a winner and a loser, rather than being mutually beneficial.

Not only does such thinking fly in the face of basic economics and centuries of empirical evidence, but it’s also downright dangerous when the individual who believes it is in a position of power:

“Zero-sum-thinking is one of the hallmarks of ‘populism’, in its most derogatory sense, political ideas which are popular precisely because they are unsophisticated and don’t actually benefit the groups they are supposedly aimed at helping.”

It’s why, when asked whether any country was close to reaching a deal, Trump flat out rejected the premise:

“Trump said he’d spoken with several unidentified world leaders. He repeated that the goal of the tariffs is to fully eliminate bilateral deficits — a tall order for the world’s biggest economy where consumer spending, and cheap goods, is a core driver of growth.

‘They’re dying to make a deal and I said, ‘We’re not going to have deficits with your country.’ We’re not going to do that, because to me a deficit is a loss. We’re going to have surpluses or, at worst, we’re going to be breaking even,’ he said.”

Trump quite literally thinks that buying more from a country than it buys from you means you’re giving them money—that they’re “ripping us off”.

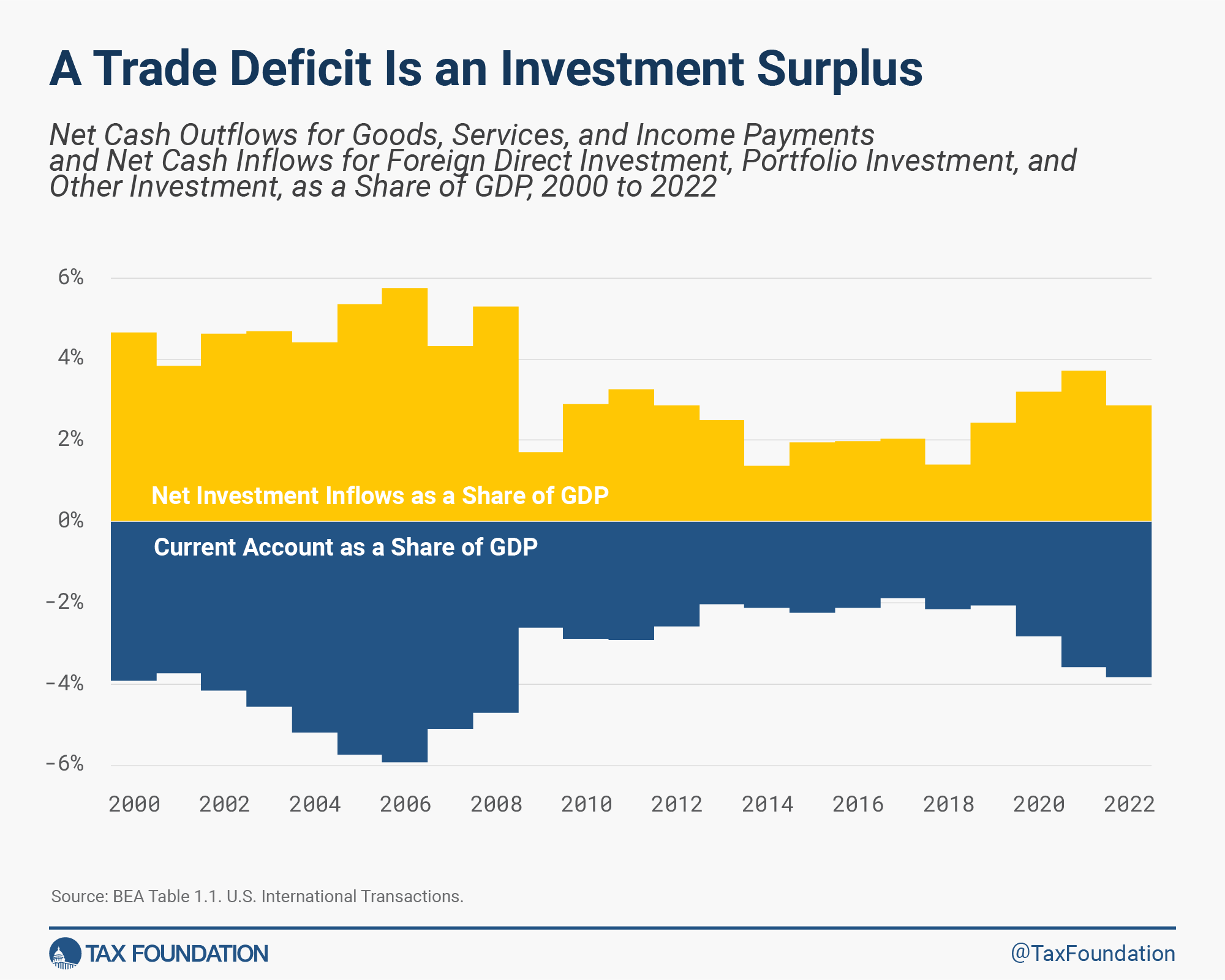

It’s during times like these that I wish instead of “trade deficits”, people would start calling them “investment surpluses”. They’re the same thing, but the latter is less likely to leave future shallow, zero-sum thinkers like Trump astray:

The only glimmer of hope is that despite Trump’s deeply flawed thinking, the near-20% collapse in equity prices and more than $10 trillion of wealth wiped out in just three days means even he must be able to see the writing on the wall by now.

And as Salena Zito wrote back in 2016, you need to “take him seriously, but not literally”. That’s the reason I still think the most likely outcome is a winding back of the Trump tariffs, dressed up as some expertly executed negotiation strategy: reading between the lines, nations should still be able to strike “deals” if they pledge to reduce their respective bilateral trade deficits over time—in much the same way China negotiated a “deal” prior to the pandemic.

I’m not sure to what extent markets have priced in such a scenario, but while they might welcome any resolution avoiding the outrageous country-specific ‘Liberation Day’ tariffs, Trump’s unpredictability and deep-seated aversion to trade cast doubt on whether he can credibly commit to such deals, leaving the investment—and therefore growth—outlook highly uncertain.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!