Monday Musings (35/24)

There were a lot of interesting things I couldn’t get to last week on account of a couple of rather Orwellian policies announced by the government that needed addressing, so without further ado, let’s get stuck in!

No reform is better than bad reform

Treasurer Jim Chalmers failed to convince the Coalition to support his reforms to the Reserve Bank of Australia (RBA), which has accused him of using the reforms to implement “a sack and stack strategy”. But rather than shelve the dual-board model, Chalmers is now going to try and cut a deal with the Greens:

“Among their demands is the preservation of the government’s authority to override RBA decisions, as well as maintaining the provision in the RBA Act that allows the RBA to channel funds into productive areas of the economy, such as clean energy.

‘Removing democratic oversight over the RBA would be Labor’s final capitulation to the power of capital, and to the neoliberal agenda’,’ McKim said.

‘Section 11 gives the Treasurer the ability to intervene to override the Reserve Bank when necessary. Dr Chalmers should use that power now to reduce interest rates and retain it so it can be used in the future.

‘Section 36 allows the RBA to direct funds to productive areas of the economy like clean energy, rather than just the continued pumping of money into housing speculation’.”

I sincerely hope that Chalmers isn’t entertaining this “deal”, and is simply using it as a threat to get the Coalition over the line. If anything, Labor should end its association with the Greens entirely, as it’s a party whose policy moves – e.g. anti-nuclear, pro-CFMEU, pro-rent and price controls, and now politicising the central bank – are nothing but thinly-veiled attempts to woo left-Labor voters even further towards the Green extreme.

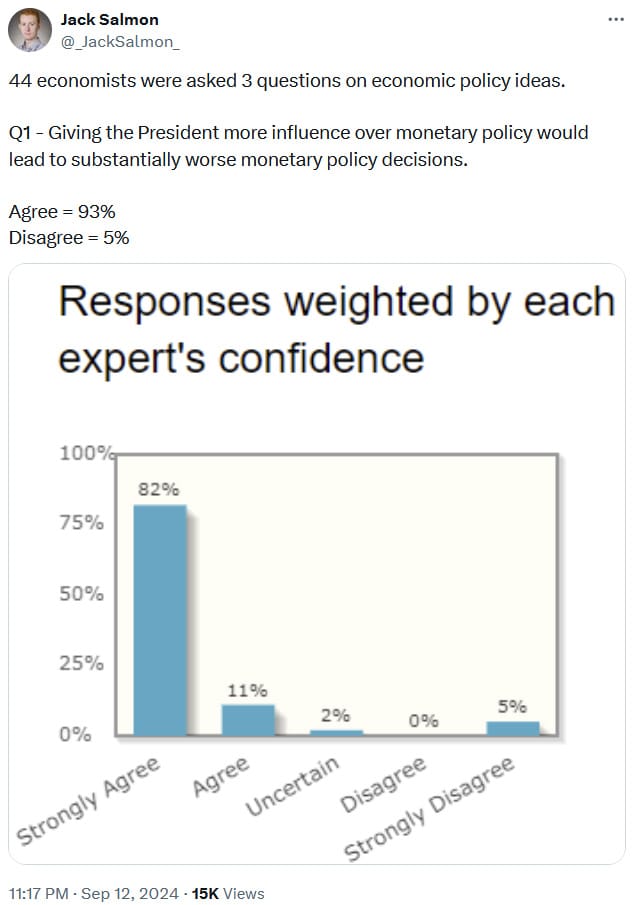

The Greens’ RBA reform demands would be worse than doing nothing at all; there’s a reason why almost every economist supports an independent central bank. It’s because history has shown, time and again, that politicians are really bad at it:

If Chalmers can’t agree not to stack the monetary board, then Australia would be better off without the board-splitting reform. Chalmers could just drop it, and I’m sure the Coalition would support the rest of the reforms, including that future board members should have “expertise in areas such as open-economy macroeconomics, the financial system, labour markets, or the supply side of the economy”, and be “appointed through a transparent process”.

Chalmers’ complete unwillingness to do so suggests that the Coalition might be onto something with the “sack and stack” theory, especially as his two appointments to date were not monetary experts – or even economists at all – and were not hired through a transparent process.

Student caps will make us poorer

Economist Matt Nolan of the e61 Institute wrote an interesting post on the government’s international student caps last week, going into some depth about the importance of the education sector to Australia and how big the cap really is [emphasis in the original]:

“None-the-less, this is a 20% drop in student numbers - and given it is likely that student numbers would have continued to grow, this is an even larger restraint on this export.

Viewing students payments on both tuition and goods and services when they are here as ’exports’ - which they are - this is Australia’s fourth biggest export sector. Furthermore, the exports are highly concentrated in NSW and Victoria - although relative to the size of the state economy revenue from export education is largest in Victoria followed by ACT, then NSW, Tasmania, and South Australia (with the relative size in Western Australian and Northern Territories much smaller).”

I’ve written about how bad the student cap is and the absurd knots that at least one prominent economic commentator tied himself in to justify a claim that international students are an “import” and therefore do not contribute to the Australian economy.

They actually make a large contribution, and so reducing their numbers by twenty percent is a big deal. And as Nolan notes, the impact won’t be felt evenly because it’s not even a blanket cap:

“Universities with the facilities and experience supporting large numbers of international students are having their caps slashed, while random regional universities are given large caps … which they probably won’t fill.

Australia is in an international market for students. Students are not thinking ‘I want to live in Australia, given that I will go anywhere’ - they are thinking ‘I am choosing between these different international universities’. If regional universities could already attract students they would - the pool isn’t scarce - as a result what will happen instead is the students will just go to a different country.

As a result, the ‘fair allocation’ argument is a mixture of nonsense and strangely insular. To attract international students you have to offer them a service - and this policy punishes the universities that can do that (due to scale and location also) for no real reason. This makes it more silly than just some blanket cap.”

Do read the full post, in which Nolan concludes that the policy “won’t do much of anything related to house prices but will have real costs for Australian students, knowledge creation in Australia, and benefit from trade for Australia”.

Strawberry fields forever?

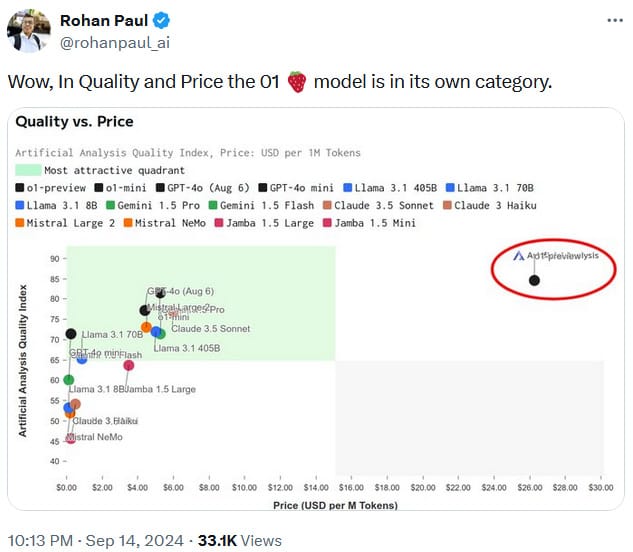

OpenAI released its latest model, ‘o1’ – dubbed ‘Strawberry’ – last week. At risk of oversimplifying, it’s basically just another large language model whose special sauce is chain-of-thought reasoning, which has been around for a couple of years. OpenAI has taken that tech and made it work in an application. The model is slower and more expensive to run than older LLMs because it now “thinks” so much, with the advantage that its responses are more accurate:

“Effectively, this means the models can better handle significantly more complicated prompts where a good result requires backtracking and ’thinking’ beyond just next token prediction.”

However, it’s still an LLM; we’re not even on the road to artificial general intelligence, so there’s no need to worry about a terminator-style end of days event just yet. It also still hallucinates, producing plausible but wrong answers, but is definitely better at avoiding them than GPT4 and Claude 3.5.

Interestingly, OpenAI – which really should change its name – has now become even more closed, ordering Strawberry to keep its entire chain-of-thought secret. If you try to trick it into revealing its reasoning, OpenAI support will even write you an angry email threatening to deactivate your account.

It’s an odd business decision, because if the chain-of-thought is secret, it means there’s nothing preventing OpenAI from charging whatever it wants (other than the user ditching it):

“While reasoning tokens are not visible via the API, they still occupy space in the model’s context window and are billed as output tokens.”

Occam’s Razor would lead me to assume that the reason for OpenAI’s secrecy is because Strawberry isn’t all that revolutionary, the competition is breathing down their neck – barring favourable regulation, there is no moat – and they’re in the middle of a big funding round that they want to wrap up before those competitors unveil their Strawberry equivalents and the latest hype dies down.

I mean, how else is CEO Sam Altman going to afford his next Koenigsegg Regera?

What to do about Qantas

There was a bunch of talk last week about breaking up Qantas. Specifically, the Coalition had supposedly agreed that Jetstar should be forcibly divested, only for the news to break that it was purely the view of a rogue Nationals senator, Bridget McKenzie:

“The Nationals leader, David Littleproud, told Sky News divestiture in aviation is ’not Coalition policy yet’ and the idea had not gone to shadow cabinet because ‘it was an op-ed about a review that the government has put out’.

He clarified McKenzie had only proposed it as an option ’to be looked at’ by the Australian Competition and Consumer Commission (ACCC).

‘I think everyone’s taken a step ahead of exactly what Bridget McKenzie said,’ he said, in reference to the piece headlined ‘Is it time to force Qantas to break up with Jetstar?’.”

Look, Qantas is a problem. According to the ACCC, its market share – which includes Jetstar – has been above 60% for many years. If you add Virgin then the domestic airline sector becomes more concentrated than “banks, supermarkets, internet service providers, newspaper publishers and insurance companies”.

Now, as good economists we know that industry concentration ≠ market power – concentration tells us nothing about level of market competition. But there are good reasons to suspect that Qantas (and to a lesser extent, Virgin) does have market power, mostly because the government gifts it highly valuable landing slots at prices well below what a market auction would fetch, restricting competition. As the ACCC put it:

“The most effective way that the Australian Government could enhance airline competition for the benefit of consumers would be to implement reforms to the way Sydney Airport slots are allocated to airlines. Without these slot changes, there will not be any material improvement in domestic airline competition in Australia in the foreseeable future.”

In other words, Qantas is only a problem because of the various laws protecting its problem-making status. Qantas has no natural monopoly. Forget divesting Jetstar; all that’s needed to make the market more competitive is to allow the threat of entry. But for that to happen the government needs to do the hard work of reforming the sector, and stop doing stupid things like actively blocking airlines that want to fly here.

Look, I know that Qantas Chairman’s Lounge membership is highly valued by our politicians. But that privilege comes at a huge cost for the rest of us economy-flying plebs.

European innovation

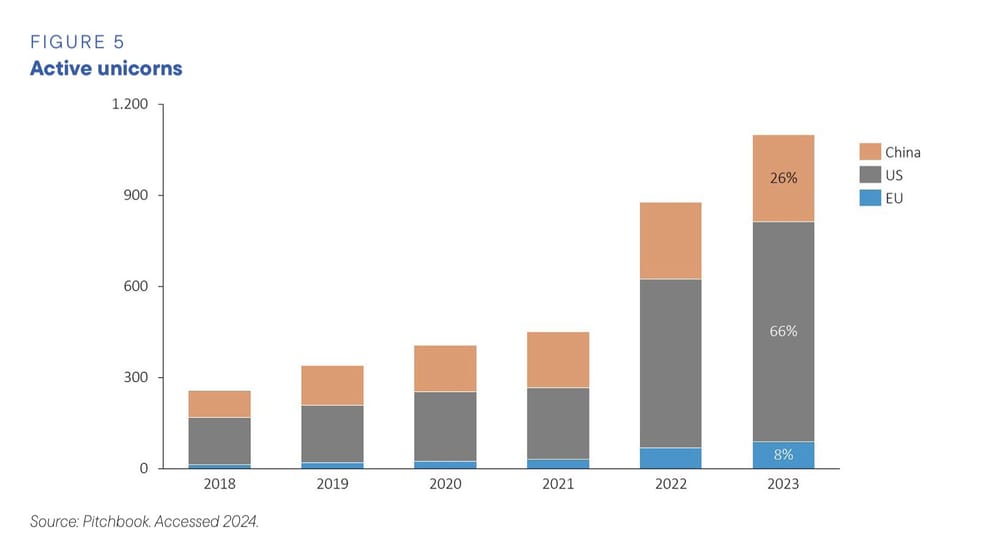

The Europeans aren’t exactly known for their innovation. They produce considerably fewer billion-dollar companies than the US and China:

But where they do innovate is on regulation. Here is professor of public policy at the LSE, Luis Garicano:

“GDPR is the big data privacy law enacted by the European Union in May 2018. It aimed to protect individuals’ personal data and privacy by setting strict rules on data collection, processing, and storage. GDPR applies to all organisations handling EU residents’ data, regardless of location.

GDPR requires firms to get clear consent before using personal data. If ensures data is used only for the purpose it was collected, and only minimum data, for minimum time, is held. It sets stringent rules for special categories of data, like health or demographics. It allows people to see what data companies hold about them, correct it, or ask for its deletion. Firms must report data breaches quickly, minimise the data collected and not use it beyond the purpose of collection. Fines for breaches can reach 4% of global revenue.”

All those annoying cookie pop-ups that you just try to get rid of as quickly as possible without reading them? You can thank the GDPR for those. But there’s another, more damaging side-effect of regulation that gets balance between consumer safety and innovation wrong:

“It appears GDPR has put smaller firms at a relative disadvantage and that it has increased market concentration, particularly benefiting very large firms, notably Google .

The reason is that GDPR increases the fixed costs of data manipulation, and hence creates new economies of scale – and advantages for large firms. It’s like telling everyone they need to buy a $1 million machine to make cookies. Google can afford that, but your local bakery? Moreover, it gives an advantage to those who have large proprietary (first party) data sets and hence can more easily contact customers.”

By suffocating the small guys, it’s also stymieing innovation:

“According to Janssen et al (2022), GDPR induced the exit of about a third of available apps; in the quarters following implementation, entry of new apps fell by half. Also, average users per app rose by about a quarter for apps born after the imposition of GDPR. Finally, consistently with the objective of the regulation, apps became somewhat less intrusive after GDPR.

More worryingly, GDPR appears to reduce (Jia et al, 2021) the number of venture deals in the EU compared to the USA and RoW following GDPR’s rollout in May 2018. The EU experienced a 26.1% reduction in the number of monthly venture deals compared to the USA, and a 34.2% reduction compared to the RoW.”

I think there are some important lessons here for Australia, notably with AI, where it’s going to be very important to get the right balance between safety and innovation. Given that our current laws are probably good enough to handle most of the risks posed by AI, I would caution against doing what the Europeans did during the internet era: namely, passing overly-prescriptive and costly rules that drove them into the productivity doldrums.

Fun fact

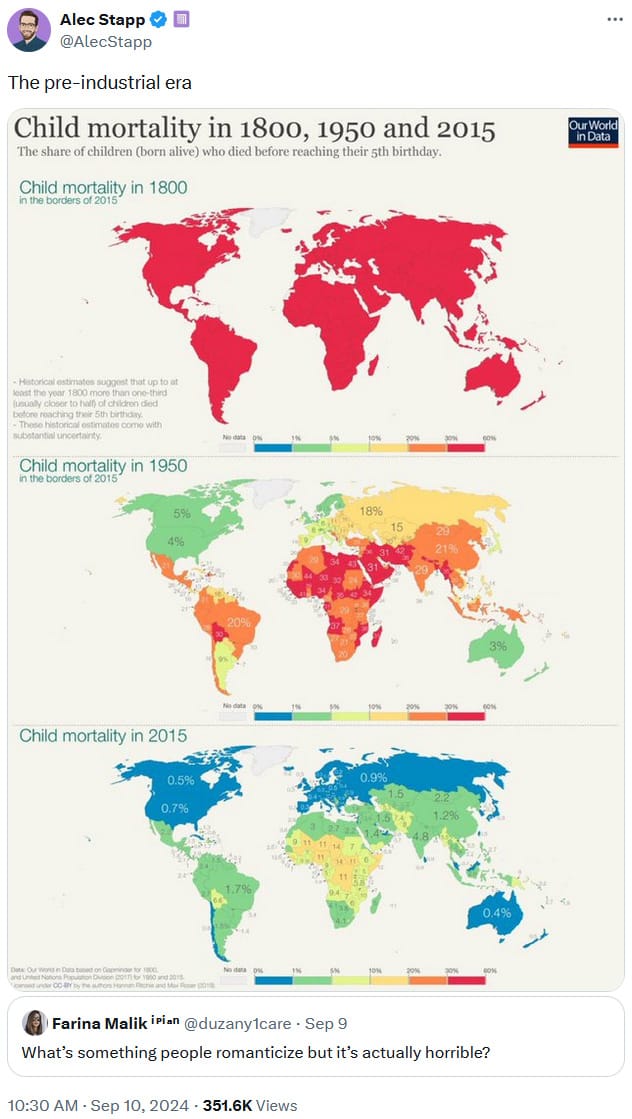

The pre-industrial era was horrible:

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!