More on Trump's tariffs, Albo's upper class welfare, Dutton's housing gimmick, Canada's pain, Australia's challenges, and why are so many of us disabled.

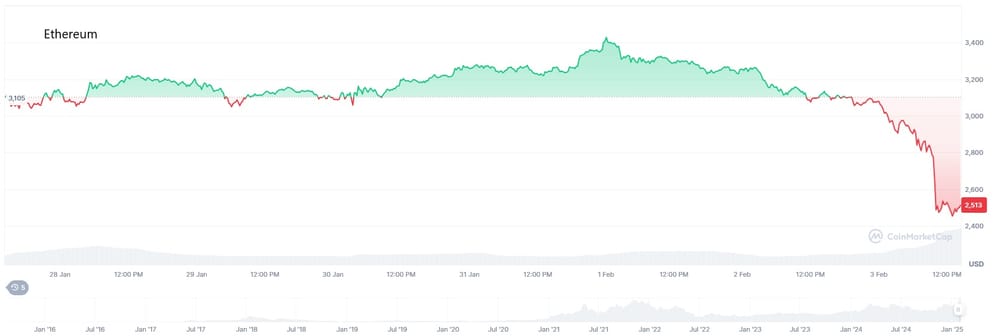

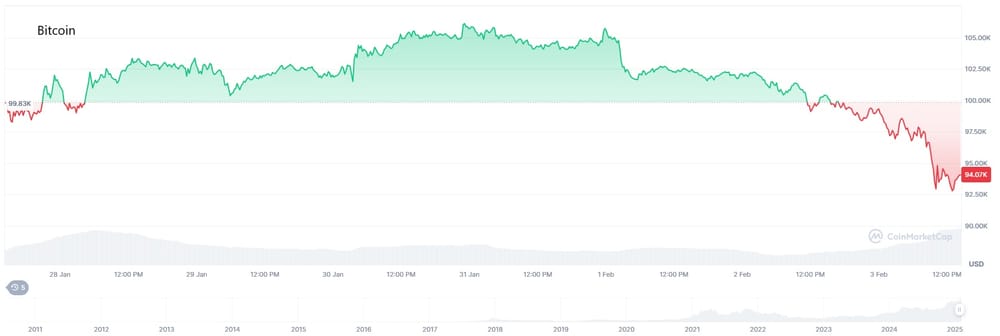

The fallout from the first Trump 2.0 tariffs has continued into the week, with the latest casualty (other than global equities) being the risky crypto that had been bid up on what was ‘supposed’ to be a market-friendly Trump government:

Crypto and equities subsequently rebounded a little after Trump reached a “deal” with Mexico, delaying the imposition of 25% tariffs for a month. The agreement will see its southern neighbour send 10,000 troops to the border, while the US will work “to prevent the trafficking of high-powered weapons to Mexico”.

As for Canada, the outlook is less certain. The threat of retaliation – specifically targeted at ‘red state’ goods – appears to have taken Trump’s team by surprise, with the head of the National Economic Council saying:

“Canadians appear to have misunderstood the plain language of the executive order and they’re interpreting it as a trade war.”

Trump is meeting with Justin Trudeau for a second time later this morning and he has a new complaint: banking. According to Trump, “they don’t allow our banks”. So perhaps he’s pushing for a relaxation on retail banking laws that make it difficult for US banks from competing for Canadian deposits.

But with Trump, who really knows. It was only a day ago that he said there was nothing Canada or Mexico could do to forestall this round of tariffs. He also fired off a couple of posts confirming that he’s a dyed in the wool mercantilist who doesn’t understand that imports are a benefit of trade, not a cost:

There’s so much wrong with these two statements that I’m almost impressed; Trump, in one fell swoop, managed to misunderstand or misstate almost every established principle of trade theory.

As for replacing tariffs with income taxes, Trump’s concept of the magnitudes required is completely off-track:

“Current income tax revenues are about $2.5 trillion per year. Goods imports are just over $3 trillion per year. So replacing individual income taxes would imply an 83 percent tariff rate. But that’s true only if raising tariff rates by over 2,500 percent (from under 3 percent to 83 percent) would have no effect on the level of imports. Because people would buy fewer imports if they had to pay that tax, the tariff rate would have to be substantially higher or the income tax system would have to be retained.”

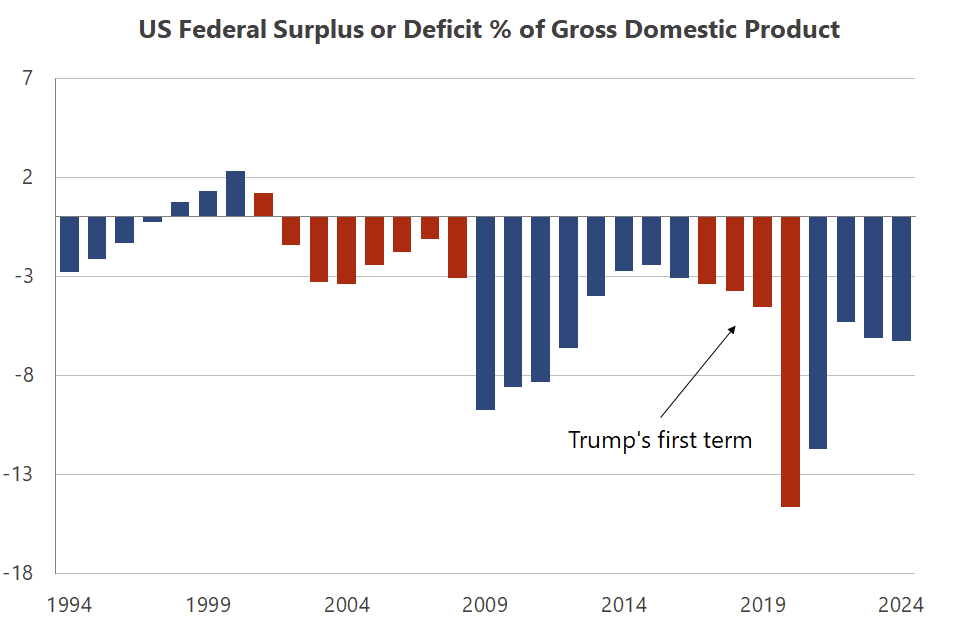

There’s just no way to replace US income taxes with tariffs without first fixing the budget deficit (which, by the way, would actually help to achieve Trump’s goal of reducing the trade deficit). But Trump is just as addicted to budget deficits as his predecessors:

Unless Trump also cuts spending by unprecedented levels – something he didn’t even attempt during his first term – then the US will have to live with income taxes and tariffs.

If so, a more apt description of Trump would be the Tax Man, which probably explains at least some of the market’s recent reaction – it’s only just starting to price in the lunacy!

Ultimately, even if a “deal” is struck with Canada and Mexico, the uncertainty created by a man who flip flops between temporary stability and blowing up entire supply chains on a daily basis is not great for investor confidence. There will be longer-term consequences of this game and the complete erosion of trust (it was only five years ago that Trump orchestrated the USMCA agreement between these nations!), and they don’t bode well for growth.

The latest middle class welfare

The Albanese government is so desperate to roll out its childcare subsidies that it brought the legislation forward to this week, in what could be the final sitting of Parliament before the election:

“Labor had planned to legislate the policy – which will abolish for three days a week the requirement that parents must work or study in return for the childcare subsidy – after the election.

The measure will not begin until January 1, 2026 and – like Labor’s promise to waive $16 billion in student debt – its implementation was designed to be contingent on Labor first being re-elected.

But with the polls deadlocked and the government escalating a campaign that claims voters will be better off after three more years of Labor, the legislation to abolish the activity test for families with a combined income up to $530,000 will now be shoehorned into the final sitting fortnight.”

Will this ease costs for families? Sure. But that doesn’t make it a worthwhile policy, which would require benefits greater than the substantial costs (remember that we’re, as a nation, borrowing against the future to pay for such spending).

In this case, it looks like a big fail.

ANU’s Ben Phillips looked at the data from the past three years of the Albanese government’s slightly less generous childcare subsidy and found that:

- childcare fees rose by 23.7%, which was faster than the economy-wide inflation of 16%; and

- childcare hours increased by 6.6%, which was below the increase in the total hours worked across the economy.

In other words, subsidising childcare in this way gives you an effect that is “similar to a welfare payment to existing childcare middle/high income families”, because higher income households consume more paid child care hours than lower income households.

Middle- and upper-income welfare. We’d be better off if he just sent people cheques.

Voters know what they want…

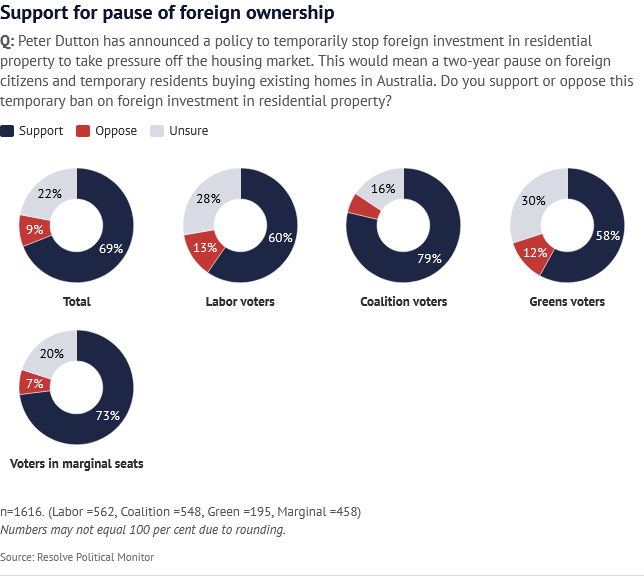

…and deserve to get it, good and hard. Apparently the majority of Australians support Peter Dutton’s pledge to “implement a two-year ban on foreign investors and temporary residents purchasing existing homes in Australia”:

I have two main issues with this policy. First, every state in Australia already has a foreign investor tax (‘surcharge’) ranging from 7-8% of the purchase price, on top of the usual stamp duty. That should be enough to compensate each state for any externalities imposed by foreign buyers; if not, raise the tax.

Second, a ban on foreign ownership would do very little to ease house prices: the most recent data show that in Australia, only around 5,000 residential properties are sold to foreigners each year (in 2022-23 it was only 1,119!). There’s no stock measure that I’m aware of, but the volume of houses sold each year is somewhere between 500,000 and 670,000, which puts the annual foreign contribution somewhere around 0.2—1.0%.

Would removing those purchases have an impact on national house prices? Yes, a small downward impact. But if those buyers are skilled migrants, families of Australians, or even students – basically, anyone who is not a citizen but needs to be physically present in Australia for some reason – it means they’re going to have to rent instead.

So, one of the main effects of Dutton’s policy – supported by most Australians – would be to increase the number of foreign renters, which would offset any decline in house prices.

And which households tend to rent the most? Those with the lowest incomes.

We truly get the politicians we deserve.

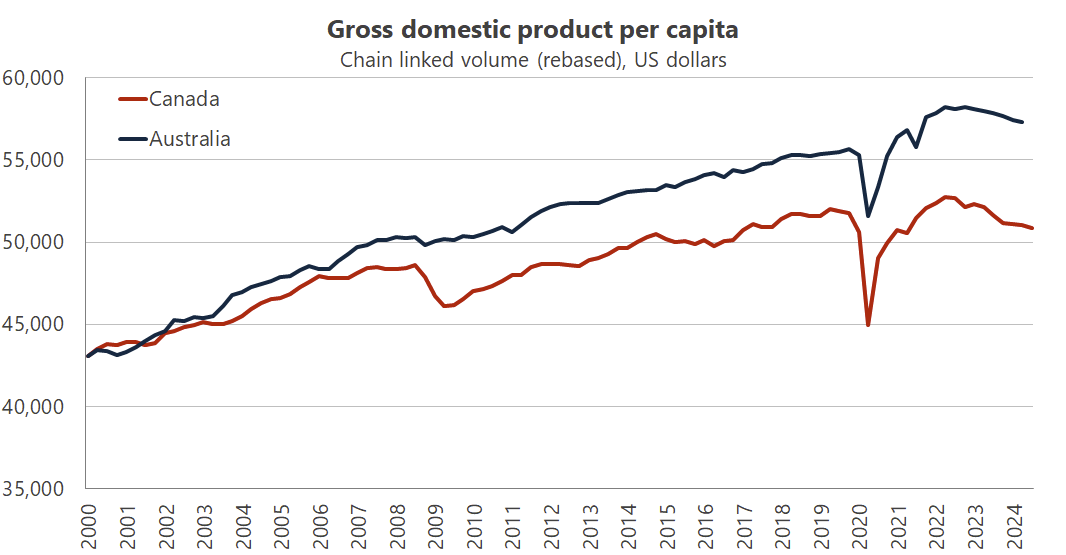

A body blow to Canada

Donald Trump’s tariffs on Canada, Mexico, and China may not cause significant economic damage to the US, but they sure will hurt its supposed allies. Since Sunday’s update, a few Canadian institutions have crunched the numbers, and it’s not pretty.

Here’s the Royal Bank of Canada’s take:

“If sustained, our initial analysis suggests that tariffs of this size (based on many assumptions) could wipe out Canadian growth for up to three years, with the largest impacts in the first and second years. Our estimates align to the Bank of Canada’s findings which simulate that a 25% increase in tariffs across the board (U.S. and global) would reduce Canadian GDP ranging from -3.4 to -4.2 percentage points, compared to the baseline forecast. Similarly, an earlier model from the Bank of Canada estimated that GDP could drop by as much as 6 percentage points. By our calculations, such reductions could push Canadian unemployment rates up by between 2 to 3 percentage points. While the precise impact depend on a variety of assumptions – including monetary and fiscal policy responses – this is a significant negative shock to Canadian growth and poses a serious risks of unemployment rate increases.”

The decision by outgoing Prime Minister Justin Trudeau to retaliate, while probably politically savvy, “will still function like tariffs do for any imposing country – by lowering growth and raising inflation on targeted goods”.

This trade war dispute couldn’t have come at a worse time for Canada. Its economy grew the third-least amount among 30 advanced economies between 2014 and 2022 (unlike Australia, it hasn’t enjoyed multiple terms of trade booms), and following the pandemic it experienced an even worse loss in per capita GDP than Australia:

Unemployment was already 6.7% before the tariffs were announced, and if a deal isn’t struck, a deep recession looks likely.

Beset by challenges

Last week Deloitte published its “flagship Business Outlook”, which contains a bunch of forecasts and predictions for the Australian economy. It was… not positive, with real GDP growth of just 1.6% in calendar 2025, “before picking up to 2.3% and 2.7% in 2026 and 2027, respectively”.

The pessimistic forecast is because “the Australian economy remains beset by challenges”:

“Real wages are now grinding higher, but it is likely to be 2030 before Australian workers recover their pre-pandemic purchasing power. Dwelling construction activity is unlikely to get any worse, but Australia’s housing crisis is likely to persist [at least another decade]. And while business investment was a key feature of the economic recovery after the pandemic, it has since faded.”

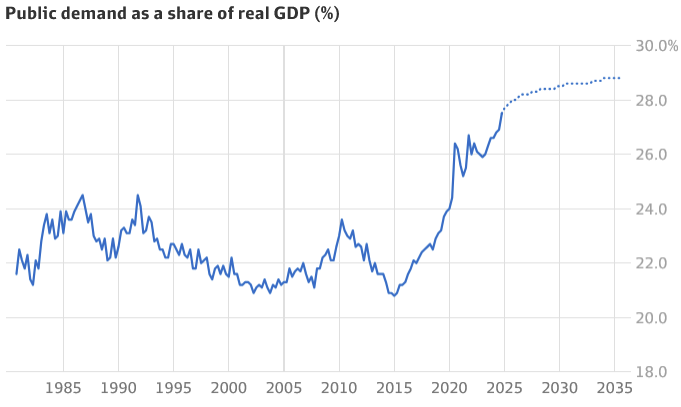

Perhaps most worryingly, Deloitte is forecasting state and federal government spending to hit a record 28% of GDP by the end of 2025 and continue to grow from there:

If Australia is to avoid Canada’s fate of a bloated public sector, zero productivity, low growth, declining investment, and high unemployment, we’re going to need “substantive and productivity-enhancing changes to the tax system”, and soon!

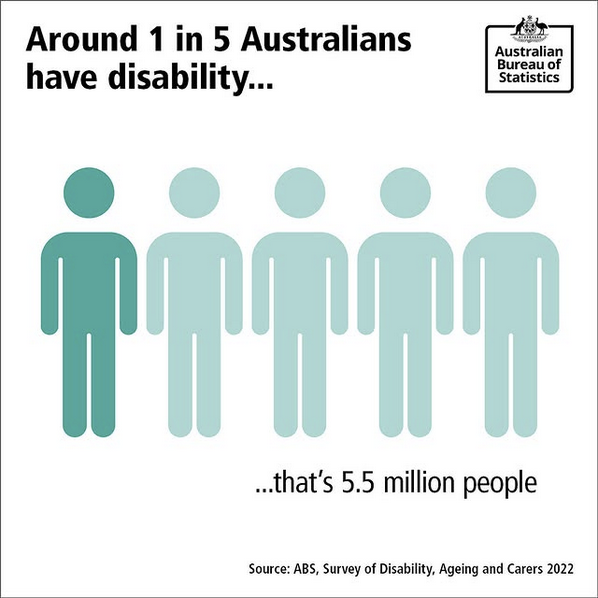

Not-so fun fact

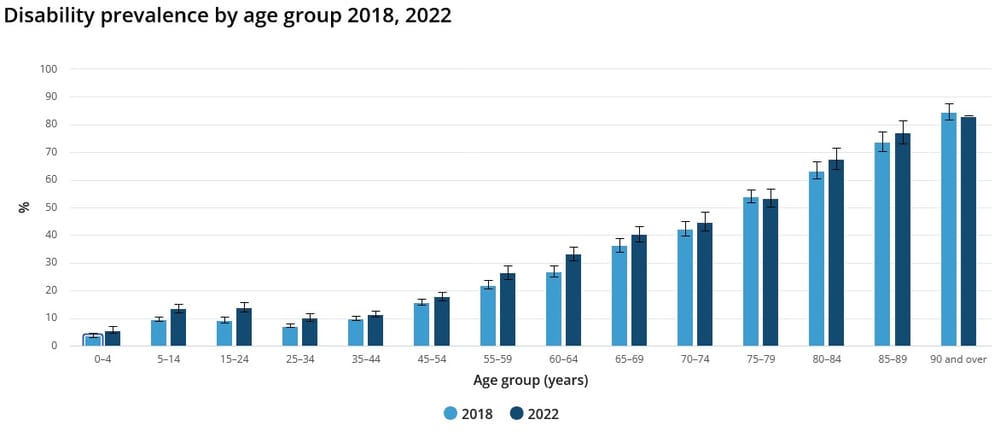

In just four years, the number of Australians with a disability increased by 1.1 million (+25%).

That’s from the ABS, which reported that:

“The increase was seen across most age groups in the most recent Survey of Disability, Ageing and Carers. As seen in previous surveys, people aged 65 years and older were more likely to have disability, with over half of this age group having disability in 2022.”

How does that stack up on a global basis? According to the WHO, an estimated 16% of the world’s population, or 1 in 6 people, fit its definition of “disabled”.

In the UK it’s 24%, or 1 in 4 people. So we’re in the ballpark.

I don’t think there’s necessarily anything wrong with the definition of “disabled”, but designing a generous entitlement program around such a broad definition can certainly be problematic for public finances, as Australia has found with the almost $50 billion dollar a year NDIS.

That’s especially true given that the disabled tend to be elderly, and we’re a rapidly aging country:

According to the 2023 Intergenerational Report:

“The number of Australians aged 65 and over will more than double and the number aged 85 and over will more than triple. The number of centenarians is expected to increase six-fold.”

The NDIS urgently needs to be reformed to use a narrower definition of “disabled”, or Australia will quickly find itself in an unfunded entitlement crisis, if we’re not already in one.

Further reading

- Economists against tariffs:

“Sound fiscal policy and effective incentives to work, save and invest can increase economic growth, but the implementation of broad-based tariffs impedes that growth and in a full-blown trade war would overwhelm it. While we have fundamental differences in our views of how to produce a sound fiscal policy and implement effective incentives for productive efforts, we are united in our belief that broad-based tariffs will impede economic growth, risk triggering a trade war, and inflict long-term harm on the economy.”

- For all the bad Trump is doing, here’s some good news:

“The [Executive] Order requires that whenever an agency promulgates a new rule, regulation, or guidance, it must identify at least 10 existing rules, regulations, or guidance documents to be repealed.”

- Could supersonic passenger flight be making a comeback? I’ll only add that supersonic flight has been illegal in the US since 1973, which stopped progress for 50 years (they should have banned excessive noise instead):

“A test aircraft built by a US start-up has broken the sound barrier for the first time during a flight, potentially paving the way for the return of supersonic commercial travel more than 20 years since Concorde’s final flight.”

- The Paris Agreement is dead:

Indonesia’s special envoy for climate change and energy, Hashim Djojohadikusumo, said he considers the Paris Agreement no longer relevant for Indonesia following the US withdrawal from the deal. ‘If the United States does not want to comply with the international agreement, why should a country like Indonesia comply with it’?"

- As predicted, Europe is next:

“[Trump] reiterated a warning to the European Union that tariffs ‘will definitely happen’, citing a large trade deficit with the bloc. ‘They don’t take our cars, they don’t take our farm products’, Trump said of the EU. They take almost nothing, and we take everything, and then millions of cars, tremendous amounts of food and farm products’.”

- Revealed preference evidence shows that “in a high-stakes, real-world context”, US tech workers value remote work so highly they’re “willing to accept a 25% pay cut for partly or fully remote roles”.

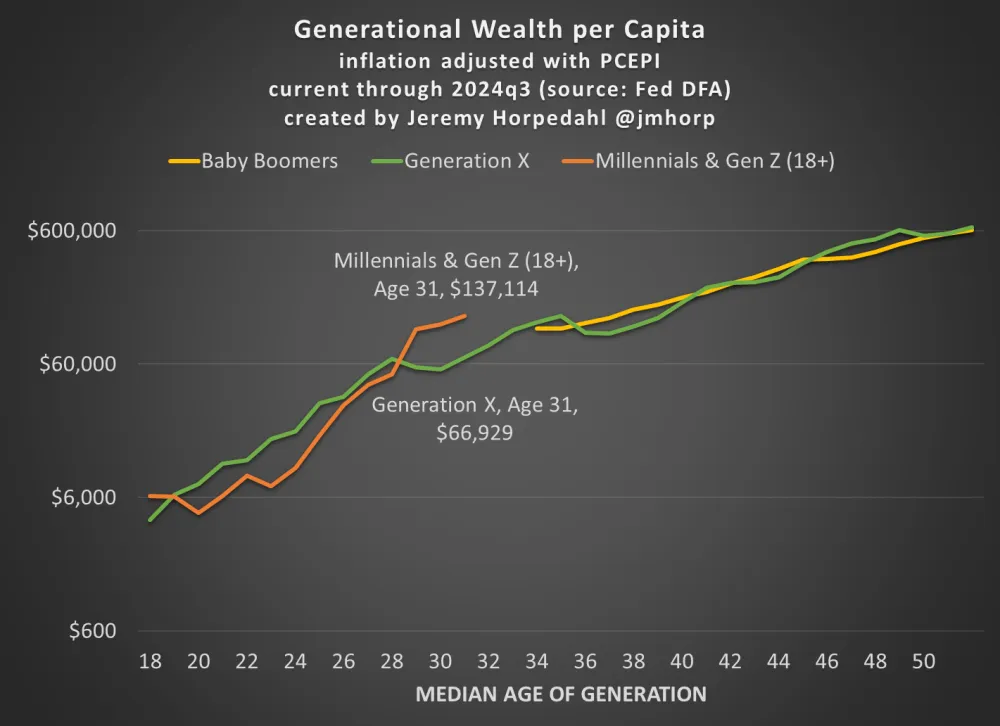

- At least in the US, Millennials and Gen Z are doing just fine:

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!