The best case for Trump's tariffs

US President Donald Trump skipped his regular Mar-a-Lago tee time to instead spend the weekend at the Vatican for the funeral of Pope Francis, where he even found the time to squeeze in a one-on-one with Ukraine’s President Volodymyr Zelensky.

Trump also ramped up his public criticism of Vladimir Putin, writing:

“There was no reason for Putin to be shooting missiles into civilian areas, cities and towns, over the last few days. It makes me think that maybe he doesn’t want to stop the war, he’s just tapping me along, and has to be dealt with differently, through ‘Banking’ or ‘Secondary Sanctions?’ Too many people are dying!!!”

So no peace deal, or perhaps a necessary wake-up call for Trump that will now see him negotiate with a more realistic understanding of Putin? I’m not sure, but Trump’s promise to end the war in his first 24 hours as President, which then became his first 100 days—i.e. tomorrow (US time)—is looking rather unlikely.

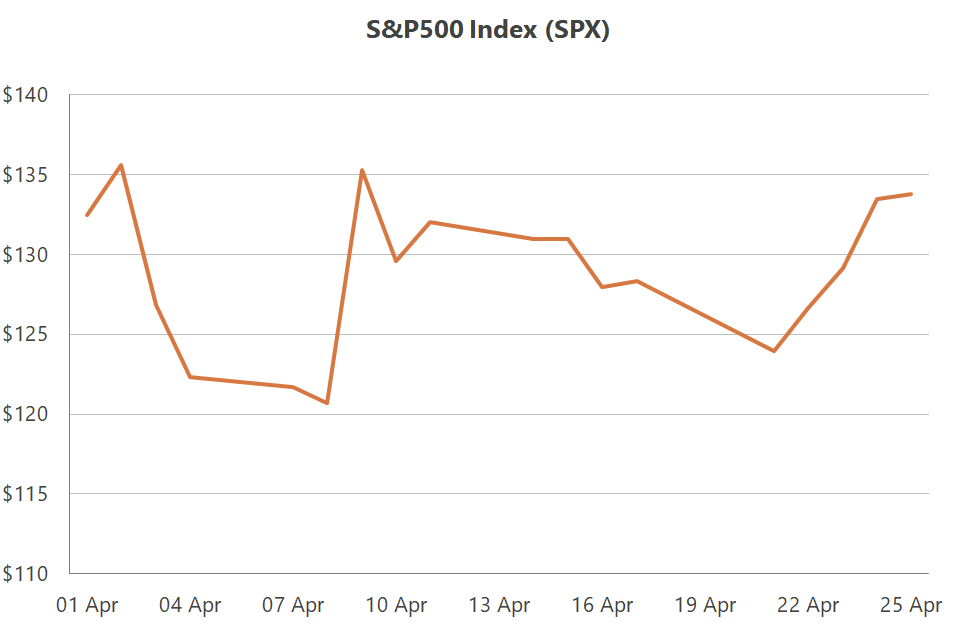

But beyond foreign policy theatrics, what I really wanted to look at today was Trump’s tariffs and their impact on markets. Believe it or not but despite all the wild gyrations since the 2 April ‘Liberation Day’ tariffs, the S&P500 is more-or-less flat for the month.

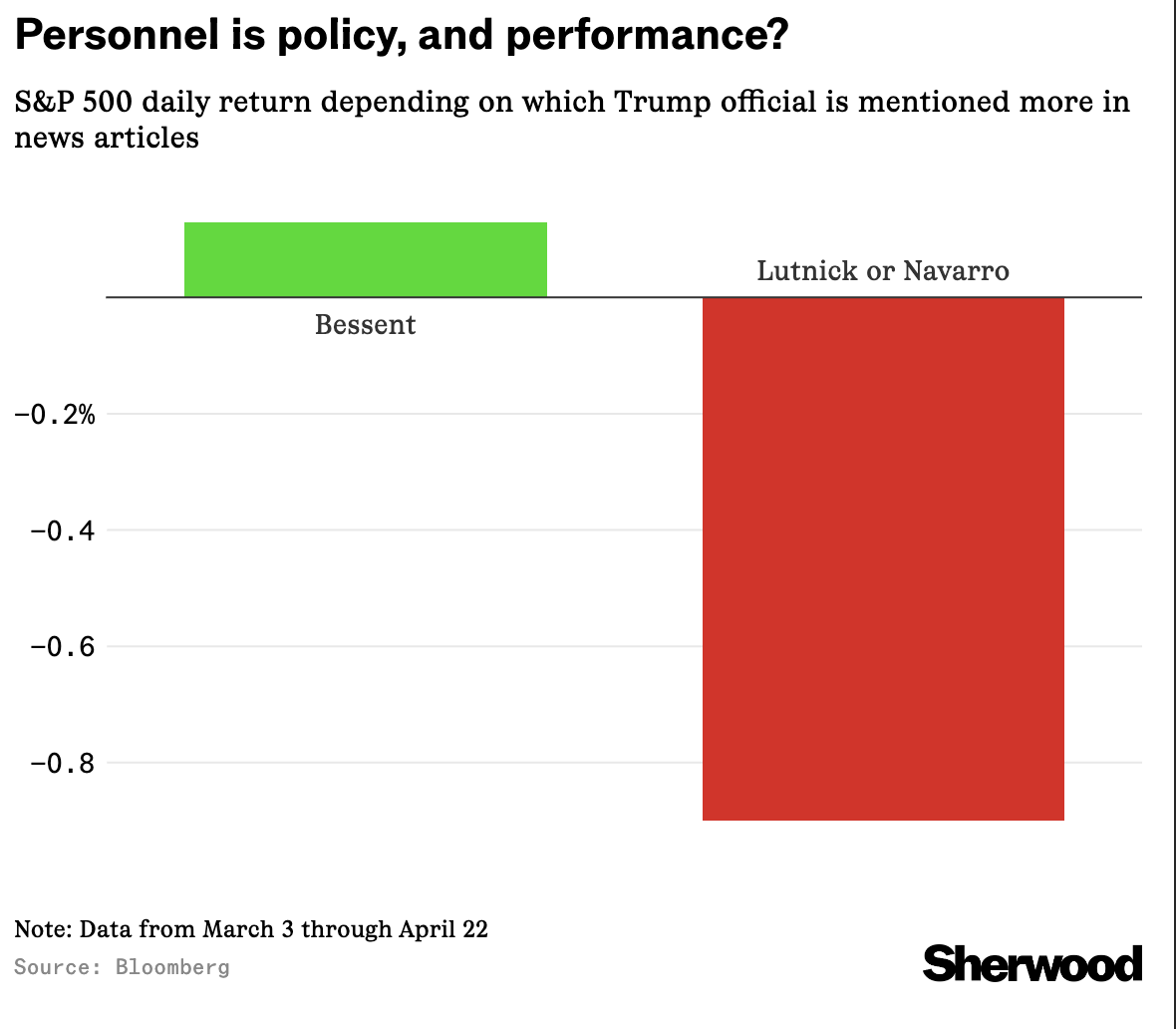

The largest moves in both directions coincided with a Trump policy announcement, which itself depended upon which advisor instigated it.

But who will get the final word?

We all know what’s likely to be the worst downside scenario: Trump listens to convicted criminal and current trade advisor Peter Navarro, does another about-turn on his ridiculous ‘Liberation Day’ tariffs and effective embargo on China by announcing that they’re here to stay, Congress does nothing to stop it because Republicans are scared of the backlash and Democrats know it’ll help them in next year’s mid-terms, the US economy sinks into a stagflationary recession, its debt crisis draws nearer, and global growth is dragged down along with it.

The most recent IMF World Economic Outlook said as much:

“Since late January, a flurry of tariff announcements by the United States, which started with Canada, China, Mexico and critical sectors, culminated with near universal levies on April 2. The US effective tariff rate surged past levels reached during the Great Depression while counter-responses from major trading partners significantly pushed up the global rate.

The resulting epistemic uncertainty and policy unpredictability is a major driver of the economic outlook. If sustained, this abrupt increase in tariffs and attendant uncertainty will significantly slow global growth.”

But what about the best case?

Factions at war

Trump loves tariffs and always has. He might not understand what a trade surplus or deficit is, but he’s still the President of the United States and he’s acting on that misunderstanding. He also has the equivalent of Wormtongue from The Lord of the Rings whispering sweet nothings into his ear in the form of Peter Navarro:

“In short, Navarro thinks imports reduce GDP. They don’t. He thinks some overseas earnings (those from goods) matter more than others (services). They don’t. He thinks a current account deficit is automatically a problem. It isn’t. He thinks that domestic investment in the US is somehow better than foreign. It isn’t. He thinks that pointing at accounting identities is economics. It isn’t.

Navarro represents the anti-trade faction within the Trump administration. At least in public, Navarro has support from two other influential Trump whisperers in Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick. But they’re not tariff extremists like Navarro; in fact, they’re the ones who convinced Trump to press pause earlier this month:

“So that morning, when Navarro was scheduled to meet with economic adviser Kevin Hassett in a different part of the White House, Bessent and Lutnick made their move, according to multiple people familiar with the intervention.

They rushed to the Oval Office to see Trump and propose a pause on some of the tariffs—without Navarro there to argue or push back. They knew they had a tight window. The meeting with Bessent and Lutnick wasn’t on Trump’s schedule.

The two men convinced Trump of the strategy to pause some of the tariffs and to announce it immediately to calm the markets. They stayed until Trump tapped out a Truth Social post, which surprised Navarro, according to one of the people familiar with the episode. Bessent and press secretary Karoline Leavitt almost immediately went to the cameras outside the White House to make a public announcement.”

That’s very similar to how it played out in Trump’s first term too, at least according to his former national security adviser HR McMaster:

“Gary Cohn and I would be taking turns jumping on the tariff or the ‘blow up this trade agreement’ grenade that was being rolled into the Oval Office every other day by Peter Navarro. But now President Trump’s a hell of a lot less patient.”

On the other side of the Oval Office is the pro-trade faction represented by Elon Musk, who has called Navarro a “moron” who is “dumber than a sack of bricks”, only to later quip that his comment “was so unfair to bricks”.

Unfortunately for Musk—who has claimed to be “an advocate of predictable tariff structures, free trade and lower tariffs”, and called for the establishment of “a free trade zone between Europe and North America”—Navarro won the first battle:

“I’ve been on the record many times saying that I believe lower tariffs are generally a good idea for prosperity, but this decision is fundamentally up to the elected representative of the people being the President of the United States.”

Musk also said he wants to leave politics, and told investors at Tesla’s most recent meeting that he would “be allocating far more of my time to Tesla” in the coming weeks.

But that doesn’t mean the pro-trade faction won’t yet win the war, especially as the economic damage of Navarro’s ideas—which spooked Bessent and Lutnick into action—comes to the fore. In fact, Trump is already losing the support of every demographic, even young men and Fox News viewers. And as the full effects of his tariffs and China embargo begin to be felt in the coming weeks, public opinion is going to rapidly fade, perhaps along with Trump’s confidence in Navarro.

Not your father’s economy

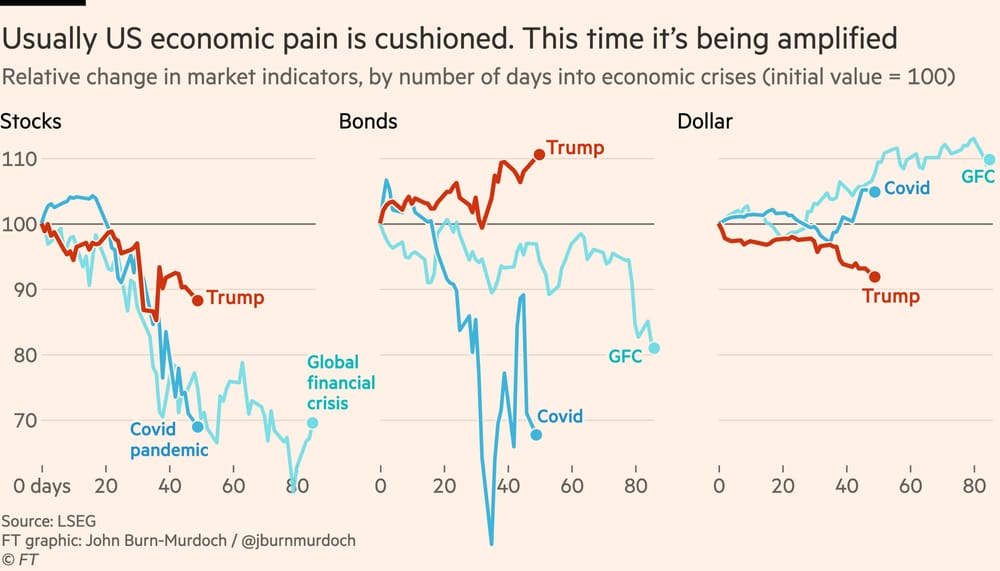

The Financial Times’ John Burn-Murdoch recently showed that for the US economy, this time is indeed different.

According to Burn-Murdoch:

“Usually US economic pain is cushioned by falling bond yields and a strengthening dollar, which mean lower interest rates and more spending power for consumers. This time we’re seeing the opposite, meaning the pain will be amplified.

Basically what normally happens is investors think ‘Stocks are too risky now, so let’s shift into US bonds and the dollar, which are a safer bet because America is a stable and well-run country with a good handle on its deficit and inflation.’ This time? Not so much.”

One reason why the US economy isn’t being cushioned this time around is because of its high level of debt. The Treasury market is in revolt not because of “plumbing” issues (e.g. basis trades), but because of reckless US fiscal policy.

According to Stanford economist Hanno Lustig, US bonds are shifting from “safe zero-beta assets” to “the risky debt regime”, under which “Treasurys are positive beta assets” (he also has a good X thread here on how the UK eventually lost its “convenience yield” privileges to the US).

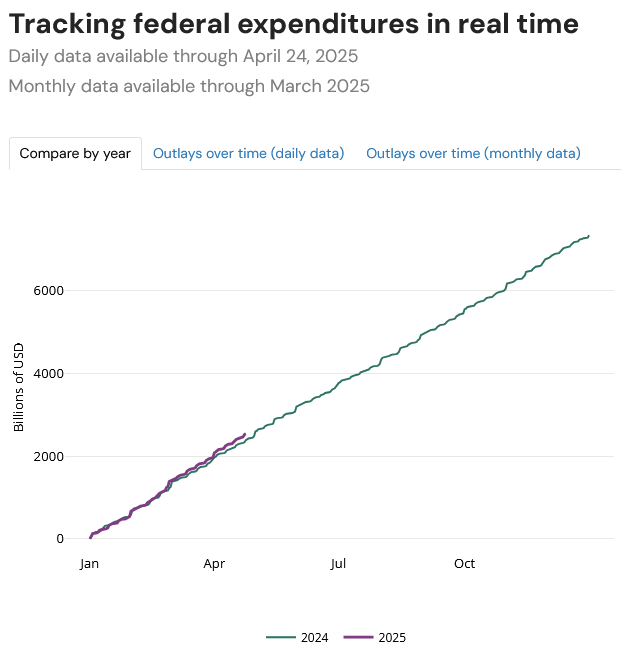

For all the headlines generated by DOGE, the Trump administration hasn’t done anything to cut federal spending, which has increased by nearly 6% from this time last year.

If you mix a trade shock with a precarious fiscal situation—which requires a period of structural budget surpluses to rectify—then you get the situation described by Burn-Murdoch above.

To paraphrase Adam Smith, an economy can only tolerate so much ruin!

The bumpy road ahead

Now, Trump can still fix his mess. The US remains a great place to invest, is home to most of the world’s leading tech companies, is relatively open to innovation, and has cheap energy by advanced-economy standards. Trump has also regularly mentioned his desire for tax reform, which is arguably more economically important than regulatory reform and—done well—could go some way to fixing the nation’s fiscal problems.

As the Wall Street Journal editors recently wrote, there’s still time for him to have a Mitterrand moment, if economic pressures and public backlash intensify:

“Readers of a certain age will recall how the French Socialist President swept into power in 1981 promising a far left agenda of government control over the private economy. The market reaction was brutal. Within a year he had put socialism on pause and by 1983 he had abandoned most of it. He went on to serve two terms.”

There are signs that Trump knows his ‘Liberation Day’ tariffs were a mistake, revealing last week that the current rates will come down, including for China:

“I’m not going to say, ‘Oh I’m going to play hardball with China’. We’re going to be very nice, they’re going to be very nice. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States. We want them involved. But they have to – and other countries have to – make a deal. And if they don’t make a deal, we’ll set the deal.”

The last part of that paragraph is key, especially when paired with Trump’s latest claim that he has “done 200 trade deals with countries across the globe, even though none have been announced”.

Trade agreements take a long time to finalise. Even the “phase one” deal with China during Trump’s first term—not a real trade agreement but a “commitment” to buy more American products— took “almost two years” to negotiate.

So, the only way that it’s possible for Trump to have struck so many deals is if they’re not deals at all, but rather tariff rates that Trump has settled on internally (e.g. 0-20% tariffs on everyone, with a higher rate for China) combined with a series of vague, non-binding ‘promises’ from countries to get their businesses to change the way they trade with American businesses.

But time is not on Trump’s side: freight volumes have fallen to Covid-19 levels and CEOs have privately told Trump that his trade “disruptions could become noticeable in two weeks”, resulting in higher “prices and empty shelves”.

Those meetings are probably why Trump said that he’ll start picking tariff rates “over the next two, three weeks”. If that eventual announcement represents a credible end to the trade shenanigans, then it would be huge for markets: remember that goods trade as a share of GDP in the US is only around 25%—i.e. half of Australia’s—and there are many more fixable regulations and taxes that distort prices by much more than would tariff rates of 0-20%. Permanent tariff rates, even if set at 20% across the board, wouldn’t be the end of the world for the US economy.

But what’s absolutely key is that Trump puts an end to the extraordinary regime uncertainty his antics have unleashed. Fixing the self-inflicted tariff mess by settling on some clear rates and guidelines for other countries would certainly be a good start, but if Trump really wanted to clear the air then he should move Peter ‘Wormtongue’ Navarro into a role that reduces his direct exposure to the Oval Office.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!