The Trump Put lives on, A rate cut in May, Batteries for everyone, We're still reliant on luck, and Who drives in Australia.

Just like that, and the tariff scare is over—or is it? Global markets rallied 5-10% yesterday because Trump, in the face of a near-certain recession and equity and bond market carnage, backed off and hit pause.

So there is still a Trump Put! Markets can still discipline politicians to prevent depression-causing policies! As Clinton political adviser James Carville once said:

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

It turns out that Trump “blinked” because while he was fine with triggering a recession, “he wanted to be sure it didn’t cause a depression”.

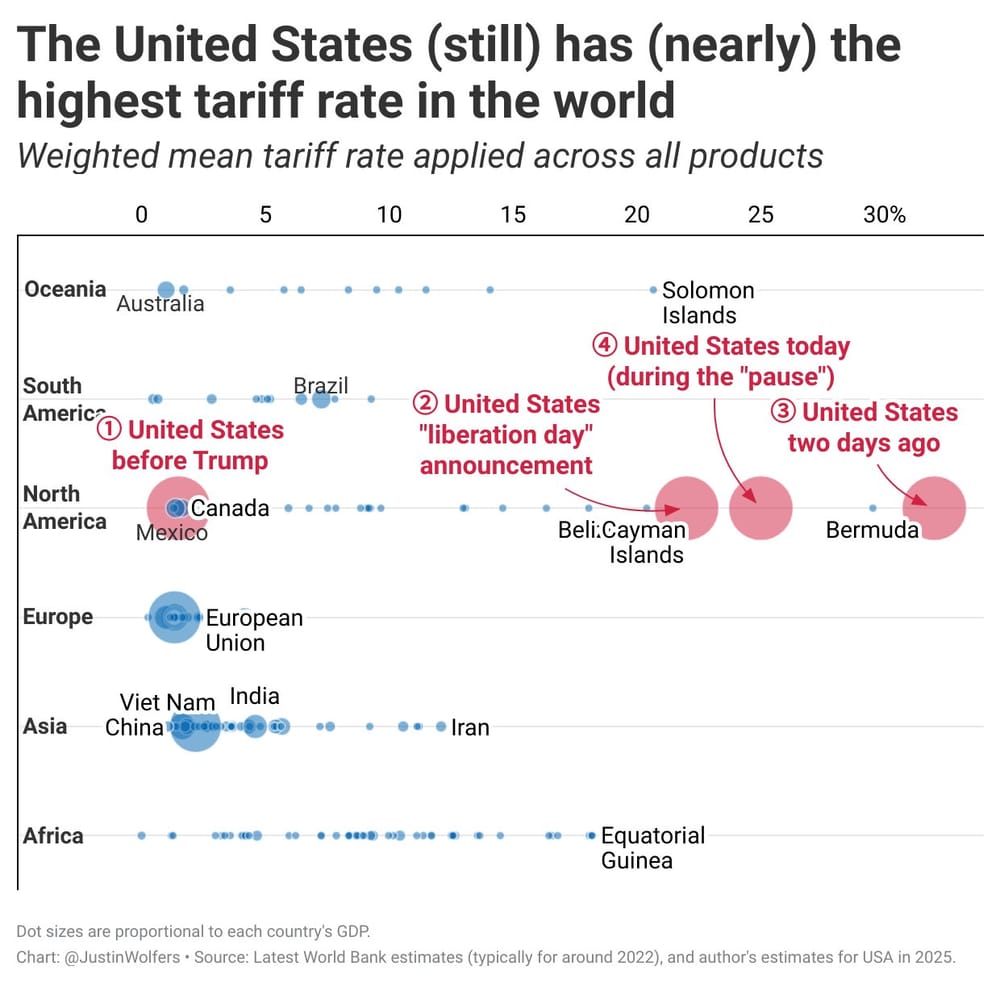

Some strong Paul Keating vibes there. But alas, while the most destructive ‘Liberation Day’ tariffs have been paused for 90 days, many still remain in place:

As a result, the US “will still have the highest tariffs in the industrialised world, perhaps 10-20 times that of most of our trading partners, and roughly ten times higher than it was before”.

The average effective US tariff rate is now 26.8%, the highest since 1903. Or in chart form:

Trump also has more product-specific tariffs in the works, such as on pharmaceuticals, copper, lumber, and semiconductors, not to mention the proposed port call levy that I mentioned earlier this week.

The guy just loves tariffs, thinks trade is bad, and revels in the attention and discretionary power the chaos brings him—his phone has probably been ringing off the hook for days on end with foreign leaders begging for favours. Indeed, when asked if companies would be able to secure exemptions and, if so, how he would determine which ones were eligible, Trump responded by saying “Instinctively”.

So, yesterday was more like a temporary reprieve than an end to Trumpian Uncertainty, which is alive and well. Remember that the Trump administration is not playing 4D chess; in fact, it has no plan at all:

“Administration officials knew the markets would dive and other nations would retaliate when President Trump announced his long-promised ‘reciprocal’ tariffs. But when pressed, several senior officials conceded that they had spent only a few days considering how the economic earthquake might have second-order effects.

And officials have yet to describe the strategy for managing a global system of astounding complexity after the initial shock wears off, other than endless threats and negotiations between the leader of the world’s largest economy and everyone else.”

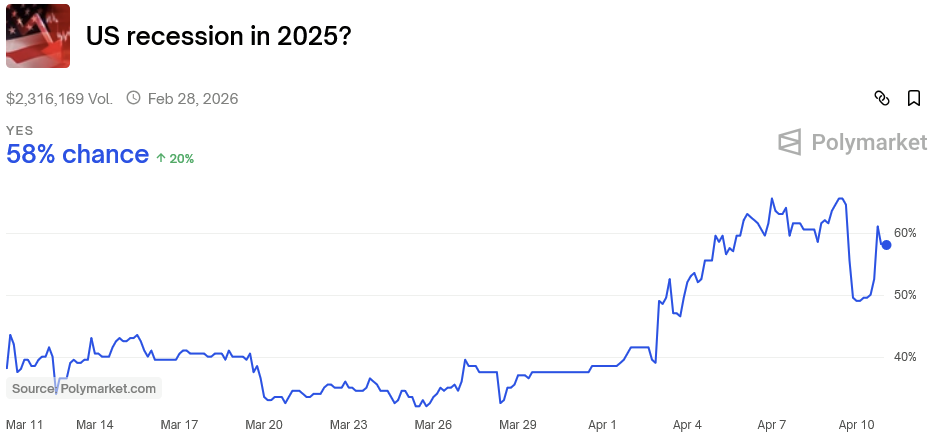

That means we’re not out of the woods by any means— US markets tanked again last night, and US 10-year bond yields are almost back to where they were when Trump hit pause. The chance of a recession this year is also back up to nearly 60%:

But anyway, enough about Trump; I’m sure this topic is going to come up again in the near future (sadly). Indeed, I’ve been writing so much about the Trump tariffs that I haven’t had the time to cover anything directly related to Australia, so let’s take a quick look at what’s been going on Down Under!

A rate cut in May?

The Reserve Bank Australia (RBA) left rates on hold last month, but the wording in its statement and governor post-meeting Bullock’s comments were (1) more dovish than at the previous meeting; and (2) apparently unphased by the recent stimulatory Budget, which plans to use borrowed money to add about 2.3% worth of GDP worth to demand in 2025-26.

But perhaps the RBA Board had a feeling that something was brewing over in Washington DC. The words “uncertain” or “uncertainty” were mentioned 14 times in its statement, compared to 9 times in February and just once in December 2024. And sure enough, since its meeting all hell broke loose on the tariff front, sending the Aussie dollar down close to pandemic-lows.

Now, normally that might be considered inflationary: the RBA’s “rule of thumb” is that “a 10% sustained depreciation typically results in an increase in the level of the overall CPI of about 1%”.

However, we’re all good economists here so we know such rules are rubbery at best – you should never reason from a price change! There are other forces at work, and because the cause of the Aussie dollar depreciation was Trump’s tariffs and China’s retaliation, if anything that’s likely to put downward pressure on domestic prices.

In essence, we’ve just had an adverse demand shock (Trump’s recession-risking tariffs and China’s retaliation) combined with a favourable supply shock (cheap Chinese goods looking for a new home), both of which should reduce inflationary pressures in Australia, assuming no monetary offset.

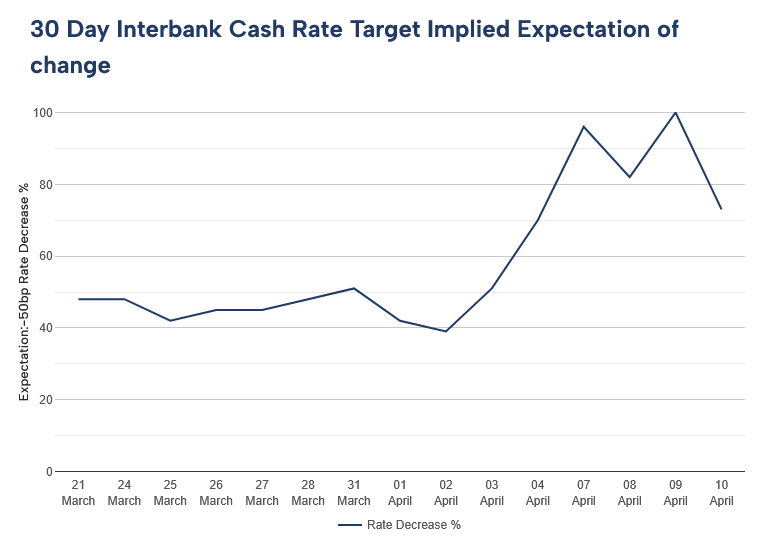

As a result, NAB came out yesterday and said it expects a 50 basis point cut in May. Futures markets are pricing pricing in a 73% chance of a 25 basis point cut, although those odds have been incredibly volatile since the ‘Liberation Day’ tariffs:

Still, if the AUD stays weak it means Trump’s trade madness is probably still going on—a flexible exchange rate is a great shock absorber!—and the positive supply shock (cheaper goods) and negative demand shock from lower global growth will likely dominate any exchange rate inflation pass-through.

That should give the RBA scope to cut rates ahead of schedule—provided, of course, that the March quarter CPI (to be released on 30 April) contains no major upside surprises.

Batteries for everyone!

If Labor wins the federal election—as looks likely—then the next big batch of middle-class welfare looks set to come in the form of home battery subsidies:

“The Cheaper Home Batteries subsidy is a 30 per cent up-front discount off the cost of a battery and will be delivered through the same government scheme that provides discounted solar. The program will cost $2.3 billion over the forward estimates and was factored into the recent budget.”

I wrote about the Western Australia version of this scheme, which kicks in on 1 July, here. Presumably those in WA can double dip, making it a no-brainer for those who already have solar or are considering it. No doubt other states have, or will have, their own programmes.

But while incentivising home batteries is a better policy than pouring more borrowed money down what is now $6.8 billion on energy bill rebates with nothing to show for it, it’s not necessarily the silver bullet to the renewables mess we’re in.

Yes, more home batteries will take the strain off the electricity grid in the short-run. But encouraging demand before the grid is ready for it could lead to unintended consequences:

“In the longer-run, it risks bringing forward grid defection. A 2024 paper published in Solar Energy found that defection was a serious risk in ‘solar-rich locations that have high electric rates’, but governments should not try to ‘discourage on-grid PV systems’ – e.g. with higher fixed fees, or the WA government’s current policy of forcibly switching people’s solar off – as that will only ‘unintentionally incentivise grid defection’.”

There are also two other issues. One, battery subsidies are inequitable: most households with solar panels are relatively well-off home-owners. Two, it makes the grid even more expensive to operate because there will be fewer households buying power during peak periods.

That’s a problem, given that the largest costs of running Australia’s energy grid are those to do with the network itself:

“Network costs account for nearly 46 per cent (or $1244) of the bill for households without controlled load and around 43 per cent ($1376) for customers with CL. This is out of the expected total bill of $2713 and $3174 respectively.”

Renewables might have zero marginal cost when they’re operating, but they require significant network upgrades that aren’t included when governments cite various levelised costs of electricity (LCOE) estimates for renewables. Any ‘firming’ power source, such as gas, also needs to generate revenue to pay for its fixed costs. With lots of renewables and batteries, it now must recoup those costs over fewer people and hours—so prices rise.

As JP Morgan’s Michael Cembalest estimated, including those systemwide costs to estimates of LCOE means adding around 30% renewables to a grid increases costs by 15%-35% in today’s dollars:

“I consider these results to be a lower bound since they exclude future increases in load due to electrification of transport and home heating, and due to increasing demand from data centres.”

And that’s in the US. In Australia, we’re already struggling hard to build the infrastructure required to add renewables into the system. For example, the cost of Queensland’s CopperString project, a 1,100-kilometre high voltage powerline designed to bring renewable energy from where it’s generated to where it’s needed, has blown out to $13.9bn from $9bn just five months ago.

Those additional network costs must be clawed back from users. But if people start installing subsidised home batteries en masse, fewer of them will be buying electricity from the grid, which barring major reforms to how households pay for energy, risks triggering the dreaded death spiral.

We’re reliant on luck

If you missed it (or were travelling like I happened to be), the independent e61 institute had some good coverage of last month’s federal budget. It wasn’t pretty:

“The major parties appear hesitant to grasp the nettle on Budget repair. At its simplest, addressing the structural budget imbalance requires raising taxes or decreasing spending. The current implicit strategy appears to rely on non-credible increases in income tax through bracket creep, and to cross our fingers and hope no new significant expenditures arise. In addition to being unrealistic, this approach creates uncertainty for households and firms.”

Ah yes, the old “assume nothing goes wrong” chestnut. There will never be another recession, trade war, actual war, pandemic, or other global crisis! Oh, and productivity will miraculously return to its 20-year average despite zero effort from either major political party to do anything about it!

Australian politics at its finest—debating a $5-a-week tax cut while the entire house burns down.

Who drives to work in Australia?

Chris Loader of “Charting Transport” recently did a deep dive into the three hundred thousand Australians (2016) that drive to work in Australia’s central business districts (CBDs). Given the relatively high costs of doing so, the demographics are as you might expect—i.e., people who put a high value on their time, or have few other choices but to drive:

- commuters on the highest incomes

- commuters working very long hours

- commuters living further from rapid transit stations

- commuters who were parenting

- older commuters (particularly for males)

- males

- commuters likely to be doing shift work – particularly police and medical workers

I don’t agree with all of Loader’s solutions, such as his desire for high frequency public transit services in the early morning and late evening to cater to these outliers. Running mostly-empty buses and trains at all hours is just a waste of resources, and a better result could be achieved with congestion pricing and cash transfers ( done properly—sorry, Sydney).

Putting a price on roads around our CBDs would reduce the number of people driving into them, while raising revenue from high income commuters (ideally offsetting more efficient taxes elsewhere). Such a tax would also be strongly progressive, especially if you provided discounts to lower-income people that have few realistic alternatives, such as police and medical workers, or parents caring for children of a certain age.

Fun fact

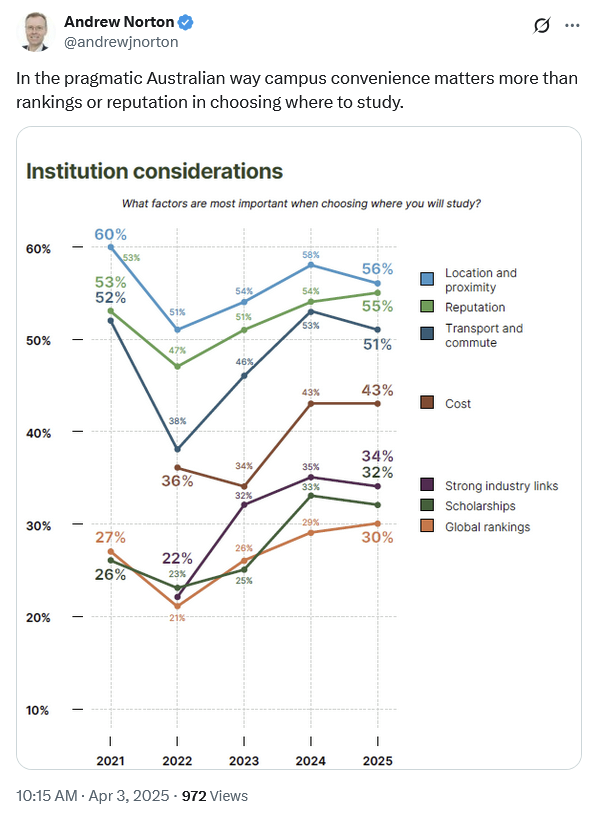

Unlike in the UK or US, Australians generally prefer to study close to home:

Further reading

- Canada’s politicians talk a big game about “free trade and unfettered market access, right up until the moment some weirdo foreigner gets it into their pathetic little brain that they should be allowed to sell me a stick of butter. Because that ain’t on, friends. Let’s get our elbows up, and bury them deep into this wheel of filthy xenocheddar”.

- New Zealand’s HMNZS Manawanui sank due to “a series of human errors”, including “the failure to disengage an autopilot control”.

- Smoking bans in bars led to more drinking. The ban might still be a net positive, but remember that there are always trade-offs.

- Green hydrogen continues to fizzle, with Trafigura scrapping its Port Pirie (SA) project, while Infinite Green Energy entered administration leaving its Northam (WA) project in limbo. I predicted as much back in May 2023.

- Most of today’s university students are “are functionally illiterate”, according to a Gen X professor at a regional public university in the United States.

- Whether legitimate or not, by preventing Marine Le Pen from running for President, France may run into some nasty consequences down the road, just as the US encountered after Donald Trump was deplatformed in 2021 and the left of centre take was that it “just like completely worked with no visible downside whatsoever”.

- Belgium is paving the way for a nuclear revival by overturning a two-decade old law mandating its phase-out, while Canada just approved the construction of a small modular reactor in Ontario.

- One way Australia can hit back at Trump and his 10% tariff would be by rolling back intellectual property protections, which would lower prices for Australian consumers and hit US pharmaceutical firms where it hurts.

- New Zealand is on board with whatever the form the world’s new free trade coalition takes: “New Zealand will continue to work with like-minded countries to promote free trade as a path to prosperity.”

- Australian politicians obsessed about trade deficits in the 1980s. We then learnt not to worry about them. It’s a real shame that Donald Trump never got the memo.

- Autonomous cars are actually pretty safe, especially when compared to human drivers.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!