The upside of falling EV prices

A few provocative news articles have been popping up on a certain Murdoch news site over the past week, with headlines including:

- ‘Effectively worthless’: EV bubble bursts

- Picture proves EV market is in trouble

- Hyundai says battery life and resale uncertainty is harming EV uptake

- ‘Can’t sell its cars’: Horror news for Tesla owners as prices plunge

I’ll save you the clicks and brain cells by summarising them. Essentially, the authors noticed that new EVs have been getting discounted. Given that a new EV is a substitute for a second-hand EV, used EVs have also fallen in price. Apparently, that’s pissed more than a few people off:

“The discounting is angering EV buyers who bought a new car only to see it offered for thousands of dollars less a week or two later, severely denting their car’s resale value.”

The authors then collectively commit the mistake of reasoning from a price change, concluding that the EV market is in big trouble. But the described behaviour is exactly how a healthy car market is expected to function: it might come as a shock to the journalists who penned those articles, but the real price of many goods tends to fall over time, even as technology improves.

It’s a similar story for used goods. Over time, a physical asset can be expected to decline in price because the demand for it also falls; it’s called depreciation. Now there are exceptions: for example, popular vintage cars tend to appreciate because their supply is fixed. Another example was during the pandemic when the supply of new cars was effectively cut off, leading to used cars rapidly appreciating, because that’s all buyers could get.

But when there’s a constant stream of new and improved cars being produced and delivered every year, the demand for and relative prices of the used versions will fall. There was no EV “bubble burst”, just basic economics.

Are EVs a bad investment?

One of the journalists compared today’s EVs to the humble Toyota Camry, noting that because EV tech is progressing so rapidly, you’d be foolish to buy one today when you could wait until tomorrow and get an even better one:

“A standard car model is generally updated every few years with a new trim and some extra mod cons inside. The most important part of the car, though – the internal combustion engine – is by and large a comparable product.

You can happily drive a 20-year-old Camry without any worries.

With EVs, however, it’s the basic function of the cars that is changing at a rapid pace.

…

Electric cars are almost like a mobile phone – the technology changes so fast that by the time you’re ready for a new one you may as well chuck out the old one.”

First of all, no one is happily driving a 20-year-old Camry “without any worries”. While it depends on how well the car has been maintained, an average ICE vehicle lasts eight years – the same as a modern EV’s battery warranty – and " [a]fter 100,000 miles any car will be leaning towards its minimum trade-in value".

As a former Toyota Corolla owner I’ll be the first to admit that they make some of the most reliable ICE vehicles, so even a poorly maintained Camry probably lasts more than eight years. But even the most durable car will eventually be scrapped. Those 20-year-old Camry’s will be heavily depreciated; I had a quick look on a car sales website and you may be able to pick up a used 20-year-old Camry for a few grand, which is around 5-10% the cost of a new version.

No one knows how well EVs will hold up over the long run, but looking at the second-hand prices of the 2019 Tesla Model 3 and Toyota Camry, compared to the new 2024 models versions, and the depreciation is about 39% and 35%, respectively. So yes, a Tesla probably depreciates a bit more than the most durable ICE car, but it’s not exactly “horror news”. When you consider that most early EV adopters probably also received a generous government subsidy and have paid considerably less for fuel over those five years, the Tesla owners may even be ahead.

There’s also a good chance that EVs pull (further) ahead in the long-run. According to the Kelley Blue Book, a US-based service that “reports market value prices for new and used automobiles of all types”:

“An electric car will last as long as a car with an internal combustion engine (ICE), if not longer, because electric vehicles (EVs) don’t have all the mechanical components of an ICE vehicle. In other words, there are more things that can wear out or go wrong in an ICE car than in an EV.”

It’s not like those “no worries” Camry’s are still reliably driving long distances; most are probably used as local runabouts, a task at which an old EV should also excel. Sure, the battery will degrade over time. But the latest BYD batteries are built to last 30 years or millions of kilometres, well more than an ICE, and if battery prices keep falling then in 20 years it might be very cheap to simply replace it. In other words, there is and will continue to be a market for second-hand EVs.

Provided the 20-year-old EV is in decent physical shape, there’s no reason why it can’t keep running well after even the hardiest Camry has met its maker. But that doesn’t mean they’re a good investment: it’s a durable good that will depreciate over time, just like an ICE car. Enjoy your consumer surplus, but don’t expect to turn a profit when the time comes to sell it.

We should welcome falling EV prices

When people warn of market “trouble”, it’s good practice to check their claims. Yes, Australian EV deliveries fell 5.1% in April from the year prior, driven entirely by a 43.5% collapse in Tesla deliveries. But monthly data can be volatile, for various reasons, including that a single car carrier can hold up to 8,500 vehicles. Tesla only delivered 2,077 vehicles in April, so the fall could be purely timing-related – perhaps an extra ship arrived in April last year?

Taking a longer view, year-to-date EV deliveries are up 32% from last year. While that’s well below hybrids (+138.2%), it’s hardly a market “in trouble”.

I don’t know what market share EVs will eventually grab in Australia and I personally think the government is foolish to set targets. But it’s hard not to be amused at these EV-denying journalists, whose scepticism conjured memories of smartphone critics. Find an old article, replace the word “Apple” with “Tesla”, “iPhone” with “Model 3”, and “Jobs” with “Musk”, and you have yourself a Murdoch news story:

“Mr. Tofel was so annoyed with the surprising iPhone price drop that he was planning to make T-shirts that read, ‘I was a $200 iPhone beta tester for Apple.’

‘I just felt so used as a consumer,’ he said. ‘They hyped up the iPhone for six months and built up our expectations, and then they grabbed our extra $200 and ran.’

…

‘I feel totally screwed,’ wrote one iPhone owner on the Unofficial Apple Weblog site. ‘My love affair with Apple is officially over.’

Mr. Jobs said the cuts were precipitated by a desire to build demand aggressively for the product in the coming holiday shopping season. Analysts, however, wondered if it was indicative of sagging demand for the expensive phone.

‘I don’t think it’s a stretch to deduce from this that maybe the rate of sales weren’t meeting expectations, so they decided to drop the price,’ said Charles Golvin, an analyst at Forrester Research. ‘Bear in mind that Steve Jobs said at the last earnings call that they expected to sell a million devices in the following quarter. Maybe they recognised the trajectory wasn’t going to get them there at that price.’

Could I get a better computer if I wait a year? Sure. But if my current computer isn’t doing the job anymore, I’m still going to buy one now. It’s the same for EVs: sure, wait a year and you might get one at a lower real price with better features, such as a longer range or a bigger touch screen. But that will be true every year; at some point you’re actually going to need a car, and depending on your needs, an EV may be right for you.

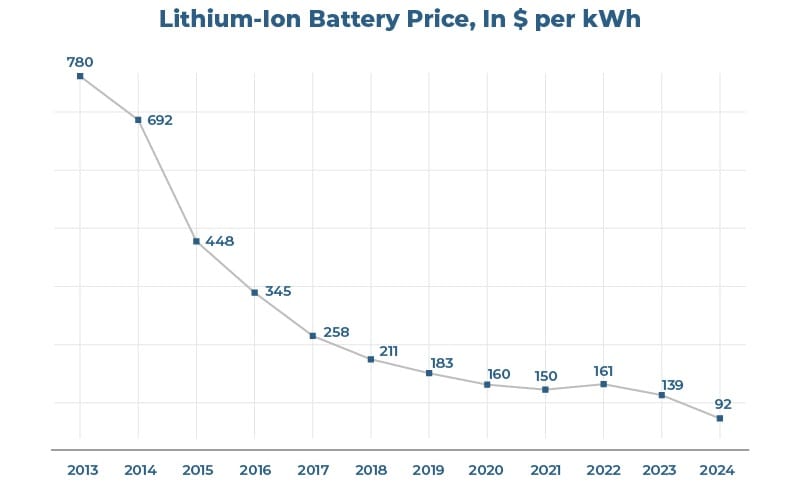

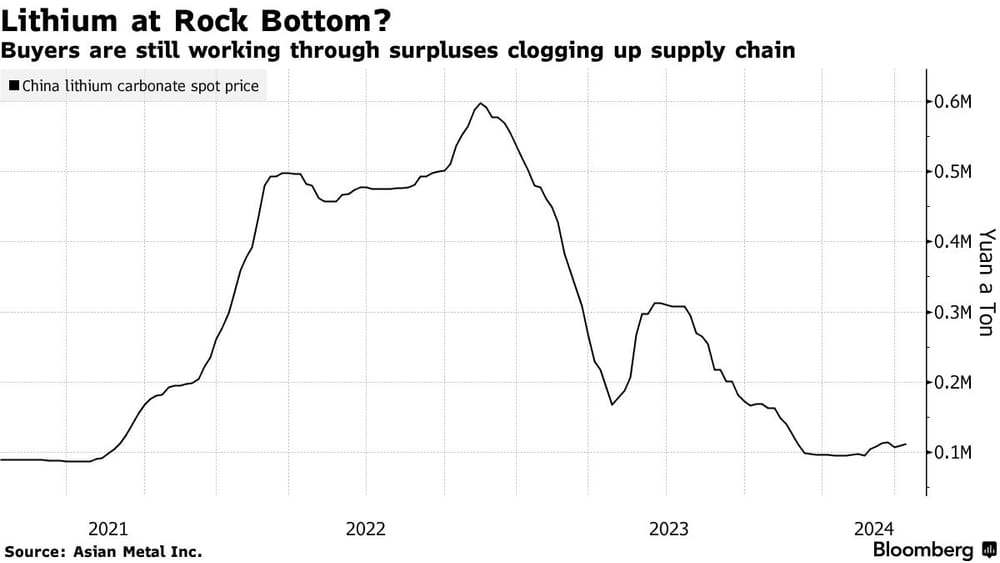

The reason EV prices are falling because of what we economists call the elasticity of supply. Normally we apply these insights to things like commodities; for example, the price of lithium – a key battery component – is back to 2021 levels in nominal terms despite the huge increase in battery production.

Where entrepreneurs cannot source additional supply, or when it’s prohibitively costly despite their best efforts, sometimes people discover substitutes. That’s what happened with batteries: we are no longer dependent on nickel or cobalt for EV batteries, the mining of which can have “dire effects on human well-being”.

But the concept of elasticity also holds for durable goods. Induced by market prices for cars and oil (plus in the case of EVs, government subsidies), a bunch of automakers innovated and discovered how to make better EVs at lower cost. Because they operate in competitive markets, much of that was then passed on to consumers in the form of lower prices (unless prevented e.g. by tariffs; sorry, America).

Provided governments don’t outright ban ICE vehicles, for EVs to gain market share their relative prices will have to continue falling in real terms, and that’s a good thing for the EV market! Most demand curves slope downward, so as the price of a good rises, the demand for it falls (and vice versa). A paradox of achieving net zero is that we will have fewer uses for oil, but supply is already locked-in for many years. As a result, oil will probably get cheaper, so the lifetime cost of owning an ICE vehicle could actually fall. Add to that the damage our government is doing to our electricity market, and the cost competitiveness of ICE cars may improve relative to EVs.

So EVs will have to get even cheaper to gain market share! Already we’re seeing the likes of BYD’s new $A23,000 Qin, dubbed the “Corolla killer”. Will that be enough to out-compete ICE vehicles? I’m not sure. Thankfully we don’t make cars in this country anymore, so all non-luxury vehicles are tariff-free. That means the market – you – will ultimately decide what market share EVs take in this country.

That share could be 10%, 50%, or 80%; it doesn’t matter. EVs aren’t going anywhere, there will always be a market for used EVs, and because they’re direct substitutes for ICE cars, the added competition will help drive down prices for owners of all types of vehicles (excuse the pun), new and old.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!