Trump isn't playing 4D chess

I’m looking to write a few posts about the upcoming federal election in Australia, but the global chaos flowing from the US is just too important not to keep discussing. That, and the Australian election has been anything but interesting so far: Albo vs Albo-lite, or as cartoonist Peter Broelman recently depicted it, two ends of the same underwhelming democracy sausage:

While I wish we had at least one candidate that was willing to meaningfully discuss the big economic issues in Australia, given what’s happening elsewhere around the world it’s probably not all that bad.

So, here we go again for the third (working) day in a row—another post on Trump’s tariffs.

Trump gives no f**ks

The collapse in equity prices on Thursday and Friday was " worse than 99.9% of other trading days since 1929. This was the 5th worst 2-day window for stocks since 1945". Futures prices suggest the bloodbath will continue on Monday.

A few weeks ago, I wrote that:

“Markets are forward-looking—they reflect investor consensus of what’s likely to happen to returns in the future. If they’re recoiling like this, it means they expect the short-term pain Trump’s inflicting to not generate the long-term gains he’s promising.

Now, that doesn’t necessarily mean there will be a US recession; as the old joke goes, the stock market has forecast 9 out of the last 5 of those. But if Trump persists with his tariff nonsense—neither he nor the true believers in the Trump 2.0 administration have given any indication that he’ll stop—growth expectations and share prices will continue to adjust accordingly.”

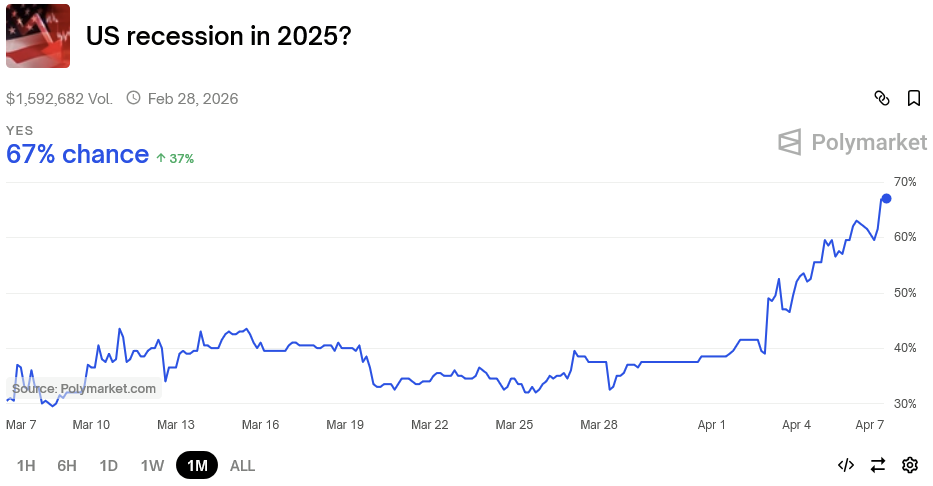

It turns out that Trump’s tariffs might be one of those five times:

With no sign of a reversal, Trump’s tariffs are now reverberating beyond Wall Street and onto Main Street: over the weekend, supply chain logistics company Flexport revealed that 28% of its customers are “pausing all ocean freight bookings from Asia until there’s more clarity on where tariffs will end up”.

Then there was Howmet, a key Boeing and Airbus supplier, which “declared a force majeure event, a legal practice that allows parties to a contract to avoid their obligations if hit by unavoidable and unpredictable external circumstances”.

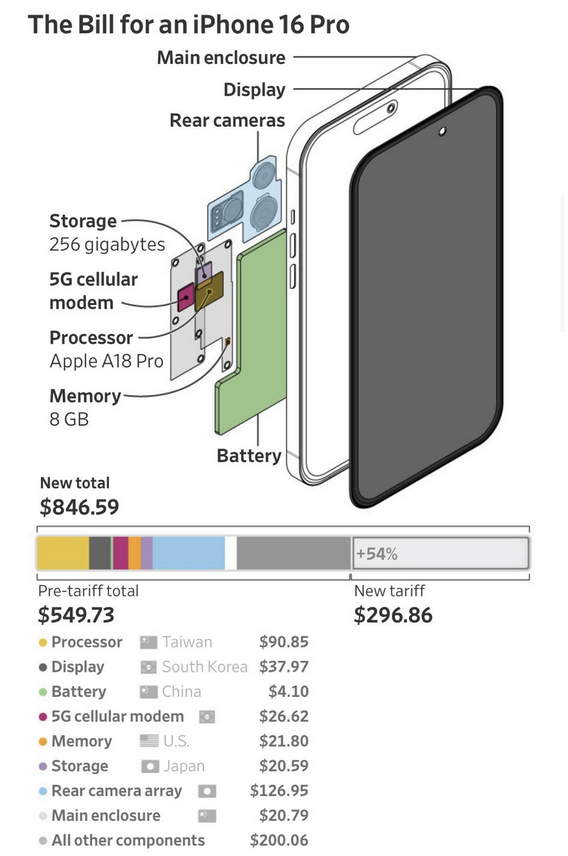

As for consumers, the WSJ reported that the price of an iPhone in the US could increase by nearly 60%, perhaps explaining some of Apple’s share price plunge:

As for Trump? He was off playing golf, apparently doing well enough to qualify for the “championship round of Senior Club golf tournament”.

Good for him. The fact is, Trump just doesn’t care. There is no 4D chess being played; no grand plan that will be revealed to us in the coming days. Trump loves tariffs and he’s embracing the chaos, going so far to post this on his social media account:

You have to remember that Trump has been pushing for tariffs publicly since at least 1987, when he appeared on Larry King Live bemoaning the US trade deficit and that “people are tired of watching other countries ripping off the United States”.

While I still think there’s a chance that the current rates are lowered this week, the tariffs themselves are unlikely to go—they’re the core Trump policy.

The free world is being run by morons

Why does Trump love tariffs? Because he’s not a very deep thinker. His views on tariffs have been dubbed Critical Trade Theory, where “[a]ny trade imbalance between two countries is de facto evidence of systemic unfair trade practices”.

It’s completely idiotic, but if the President of the United States believes it, and has surrounded himself with people who either also believe it or have no backbone, then Houston, we have a problem! As a Trump ‘insider’ recently revealed:

“He’s at the peak of just not giving a f— anymore,” said a White House official with knowledge of Trump’s thinking. “Bad news stories? Doesn’t give a f—. He’s going to do what he’s going to do.”

There are no level heads left in his inner circle. Gary Cohn, Steven Mnuchin, Mike Pence? Gone. It’s all Peter Navarro and other economic ignoramuses whispering in Trump’s ear, reinforcing his confirmation bias so badly that he’s able to blissfully revel in the damage that his policies are causing.

Even his supporters can’t help themselves, with otherwise-intelligent Republicans tying themselves in knots attempting to make sense of the nonsense, and justify the unjustifiable. The Trump tariffs are a " full spectrum reset"! Or they are really designed to “bring down bond yields” and oil prices (with a recession). No wait, actually they’re helping to unwind some of the “hidden costs” of the US dollar’s dominance!

The fact they believe crude tools like tariffs can solve all of these supposed ills not only flies in the face of the Tinbergen Rule – that to achieve multiple policy goals necessitates that you control an equal number of policy instruments – but also reality: trade deficits don’t make a country poorer.

Free trade didn’t kill the middle class.

Automation and a lack of competition is why the rust belt faded, not international trade. And what do tariffs do? They lessen competition, transforming more industry into something that more closely resembles shipbuilding, one of the most heavily protected and worst performing sectors in the US.

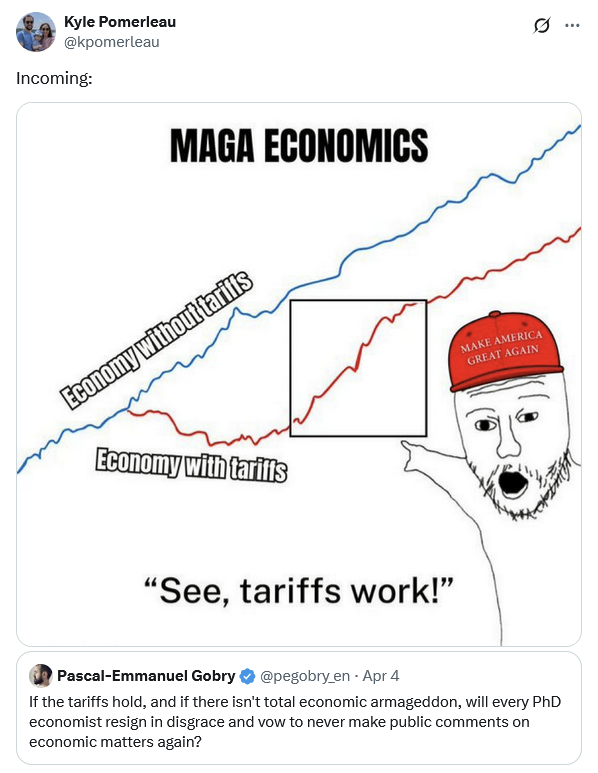

But that won’t stop them from claiming victory. For example, Trump’s supporters will inevitably point to any temporary rise in profits as proof their plan is working—even though that’s exactly what you might expect following a new tariff tax:

“The economic cost is no longer the price they paid last month, but the cost of replacing goods today. This may lead to a brief increase in accounting profits, even though economic profits decline.”

When stocks and other macroeconomic aggregates eventually recover, they’ll probably use charts like this, conveniently ignoring the counterfactual:

Basically, America is being run by morons:

“The man is as deep as a puddle. He is, sincerely, just a very stupid guy who thinks that when we buy vanilla beans from Madagascar - which grows 80% of the world’s vanilla supply - they are by definition ‘ripping us off’. It’s only ‘fair’ if they buy back an equivalent amount of Boeing jets, which they can’t do because they’re a desperately poor third-world country. This is a moronic thing to believe, much in the same way that it would be moronic if I said my barber is cheating me because I buy haircuts from him but he doesn’t buy blog posts in return from me. It would be stupid to cry about my ’trade deficit’ with my barber. But Trump sincerely believes it. He does not have complicated theories about Bretton Woods or monetary theory or the international trade system rebalancing. He simply thinks trade deficit = cheating, by default. That’s why poor little Madagascar has been hit with a new 47% tariff rate. Trump is just an idiot and has surrounded himself with flunkies happy to carry out his idiotic plans.

…

There’s nothing behind the curtain. The emperor has no clothes. He’s just a dumb idiot and you will keep being wrong about him until you incorporate this fact.”

The longer this charade goes on, the more I’m inclined to agree, especially given how they concocted this tariff ‘plan’, if you can call it that.

The tariff rates were based on an error

Apparently the “flunkies” Trump has surrounded himself with aren’t all that great at simple mathematics. According to an AEI report—later confirmed by the author of the paper in question himself—the announced tariffs should have been four times smaller, had the Trump administration correctly applied the relevant elasticities:

“Their mistake is that they base the elasticity on the response of retail prices to tariffs, as opposed to import prices as they should have done. The article they cite by Alberto Cavallo and his coauthors makes this distinction clear… Correcting the Trump Administration’s error would reduce the tariffs assumed to be applied by each country to the United States to about a fourth of their stated level, and as a result, cut the tariffs announced by President Trump on Wednesday by the same fraction, subject to the 10 percent tariff floor.”

That raises a question: will they fix their mistake prior to 9 April, reducing the maximum tariff to around 14%, or was the equation all a ruse to begin with—they just want to reduce trade, full stop, and they’ll stick with the current rates anyway?

That decision matters a lot. The cost (deadweight loss) of a tariff is the square of the tariff rate, as it is for all taxes. As economist Justin Wolfers pointed out:

“[The] latest round pushes our current rate to around 15 times its 2016 level, and so squaring that, it’s 225 times more painful. That’s more than 50 times as large as the cost of Mr. Trump’s first-term tariff increase.”

But unlike other taxes, tariffs are especially bad because they stack: every time a good crosses the border, which in the case of US auto manufacturing can be several times for each component, the tariff is reapplied. Tariffs also discriminate between goods based on the location of production, thereby distorting supply chains, which further reduces efficiency (unlike a value-added tax which is relatively efficient because it only affects the demand side).

But even ignoring those other effects, a weighted average tariff rate between 10% and 14% would be considerably less bad than the proposed 22.5%: instead of being 55 times as painful as the Trump 1.0 tariffs, they’ll only be 11-22 times as bad.

Trade policy is foreign policy

I’m not so sure a reversal, whether due to the error above or dressed up as Trump masterfully ’negotiating’ a deal with several nations, is enough to fix the damage he has already caused the world.

For example, in less than a week Trump has done more to improve China’s global standing than decades of Chinese Communist Party (CCP) propaganda, ‘Belt and Road’ debt traps, or ‘soft diplomacy’. Earlier this year, China completely removed tariffs for 33 African nations. Those same countries now face at least a 10% tariff for goods they want to sell to the US.

These are poor countries that will now be more willing to side with China in any geopolitical shenanigans. They’re also selling things like commodities and low-value items like garments; goods that the US will never make at home unless they want to be just as poor. As Bloomberg’s Joe Weisenthal wrote:

“Do we think there are hundreds of thousands of people in the US eager to work in sneaker and t-shirt factories at the wages that sneaker and t-shirt factories pay? Are there people eager to work in sneaker factories even at ‘good’ wages? Do we think that the US has the level of robotic capability to replace these factories without having to hire a lot of workers? And if not, what is the administration trying to accomplish?”

The uncomfortable truth is people in the Trump administration do want to onshore this kind of low value-add manufacturing. Labor Secretary Lori Chavez-DeRemer said so yesterday. JD Vance has claimed he “believes in economic self-sufficiency”. And Oren Cass, one of the loudest cheerleaders for Trump’s tariffs, openly admitted that he doesn’t even understand the basic concept of comparative advantage—the idea that to maximise productivity, a nation should sacrifice the least to get what it wants.

They honestly don’t know what they’re talking about, and America – along with the world – is going to be a lot poorer if they’re able to see this through to the bitter end. As Dartmouth’s trade economist Douglas Irwin recently wrote:

“These tariffs—on friend and foe alike, as Mr Trump likes to say—are almost certain to push friends away. It isn’t easy to have good diplomatic relations with a rogue power that flippantly and capriciously blocks trade. Co-operation with allies on all manner of issues, from security to public health, is likely to suffer. Mark Carney, Canada’s prime minister, was not being loose with his words when he said recently that the long-standing co-operative US-Canadian relationship is ‘over’. Europeans are thinking the same thing. And trust, once lost, is hard to rebuild.”

While some nations have effectively bent the knee to Trump’s new world order—the UK’s Prime Minister, Keir Starmer, yesterday claimed that “globalisation is over”—I still have hope that coolers heads will eventually prevail and that global trade institutions will survive.

Trade still has many allies. For example, Canada announced that “it will build a coalition of countries who share their values to build their economy and trade opportunities and will exclude the United States”. Australia’s Anthony Albanese and Peter Dutton have both ruled out reciprocal tariffs, and “will not join a race to the bottom that leads to higher prices and slower growth”.

Hopefully a new world trading order is established with the US on the sidelines.

Pressure will be mounting on Trump

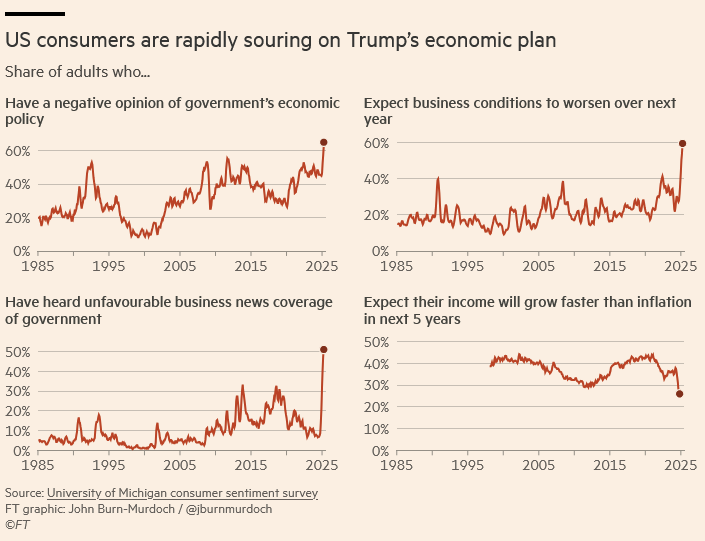

Despite his defiant social media posts, several forces will be putting immense pressure on Trump to wind back his tariffs. As the Financial Times’ John Burn-Murdoch showed across several charts, the American public hold deeply negative sentiment towards Trump’s tariffs:

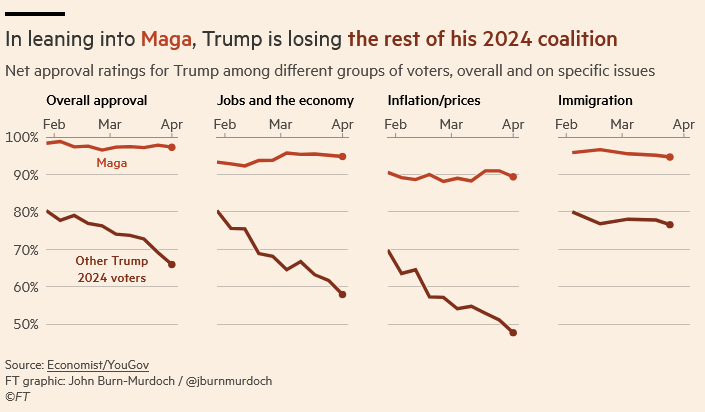

Trump’s also rapidly losing political support:

A handful of Republicans have now openly challenged Trump’s authority to implement his tariffs, along with many Democrats—although some of the latter have sided with the President (there’s a reason that Kamala Harris lost to Trump, and the Democrats’ general incompetence on most economic issues is one of those reasons). Outspoken Texas senator Ted Cruz warned of a “bloodbath” in next year’s mid-terms if Trump holds on his tariff plan, calling instead for “dramatically lower tariffs abroad and… dramatically lowering tariffs here”.

There’s also the threat of a legal challenge, with a group backed by billionaire Republican Charles Koch lodging a suit alleging that “Trump lacked the authority to impose these levies”—although that will likely take weeks to work its way to a resolution.

Finally, there might also be a rift within Trump’s inner circle itself. On Sunday, Elon Musk publicly criticised Trump’s top trade advisor, Peter Navarro, and said that he hopes “the United States and Europe move to a zero tariff situation, effectively creating a free trade zone between Europe and North America… That’s been my advice to the President”.

Then there was a scoop from MSNBC host Stephanie Ruhle, who suggested that Treasury Secretary Scott Bessent “is reportedly looking for a way out of the Trump administration following the Republican president’s disastrous tariff rollout”:

“Some [sources] have said to me, he’s looking for an exit door to try to get himself to the Fed, because in the last few days he’s really hurting his own credibility and history in the markets.”

Trump’s tariffs don’t kick in until Thursday (Australian time). That means there’s still three full days for Trump to come to his senses and break free from his echo chamber, either by admitting the error his team made in devising the tariff rates (unlikely); or claiming he has struck some kind of “deal” that will see most rates cut to something like 14% or less anyway (more likely).

That would still be a large, highly distortionary tax increase. But to the extent that it’s credible (Trump is hardly trustworthy), it would still be a marked improvement on what we’re currently facing, markets would rally, and with any luck this whole anti-trade saga will be behind us—at least for the time being.

If not, then there’s plenty more pain still to come.

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!