Why are the Kiwis so unproductive?

Sometime later this year, Australia’s Productivity Commission (PC) will deliver “preliminary actionable recommendations for productivity-enhancing reforms” to Treasurer Jim Chalmers, who has made Australia’s dismal long-term productivity performance a key agenda item for his government’s second term.

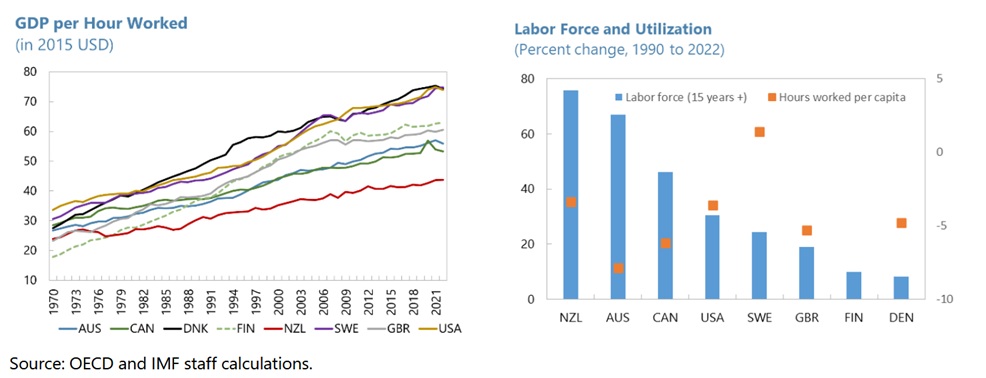

But while we wait for those to be developed, it turns out that our cousins across the ditch—who disbanded their own PC in February 2024—are stuck in something of their own productivity quagmire. In fact, according to a new special report by the International Monetary Fund (IMF), in recent years New Zealand has performed even worse than Australia.

Much worse:

To maintain growth, the Kiwis have added more workers and worked longer hours (right panel in the above chart). They’re effectively working harder, not smarter:

“By 2019, capital stock per hour worked in New Zealand was half of that in Australia and Finland, and 60 percent below levels in Denmark.”

A lack of capital is one thing. But the Kiwis are also using the capital they do have less productively than other countries:

“Among peers AEs [advanced economies], only Belgium and Australia saw larger drops in capital productivity than New Zealand. Yet in Australia and Belgium, as well as in several other peers, declines in capital productivity were concurrent with an increase in the capital-stock-to output ratio and with a more rapid increase in capital stock per hour worked (both consistent with capital deepening). In contrast, capital stock per hour worked grew slowly in New Zealand, and the capital stock to output ratio remained nearly flat between 2000 and 2019.”

Put it all together and it explains a fair bit of New Zealand’s world-lagging productivity. As for the causes, the IMF suggests several possibilities. Here are a few:

“Lower MFP [multi-factor productivity] growth could be consistent with limited economies of scale and low competition. It is also consistent with recent findings of slow technological diffusion and lagging frontier firms in New Zealand.”

Basically, the Kiwis need more investment (capital) and they need to use it better, for example by enabling their most productive firms to get bigger at the expense of low-productivity incumbents that are holding them back.

But to do that, several things probably need to happen. For example, they probably need a good dose of competition reform, to relax their administrative and regulatory burdens (especially related to land-use), and—because their pool of domestic savings is so small (which they could boost by “incentivising the accumulation of private savings outside of real estate”)—ease restrictions on foreign investment.

On that latter point, here’s the IMF again:

“New Zealand’s foreign investment screening regime has been historically one of the most restrictive among AEs. Inward FDI has thus been lower than in many peer economies (as percent of GDP), despite an open trade account and significant exports.”

Anyway, food for thought ahead of what will no doubt be a much more comprehensive review by Australia’s PC and its nearly 200-strong employees later this year!

Comments

Comments have been disabled and we're not sure if we'll ever turn them back on. If you have something you would like to contribute, please send Justin an email or hit up social media!