Friday Fodder (5/24)

Here are a few short takes for you to chew over on the weekend, from the week's happenings that probably didn't need a full post.

1. Stepped on by stamp duty

Move over income tax, because the always-interesting folks at the e61 Institute released a note this week looking at another highly inefficient tax: stamp duty. According to the authors, it now costs the average city dweller five months of after-tax income just to move house. And yes, our old friend bracket creep is largely responsible:

"This cost as covertly doubled since the 2000s. There is no specific policy change to blame, just housing prices out-pacing income as well as stamp duty bracket creep. State government budgets have benefits from the growing tax revenue."

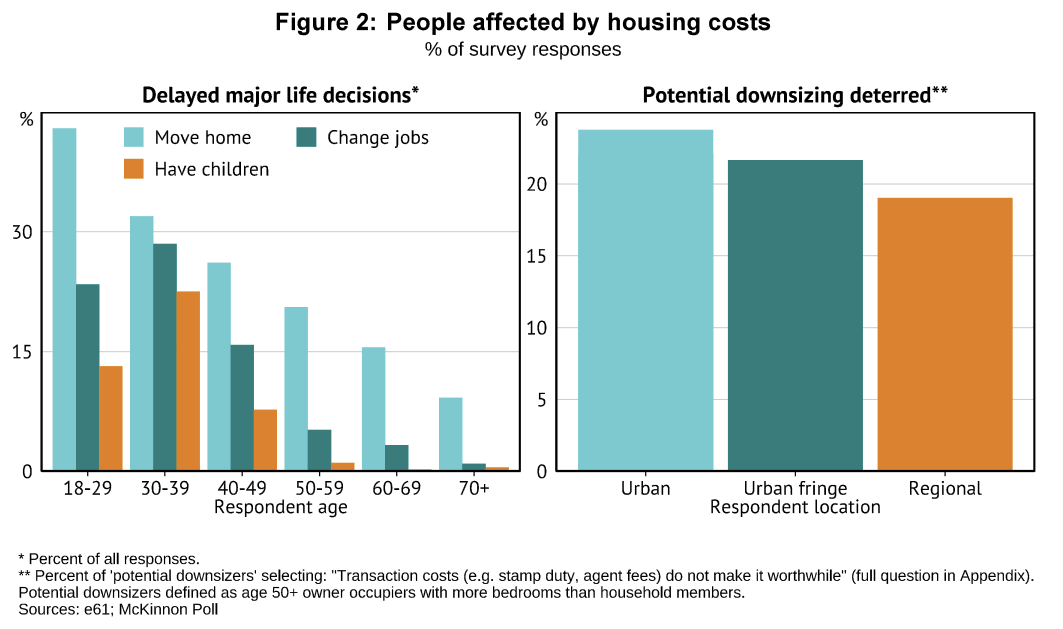

There are huge behavioural costs associated with this tax, including how it delays people changing jobs; stop them from having children; and prevents potential downsizers from freeing up scarce housing supply.

Stamp duty is a state tax and happens to be one of their largest revenue raisers. The NSW government recently tried to abolish it for first homeowners, only to lose the election and have the new Labor government bring it right back.

For those who don't remember, stamp duty was supposed to be abolished as part of the Howard and Costello GST agreement, only to be left out at the last minute because of a deal struck with the Democrats to remove GST on food, which left the states with less revenue. Instead of guaranteeing a minimum floor, Howard and Costello deferred the removal of stamp duties indefinitely.

[EDIT: I misread the article; stamp duties on just about everything except land were to be abolished as part of the original GST agreement and were then removed at the last minute.]

Stamp duty is now such a big revenue raiser that the political economy means despite its inefficiency, it will be a tough beast to slay.

2. An innovator in regulating innovation

Artificial intelligence isn't going away. To the contrary, OpenAI's Sam Altman is reportedly looking to:

"[R]aise funds for a wildly ambitious tech initiative that would boost the world's chip-building capacity, expand its ability to power AI, among other things, and cost several trillion dollars, according to people familiar with the matter."

Scott Alexander offered perhaps the best response to the inevitable question of why does he need so much? It all has to do with how much computing power large language models take to build:

"The basic logic: GPT-1 cost approximately nothing to train. GPT-2 cost $40,000. GPT-3 cost $4 million. GPT-4 cost $100 million. Details about GPT-5 are still secret, but one extremely unreliable estimate says $2.5 billion, and this seems the right order of magnitude given the $8 billion that Microsoft gave OpenAI.

So each GPT costs between 25x and 100x the last one. Let's say 30x on average. That means we can expect GPT-6 to cost $75 billion, and GPT-7 to cost $2 trillion."

Altman wants to regain the lead in AI, as his attempts at becoming a regulated monopoly have so far failed – Google's Gemini is catching up to GPT-4 very quickly, and US regulators have so far resisted his attempts at raising his rivals' costs through new red tape. But one region that has wholeheartedly embraced his call for AI safety regulation is Europe:

"[A]s the EU moves to contain AI before most of its potential is even understood, it is worth taking the long view. Nearly all of Europe is now subject to the rulemaking of a bureaucracy that has in its short history erred on the side of excessive caution concerning technology. In that short period, tech has mostly passed Europe by, concentrating in the US, whose GDP continues to diverge from Europe's. If we are in an age of digital exploration, it seems that the EU, much like the Ming bureaucracy, is labouring to restrain its people from the farther reaches of this new world."

That's from an interesting essay by Snowden Todd, which compares the bureaucratisation and ultimate demise of the Ming dynasty to today's Europe and AI. If any Australian regulators are reading and are looking for ideas for how to regulate AI, Europe's excessively prescriptive, 900-page AI Act is an excellent example of what not to do.

3. Climate change goes through China

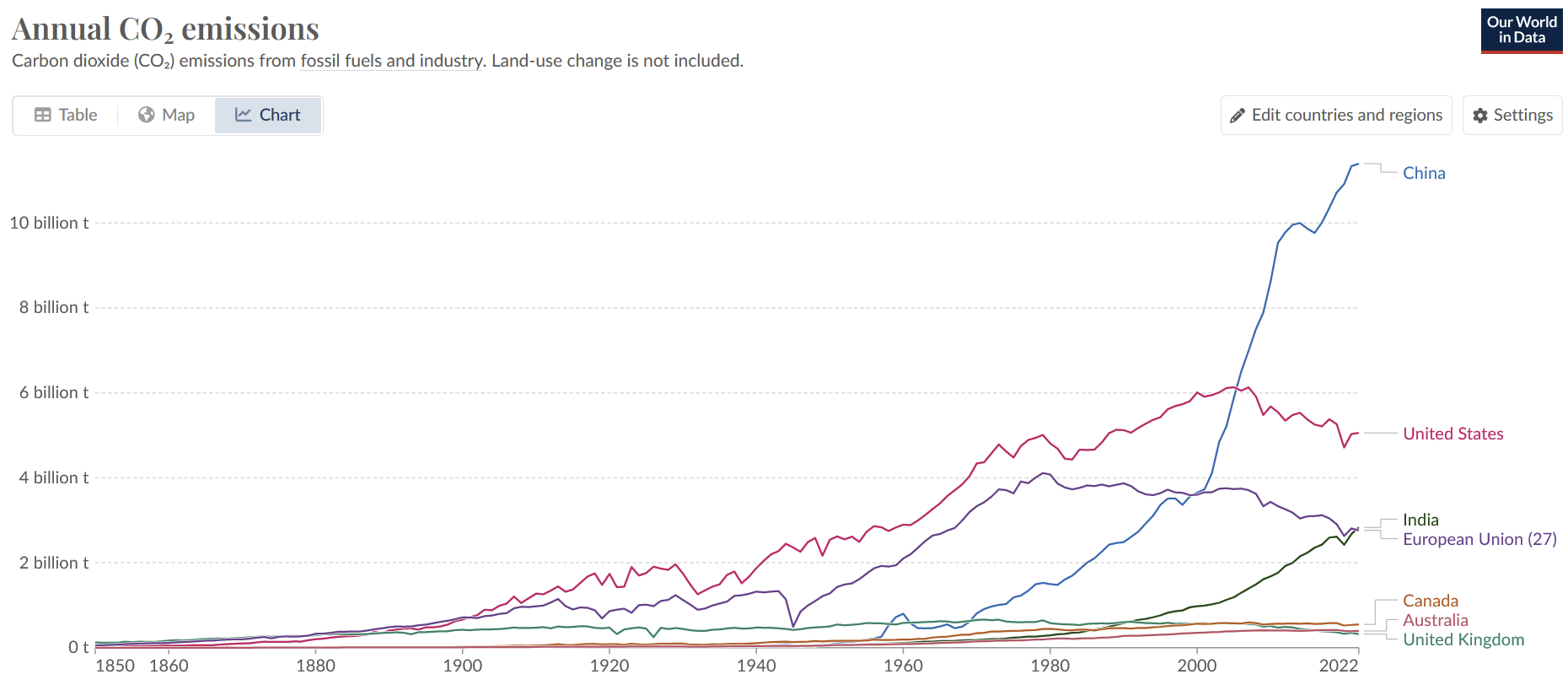

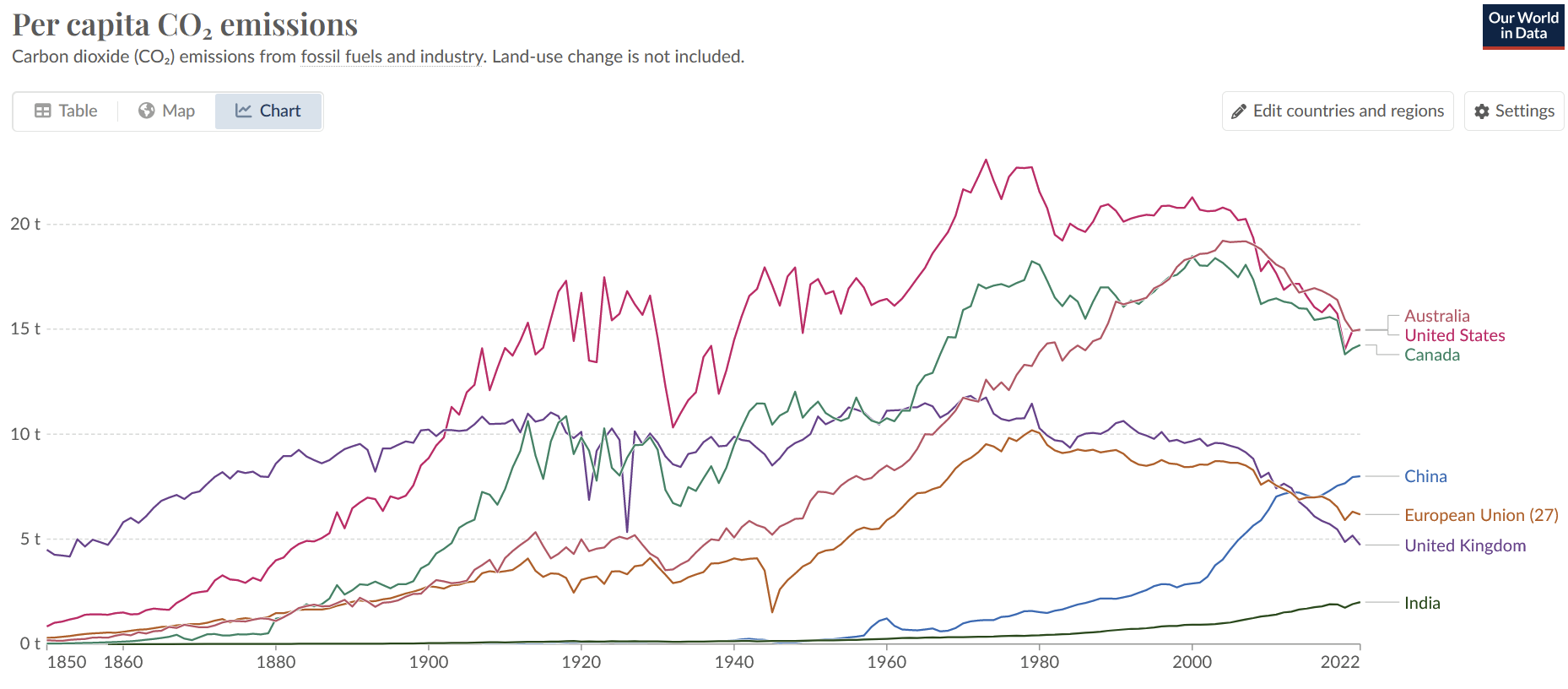

We like to think we can do our part to stop climate change here in Australia. And we can, to an extent: we're getting our per capita carbon emission levels down but as a country, we never really emitted that much to begin with.

For all the good we've done, climate change doesn't care about per capita – it's the decisions being made in places like China and India that will really shape the future.

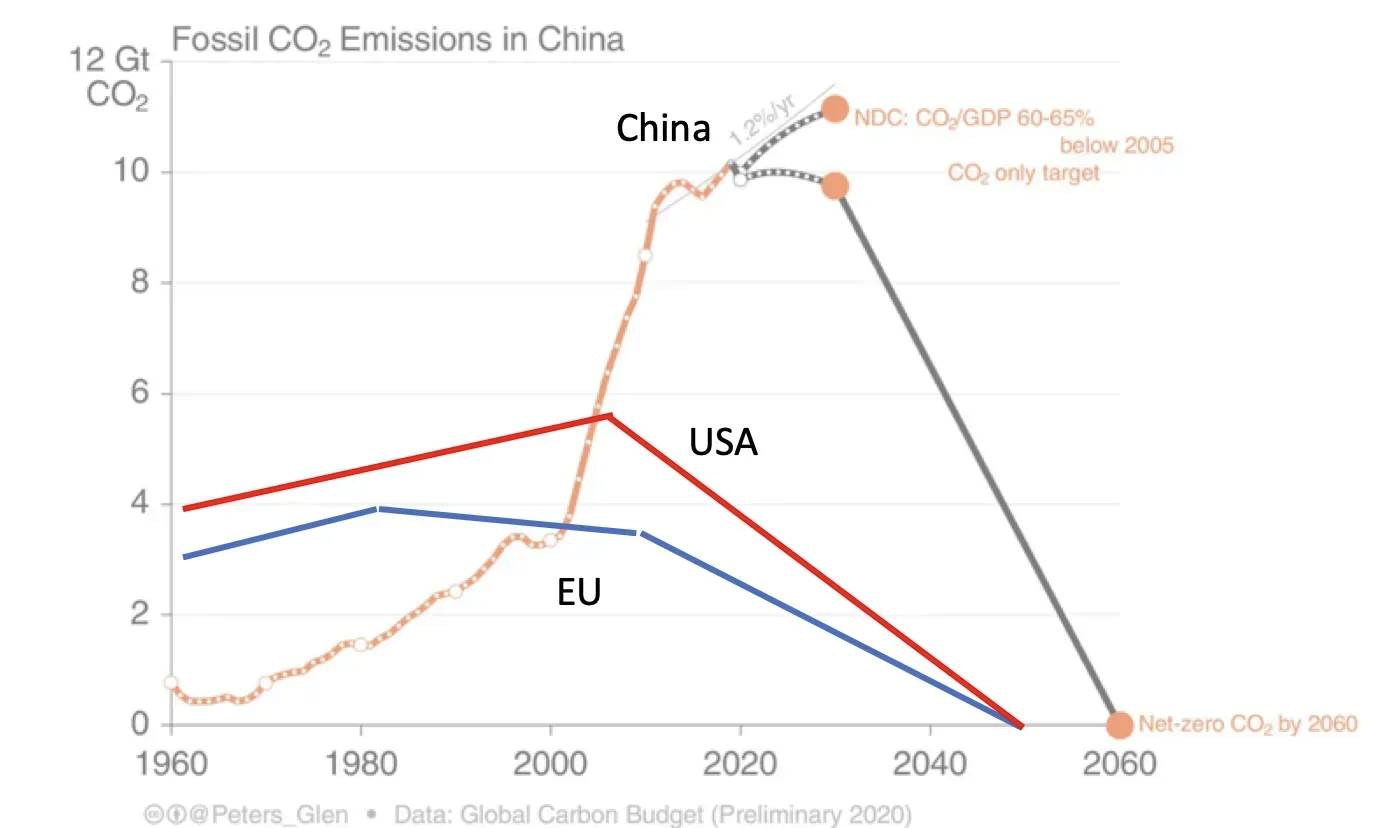

So how are they tracking? Adam Tooze had a look, concluding that China's ambitions to reduce its carbon footprint are "far more ambitious than anything envisioned in the West". He provided this chart, which shows just how drastic China's "hairpin" decline would have to be:

According to Tooze:

"Assuming we have the good fortune of being able to look back on this process from the vantage point of 2070 or 2080, the drama of the energy transition will not to be found in the West, but in Asia, in China's hairpin and the efforts by India and other developing countries to find paths to growth that do not make them into more Chinas."

China is investing a lot in green energy. In 2023 alone, it installed 301GW of renewable power generation capacity, or 59% of the global total. It installed more solar panels in a single year than the US has done... ever. But 60% of the country's electricity still comes from coal, and last year it "accounted for 96% of [the world's] new coal power construction, 81% of newly announced projects, and 68% of generators coming online".

Needless to say, China's hairpin plan looks ambitious, to say the least. Possible? Sure. Likely? No.

4. Tassie's going to the polls

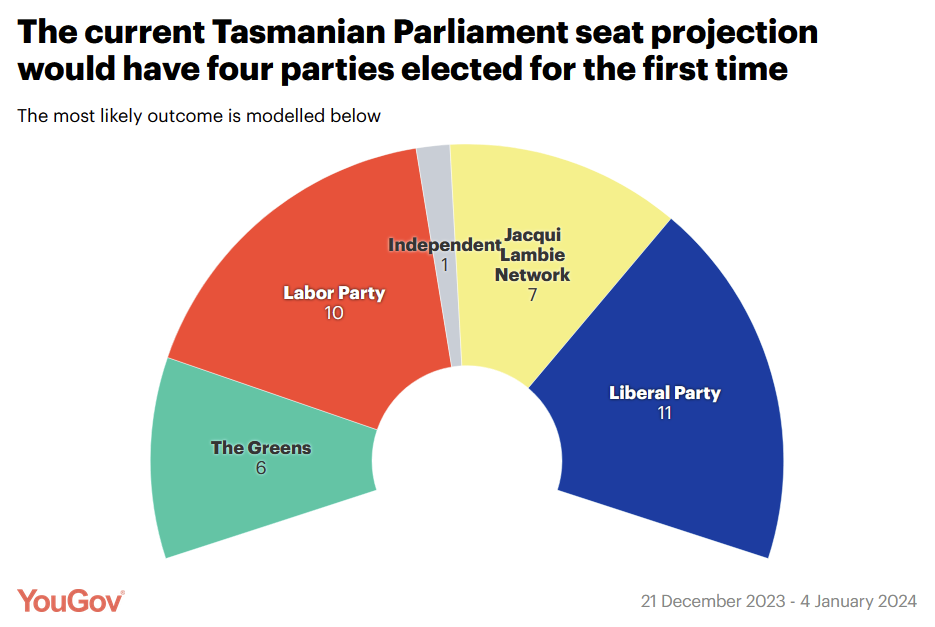

The only state or territory with a Liberal leader is heading to the polls nearly a year and a half early, after Premier Jeremy Rockliff failed to secure the agreement of two formerly-Liberal independents to support the government. The most recent opinion polling has a hung Parliament as the most likely outcome, with the Liberals picking up the most seats but probably having to do a deal with the Jackie Lambie Network to form government.

What puzzles me the most is that a lot of the discontent in Tasmania is due to Rockliff's infatuation with Tassie's new AFL stadium. It's reportedly going to cost up to $1 billion – well above the $750m initial estimate, as is always the case – and the benefits are murky at best. Rockliff's government likes to cite PwC/Hanson modelling that claims benefits of "$2bn over 20 years", but Tasmania's own parliamentary committee report on the stadium – which must actually have an economist or two on its staff – disagreed, noting specifically "the absence of assumptions related to opportunity costs and implausible event attraction details".

There are few things economists agree on with near unanimity. The shoddiness of consultant reports claiming "economic impacts" for major events and stadiums are one such example, especially when those reports ignore opportunity cost: the new stadium is only worthwhile if its benefits outweigh its cost and if it is the most efficient use of those resources!

In this case, can Rockliff seriously claim that he can't find a better use for that $1 billion, not to mention the ongoing maintenance costs? First off, Tasmania is in debt, so it will have to take even more on to pay for this. A better option may have just been to not borrow the extra billion in the first place.

But if Rockliff simply must spend it, here's a quick thought experiment. Tasmania's median income was $81,562 in 2021. Let's bump that up to $100,000 to account for inflation and administrative costs, which would mean the government could have instead hired 400 full-time employees for the next 25 years to build roads, water infrastructure, power lines, houses – I'm sure Tassie needs plenty of those. I'm not saying that's the next best use of the money, just that there are probably dozens of ways he could have used it to achieve a higher economic return for the state than on a new stadium, most of the benefits of which will accrue to the already-wealthy AFL (it's only contributing $15 million, or 1.5% of the construction cost) and a handful of fans.

Rockliff may win the election, depending on how Jackie Lambie is feeling when the time comes and how well he, Labor and the Greens campaign (Labor doesn't even have a position on the stadium, while the Greens oppose it). But by vehemently backing the construction of a new stadium – an endeavour in corporate welfare – during a cost of living crisis, Rockliff could well have alienated some Liberal voters who thought they were voting for someone who believed in "work[ing] towards a lean government", and that "wherever possible, government should not compete with an efficient private sector"!

5. And if you missed it, from Aussienomics

How big is too big? – Dick Smith wants to cap Australia's population at 30 million over concerns about a lack of resources and housing costs. In doing so he falls for the 'lump of labour' fallacy, and fails Econ 101: it's poor planning, not immigrants, that erodes housing affordability in Australia.

The wealth of our working nation – Japan's "lost decades" of low growth are due to its declining working-age population, not necessarily failed policies. With aging populations, policymakers in developed nations such as Australia will need to focus on right metrics, not just GDP growth, to craft effective policies.

Member discussion