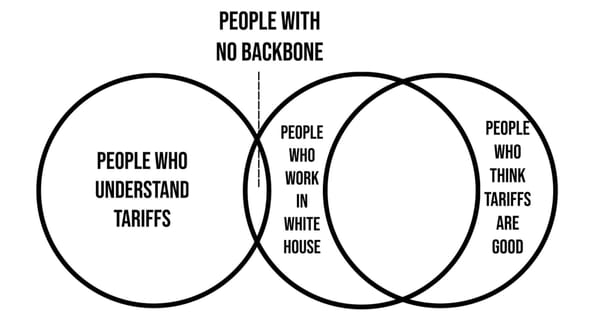

Oz Econ Pulse: Peter Dutton, Tradie shortage, Donald-25 mind virus, and Economists against tariffs

No doubt many of you are still enjoying a long Easter/ANZAC Day break, but for those of you pining for some economic news, here are a few bits of interest that caught my eye this week—starting with my comprehensive essay on Peter Dutton. Peter Dutton is a man