What Australia's per capita recession really means

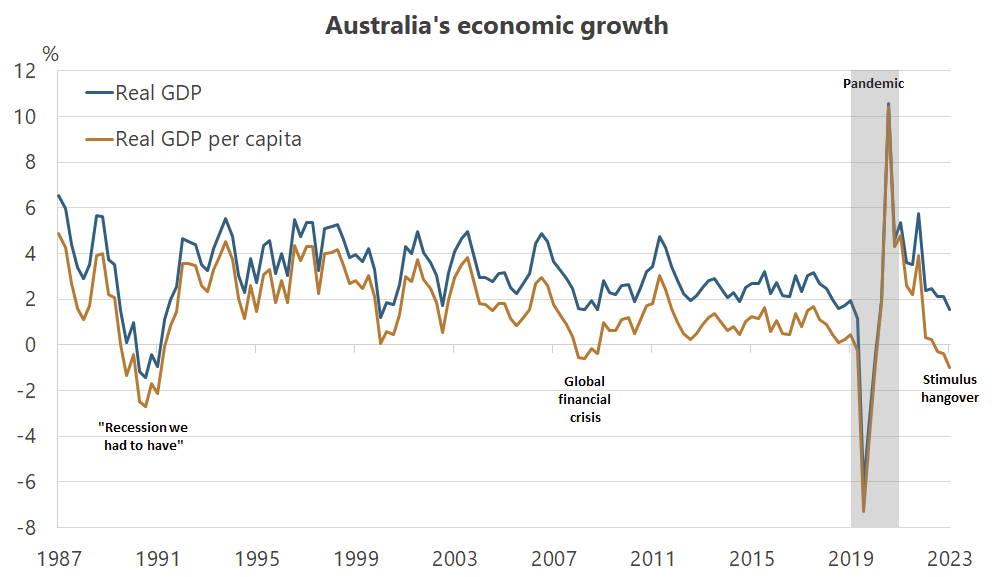

Australia's national accounts were released last week and confirmed that our per capita recession – defined as two consecutive quarterly contractions – didn't just continue into the December quarter, but deepened: on a per person basis, our economy is now a full 1% smaller than where it was a year ago.

Excluding the pandemic, it's Australia's first per capita recession since 2009, and only our second since the depths of the early-1990s "recession we had to have".

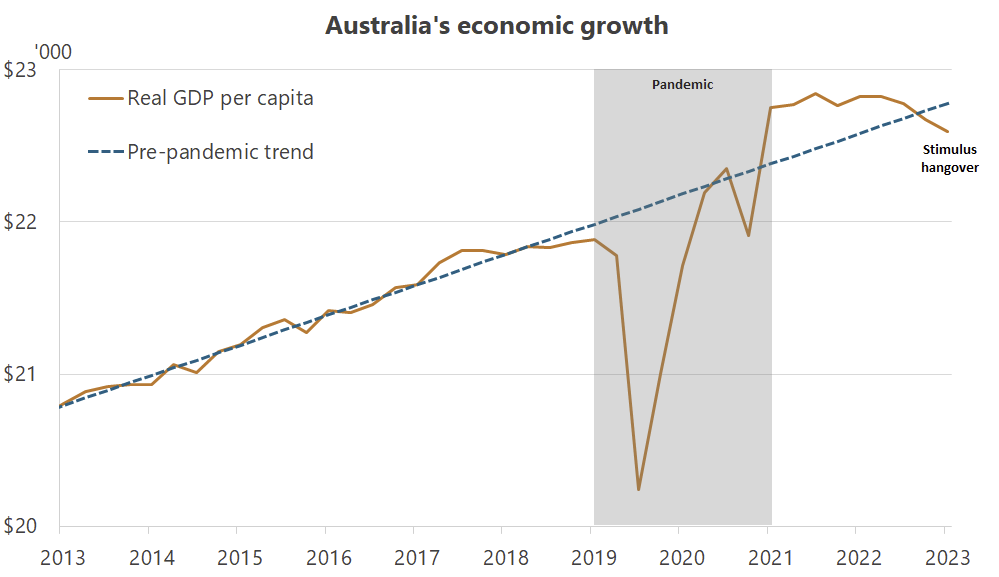

If the current slowdown in real GDP growth continues its current trend, we could soon have our first technical recession since then, too, although we're kind of already there, anyway: in level terms, real GDP is now well below the pre-pandemic trend.

The fact is that despite above-trend growth for a couple of years, we lost a considerable amount of wealth during the pandemic. So, what should we make of the rather sombre news, and what can be done about it?

Diving into the aggregates

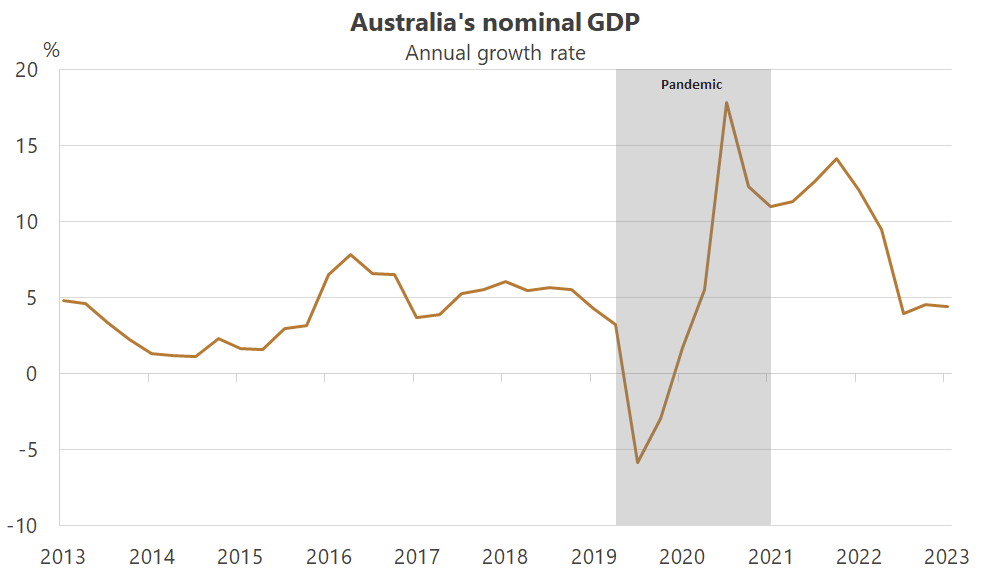

The first thing I'll note is that an economic slowdown was probably inevitable after the stimulus-fuelled largesse of 2021-23, a period when nominal GDP (NGDP) – a broader indicator of aggregate demand pressures than the consumer price index – was consistently growing in the double-digits.

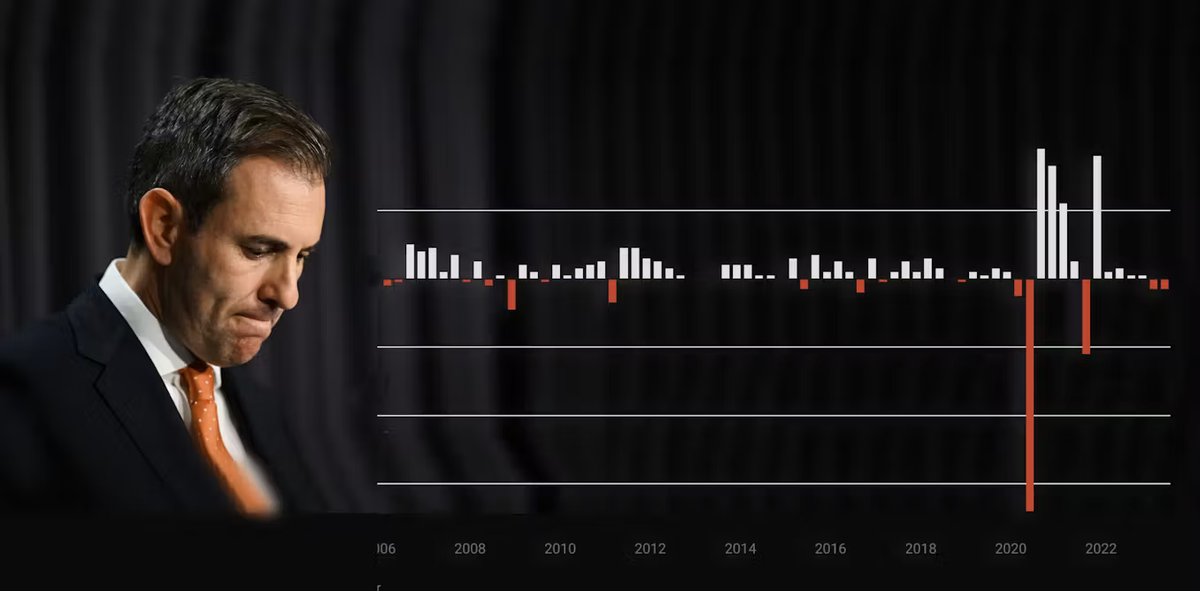

While NGDP is not as reliable an indicator in Australia compared to, say, the much more diverse US economy – mostly because of how influenced we are by changes in global commodity prices – it can still be important, as it is in this case. For example, since 1990, other than a single quarter in 2009, Australia's NGDP had never increased more than 10% annually. Yet across calendar 2021-22, it grew above 10% for seven consecutive quarters.

Needless to say, NGDP running at that rate is an indicator of excessively easy monetary policy, which we know is exactly what happened during and following the pandemic. The good news is that it has now been back at around 4.5% for three consecutive quarters, suggesting that the Reserve Bank of Australia (RBA) may soon have inflation under control, at least from a monetary perspective.

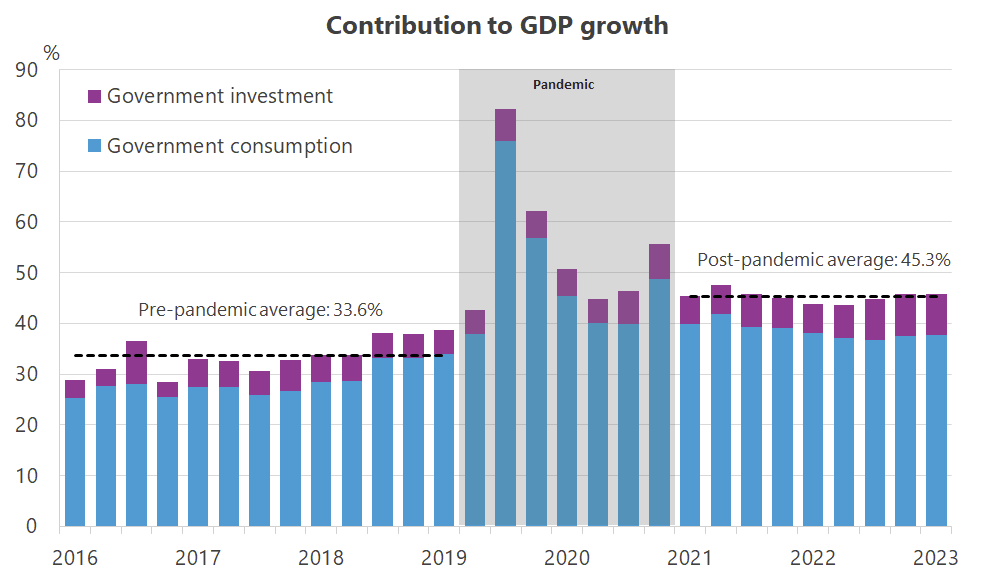

The bad news is that not only has the monetary punch bowl been removed, but a lot of the growth we experienced over the past few years was driven by a seemingly permanent level change in the contribution of government consumption to Australia's economy.

The private sector was responsible for only a touch over half of real economic growth since 2021, compared to an average of around 70% prior to the pandemic, with the public sector – specifically, debt-financed state and federal government consumption – doing the bulk of the heavy lifting since then.

It's too early to say if this is a permanent shift in the structure of the Australian economy: a decent chunk of the increase in consumption has been for "government benefits for households", which are not likely to be sustained beyond the next election. However, the ABS also reported "higher employee expenses across commonwealth departments", which could prove far stickier.

Generally speaking, a larger role for less productive government consumption crowds out the private sector (the government can only consume by taxing the private sector or through borrowing, the latter of which will need to be paid with future taxes or inflation), and probably contributed to the excess aggregate demand that led to inflation and cost of living crisis. If we want to help improve productivity and reduce inflation, we're probably going to need to see those blue lines come back down.