Why real wages had to fall

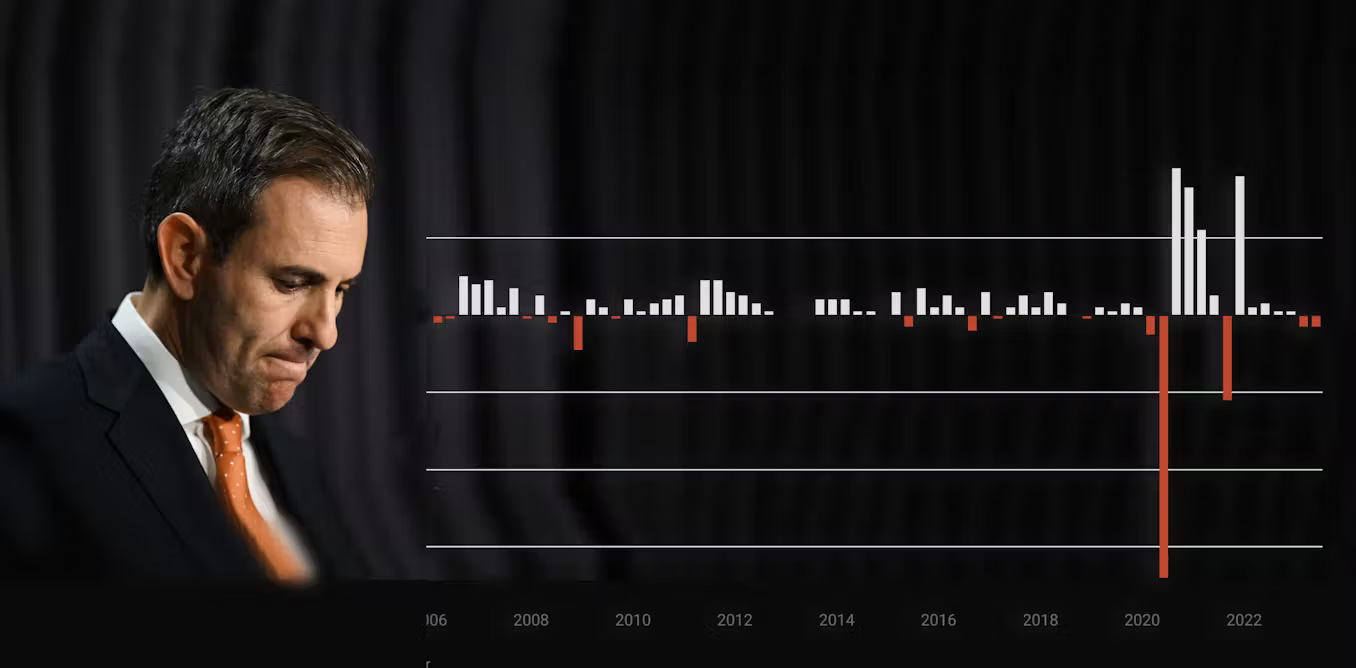

It's no secret that real wages in Australia have been in the proverbial gutter in recent years. According to last week's wage price index (WPI), wages growth slowed to 0.8% in the March quarter, which if sustained for a full year equates to an annualised rate of 3.3%. Now in normal times that wouldn't be so bad; the problem is we're not in normal times. Inflation, as measured by the consumer price index (CPI), also increased by 1.0% in the same quarter (3.9% annualised).

Net one off the other and for the first time in a year, real wages went backwards.

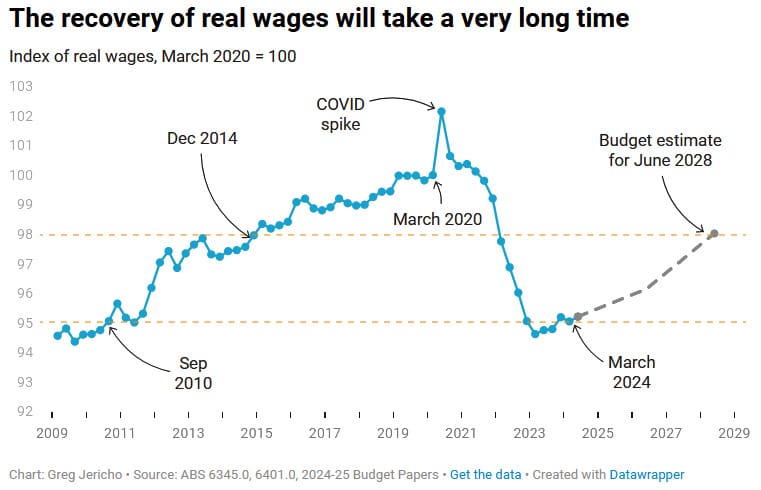

That news generated a few headlines. The most pessimistic of the bunch was from The Guardian's Greg Jericho, who noted the fact that real wages have gone so far backwards that they're now equivalent to 2010 levels:

There's nothing inherently wrong with that chart. But it is wrong to interpret it, as Jericho did, to mean that:

"In effect we have lost 14 years of progress on living standards and, unless real wages grow faster than they did before the pandemic, we shall continue to be that far behind until the middle of next decade."

Jericho's mistake

Jericho's mistake stems from misunderstanding what the WPI and CPI measure. Starting with the WPI, it's not actually a measure of people's wages but a measure of wages for specific jobs. If everyone stayed in the same job forever, then it would be a great proxy for incomes. But they don't, so it's not – in Australia, of our more than 14 million workers, nearly 10% changed jobs in just the past year, and over half of all workers have been at their current job for fewer than 5 years.

The WPI captures some of this effect – for example, if a firm raises wages to poach or retain a worker – but also misses a lot. And the misses can be significant; in Australia, the e61 Institute recently estimated that switching jobs results in a 9 percentage point higher pay increase than if a person stayed at the same job.

Put it all together, and it's likely that the WPI has underestimated nominal wages over the past few years, a quirk that was likely intensified by the pandemic.

As for the CPI, it only captures pure price changes. It does not account for substitution effects, or changes in the composition of household expenditure, so can overestimate how far people's living standards have fallen.

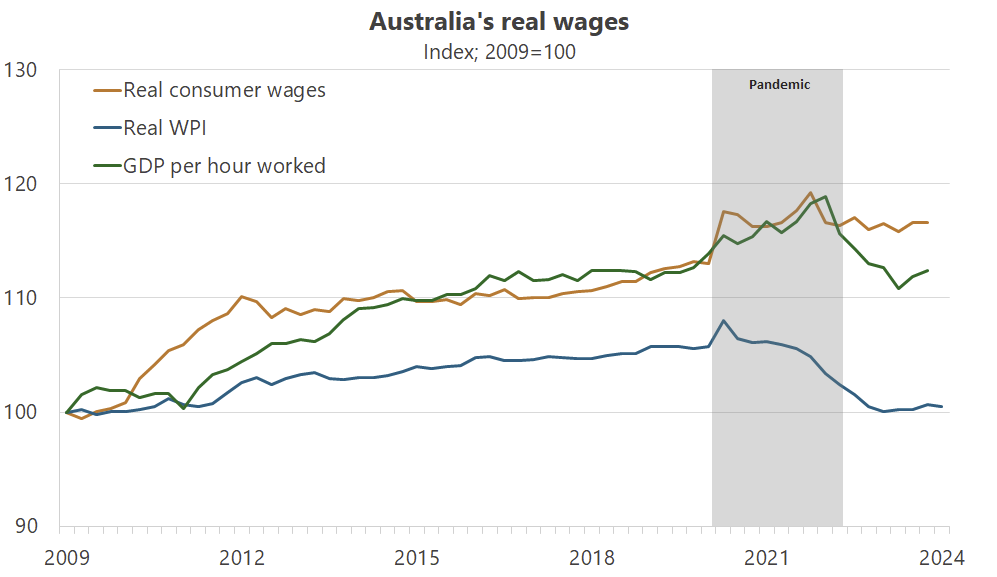

To get a better idea of those changes, we can look at household final consumption, which is a proxy for all household expenditure. If we then use that to deflate total non-farm compensation per worker, which "comprises wages and salaries (in cash and in kind) and employers' social contributions", we get what is known as the consumer wage. In the long run, this indicator closely tracks labour productivity and is therefore a better proxy for living standards than the WPI/CPI measure used by Jericho:

It's true that real consumer wages have gone nowhere in four years. But they're still above where they were in 2010 and are well above labour productivity, which is actually part of the reason we've seen no growth since 2020: when real wages get too far ahead of productivity (such as during a mining boom), they tend to flat-line or fall for a period until the latter catches up, preventing high unemployment. While it would be more efficient for nominal wages to also fall and speed the process up, that's unlikely because "cuts to nominal wages can reduce morale and prompt resistance even in difficult economic times", so businesses tend to adjust by using fewer workers or more capital (and nominal wage cuts are illegal in the public sector).

So, the stagnation of real consumer wages in recent years, and falls in the WPI/CPI real wage, is best thought of as part of the adjustment process to the pandemic and mining boom the global response to it kicked off. When labour productivity catches back up, we should start to see real wage growth again.

Wages do influence inflation

Perhaps Jericho's most egregious claim was that "it is impossible for wages to drive inflation when they are actually rising slower than inflation!".