Why we may not be done with inflation

Last week Canada became the first major economy to cut interest rates since the pandemic, followed closely by European Central Bank (ECB) a day later. Those decisions raise the obvious question of: when is it Australia's turn for a rate cut?

But before diving into that, let's take a quick look at why these central banks decided to cut rates. First up was the Bank of Canada (BOC):

"In Canada, economic growth resumed in the first quarter of 2024 after stalling in the second half of last year. At 1.7%, first-quarter GDP growth was slower than forecast in the MPR. Weaker inventory investment dampened activity. Consumption growth was solid at about 3%, and business investment and housing activity also increased. Labour market data show businesses continue to hire, although employment has been growing at a slower pace than the working-age population. Wage pressures remain but look to be moderating gradually. Overall, recent data suggest the economy is still operating in excess supply.

CPI inflation eased further in April, to 2.7%. The Bank's preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum. Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average. However, shelter price inflation remains high."

Ok, so growth is slowing in Canada despite "solid" consumption and investment, but most importantly the BOC thinks the economy is "operating in excess supply" – that's econ-speak for market prices being above what it deems competitive prices. Add that to inflation slowing to within its 1-3% target band, with "continued downward momentum" expected, and it's not hard to see why the BOC started to ease.

Now here was what the ECB had to say (curiously, there was some dissent in this decision):

"Since the Governing Council meeting in September 2023, inflation has fallen by more than 2.5 percentage points and the inflation outlook has improved markedly. Underlying inflation has also eased, reinforcing the signs that price pressures have weakened, and inflation expectations have declined at all horizons."

What's interesting is that unlike Canada, inflation in the eurozone accelerated in May, rising to 2.6% from 2.4% in April. Core inflation, which strips out volatile food and energy prices, rose by the same 0.2 percentage points, and nominal wages have been growing above expectations this year. So while this might be the first of several cuts for Canada, the ECB may now be on hold:

"At the same time, despite the progress over recent quarters, domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year."

So, what does all this mean for Australia? Let's just say that our economic situation is vastly different and we should be careful reading too much into these decisions.

Why we're different

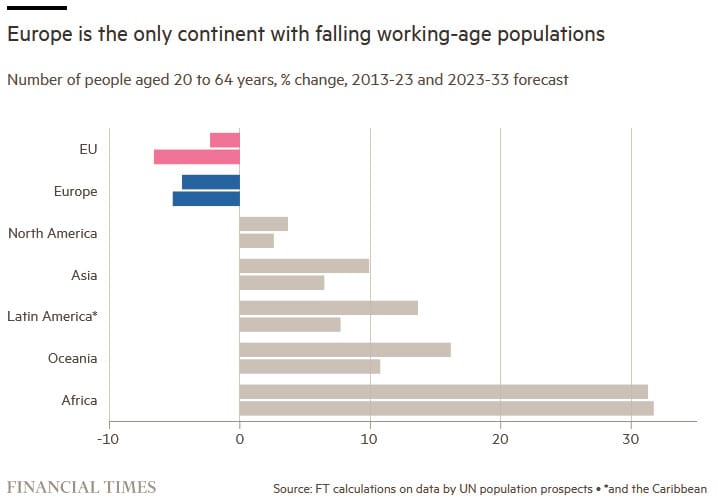

I'll start with the eurozone, which is on the only continent in the world where the working-aged population is falling: