Inflation's bumpy landing

Australia's March quarter inflation figures were released last week and let's just say if you were hoping for a rate cut anytime soon – perhaps even this year – you're going to be left disappointed. Not only did the consumer price index grow faster than analysts expected at 3.6% annually, but it actually ticked up again to 1% on a quarterly basis, which if sustained would correspond to an annualised rate of around 4.1%.

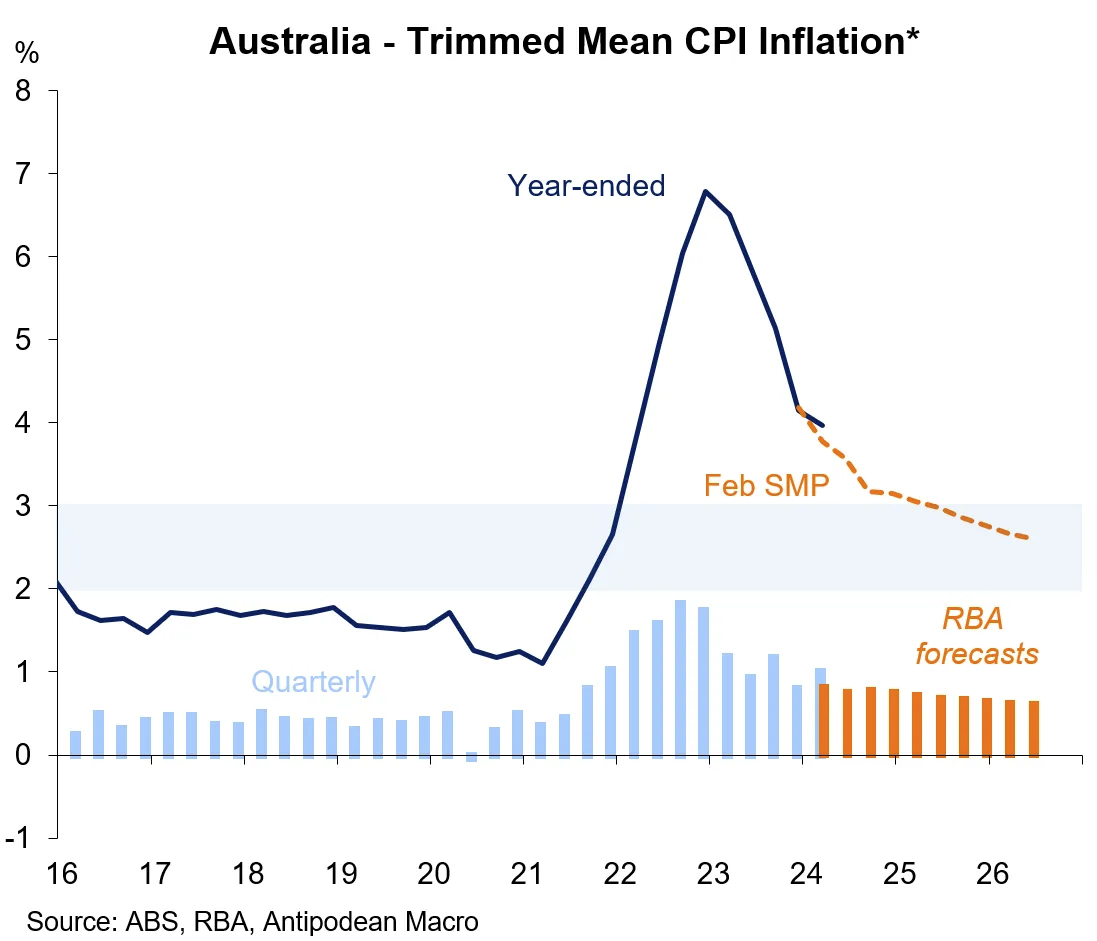

Perhaps more worryingly, the trimmed mean (core) reading, which strips out "volatile" items, rose 4.0% and is now above the most important forecast of them all: that of the Reserve Bank of Australia (RBA).

And don't say you weren't warned! I wrote back in January that:

"I think inflation might stay above the RBA's 2-3% target for some time yet, which means we're not likely to see rate cuts anytime soon – perhaps not even this year".

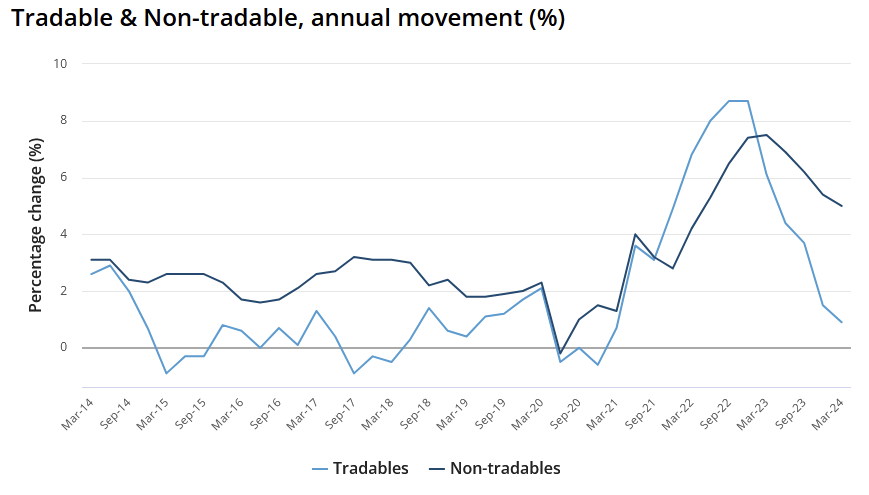

My reasoning was that "services inflation tends to be stickier than goods inflation", and that's exactly what's happening. After hitting a high of 9.6% in September 2022, goods inflation is now growing at just 3.1% annually, while services inflation looks to be settling at an annual rate above 4%.

It's a similar story with tradables versus non-tradables. While we can import disinflation from China and other countries that are investing too many resources in manufacturing – effectively subsidising foreign consumers – inflation in non-tradables is all about domestic fiscal and monetary policy goosing demand.

And on that front, we still have a lot of work to do, with the dichotomy between tradables and non-tradables especially noteworthy.

While tradables are experiencing disinflationary pressures, non-tradables look to be stabilising at an annual rate above 4%. If we can't get services and non-tradables inflation back down, the RBA may not simply hold rates where they're at for the rest of 2024 but could even raise them, with significant implications for the broader economy, particularly for households and businesses with variable-rate mortgages and loans.

Persistent and stubborn

Consultant Capital Economics recently wrote that "we now expect the RBA to hike rates by another 25bp (basis points) when it meets in two weeks' time".

That sentiment was echoed by Warren Hogan, a former Treasury economist, who argued that the RBA's strategy doesn't appear to be working: