Albo's stage 3 backflip

I was almost done writing an essay on the federal government's recent vaping crackdown when 2GB broke the news that the Anthony Albanese's early, half a million dollar taxpayer-funded Labor caucus was to discuss changes to those love'em or hate'em stage 3 tax cuts. In the midst of a cost of living crisis, I figured tax was probably a more interesting topic, so here we are.

But before I get stuck into it, some housekeeping. There will be no Friday Fodder this week on account of the Australia Day public holiday. It will be replaced with a one-off Monday Musings on the 29th, so keep your eyes out for that one.

Now on to Albo's stage 3 backflip. For those out of the loop, after the better part of two years promising the stage 3 tax cuts will go ahead as legislated, the Labor caucus is expected to sign off on modifications to them later today. Hence, backflip. The ABC provided a decent summary of what might be about to happen:

"As legislated, the stage 3 cuts will apply a 30 per cent tax rate on income earned between $45,000 and $200,000 from July.

On Monday, 2GB reported the government would instead keep the current 45 per cent tax rate between $180,000 and $200,000, which would trim the tax cut from $9,075 to $6,075 for those who earn over $200,000.

It would then raise the tax-free threshold, which applies to all taxpayers.

Independent economist Chris Richardson suggested the threshold could increase from $18,200 to $19,500 using the money saved at the top, delivering an across-the-board tax cut of $247 a year."

News Corp has subsequently reported that the the 37% threshold will not actually be abolished, and that the top 45% bracket will move to $190,000 instead of $200,000. Whatever the case may be, essentially the change is likely to see "a small amount of money going to a lot of people, many of whom are not doing that badly".

Right. I'm honestly not sure why Albo is willing to risk so much political capital on a relatively small distributional change just to get his very own Oprah moment, but it has given me an opportunity to write about why stage 3 came about in the first place and how we might be able to avoid this clown show ever happening again.

Stage 3 and the insidious effect known as bracket creep

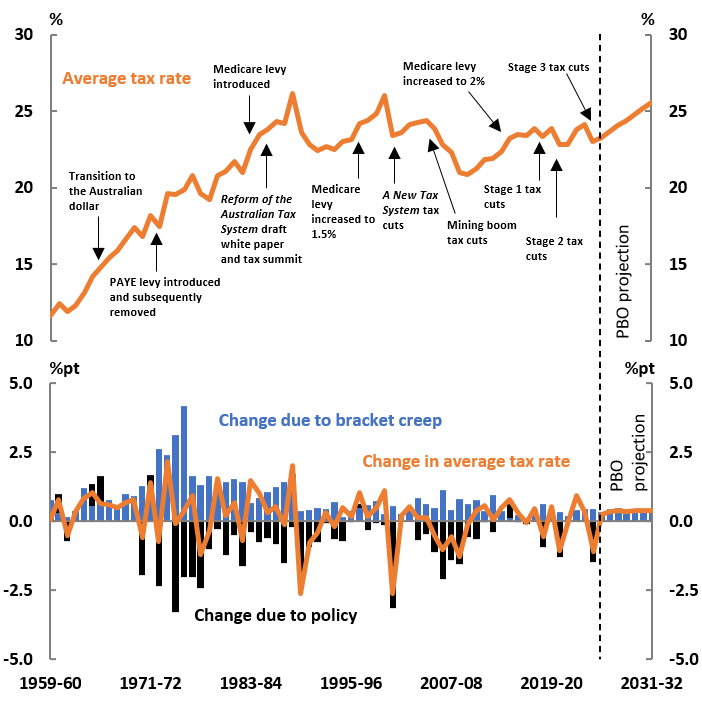

These stage 3 tax cuts were legislated back in 2019 with bipartisan support. They stem from a long-running issue in Australia known as bracket creep, which comes about when a fiat currency that loses 2-3% of its value every year (the RBA's inflation target) runs into a fixed wall of tax brackets set on nominal, not real, values.

To take just the most extreme example, the current top $180,000 tax threshold has been unchanged since mid-2008. If it had been indexed to inflation, it would equate to more than $250,000 today. That 'creep' happens across all income levels, from the bottom $18,200 tax-free threshold all the way to the top. Essentially, the government is raising taxes every year without having to actually raise taxes; a free lunch for politicians, at our expense.

A Parliamentary Budget Office (PBO) report recently concluded that "bracket creep plays a key role in revenue growth". The PBO also noted that the government's ability to collect revenue passively through bracket creep has distorted the composition of our tax base to be more heavily reliant on personal income taxes than in countries where tax brackets are indexed to account for inflation.

The stage 1 (2019) and stage 2 (2023) tax changes provided some relief to those on lower and middle incomes, and now Albanese is simply changing the distribution of stage 3 to also benefit people in those income ranges, at the expense of those earning over $150,000 each year – despite promising otherwise (which is why this is a political hot potato).

Why bracket creep is so damaging

When you tax people, it creates what economists call deadweight losses. Those losses are equal to the value of the activities that never happen because of the tax. For example, if the 'consumer surplus' you receive from a pack of cigarettes is $5 when the price of a packet is $40, and the government raises taxes on cigarettes by another $5 a packet, the value of that packet to you is now less than its price. As a result, you will no longer buy that packet, and the government will not collect any revenue. This idea is what underpins Australia's so-called sin taxes, and is why we pay so much for certain vices.

The same theory applies to labour income. If the tax you pay on the last dollar earned (the marginal dollar) is greater than the surplus you expect to get from it, you'll tend to work less. That might be working a 9-day fortnight, not taking that overtime shift, or electing for a less stressful role that doesn't pay as much. Regardless of the precise behavioural change, a deadweight loss is created from the new taxation. An activity does not take place, and the government collects no revenue, represented visually by the Laffer curve.

These distortions can be significant. Research from the US estimates that when marginal income tax rates are increased by 1%, the decline in taxable income from behavioural changes, when combined with the deadweight losses themselves, could be worth as much as $1.76 per $1 raised in revenue. In Australia, Treasury analysis concluded that financing the budget through bracket creep – which is the same as an increase in average tax rates – is far more costly for the economy than reducing government spending, especially during periods when the economy is operating close to full capacity or employment (as it is today), because of how "government spending crowds out private activity". Using the figures above, the government's least valuable spending would have to produce benefits greater than $1.76 per dollar raised to offset the deadweight and revenue losses – no easy task!

When discussing taxes, you have to remember that what matters most for an economy are marginal tax rates, not necessarily total taxes. If there were a way to 'tax the rich' (or in the case of bracket creep, everyone who earns income) without creating distortions, such as the disincentive to build wealth and perform the socially useful activities that go along with that, it wouldn't be such a big deal. But that's not the world in which we live, so bracket creep matters. Altering the stage 3 cuts could well cost the economy, in terms of lost output, more than the benefits that will be transferred to low and middle income earners, but without a cost benefit analysis we'll never know for sure.

Albo's solution leaves a lot to be desired

If all Albo is doing is altering the distribution of the stage 3 cuts, as reported by the media, I'm fine with it; transferring wealth is a big part of what modern politicians do. It may not be entirely clear why he's doing it – the media circus and perpetual uncertainty that has circled it since the election means he's having to exhaust a lot of political capital on this – but he's certainly within his rights to do it. The electorate can then express their (dis)approval at the next election.

But what does irk me about Albo's decision are the macroeconomic impacts. If he wants to give tax cuts to everyone, then he should really be cutting spending elsewhere to offset the inflationary impacts, given the higher propensity to consume that people in middle- to lower-income brackets tend to have. ANZ estimated that stage 3, as legislated, "are equivalent to about two quarter-point interest-rate reductions". Albo's changes will only increase that fiscal impulse, and the last thing we need right now is more fiscal stimulus during a period of economic growth and elevated inflation. If you were hoping for rate cuts this year, you might want to think again.

However, the biggest issue I have with Albo's stage 3 backflip is the lack of discussion about the decades of lazy governing from both sides of Parliament that got us here in the first place. We desperately need tax reform in this country, but generations of politicians have barely even paid it lip service.

Students of public choice will immediately understand why: the political incentives are too strong in the other direction. What politician wouldn't want the ability to constantly raise taxes by stealth, giving them the ability to offer us mere citizens expensive freebies every few years? It's a sad state of affairs, and we're all worse off because of it, but I honestly don't know how to change the status quo without someone like Javier Milei navigating their way through the Canberra 'swamp' (on that note, it's a real shame Andrew Leigh has been sidelined into Assistant Minister roles by this government).

A fairer way to tax

Taxes are a necessary evil to finance our government and should be raised with as few distortions (i.e., deadweight losses) as possible. While all taxation inevitably creates distortions, they do so to varying degrees. Generally speaking, the most efficient way of raising revenue is with some kind of flat, broad-based consumption or income tax, with targeted transfers made to those less well off, ensuring the tax-and-transfer system remains "fair".

But before you get your hopes up, that model simply won't fly here. In Australia, switching to any kind of consumption tax would be extremely difficult, given that GST revenue is collected centrally but is then fully distributed to the states and territories. Reworking the balance of the nation's taxes and juggling the thorny issue of Commonwealth/State relations would require nothing short of a political miracle.

So if not consumption, what else? Some taxes should just be avoided completely. For example, research from ANU estimates that Australia's 30% corporate tax is considerably less efficient than just about any other tax we collect, creating a deadweight loss of 83 cents per dollar of tax revenue raised, with the excess burden falling mostly on households. That's because it doesn't matter on whom or what you level the tax, but on the tax incidence – on whom the tax ultimately falls. Corporate taxes are paid for with higher prices, lower wages, or reduced dividends to shareholders. They also create an army of tax-deductible lawyers and lobbyists seeking favours and exemptions, when they could be doing something more productive with their time. Yuck.

Unfortunately, the corporate tax itself is a product of our relatively high personal income taxes: in such a regime, it's difficult to cut corporate taxes – if you do, people will simply incorporate to avoid paying tax, even if the optimal corporate tax rate is zero. The federal government also loves the corporate tax, because it can clip another 30% from almost every tonne of iron ore we export; it's not like mining companies can pack up shop and move offshore (to use economic jargon, their assets are highly specific, so are a great target for rent-seekers)!

If you wanted to create a more diverse, dynamic economy, you're never going to achieve that in Australia with its world-leading corporate tax rate. Not unless we get a major commodity bust and politicians are finally forced to reform their way out of becoming a banana republic, anyway.

So we're dependent on personal income and corporate taxes, and that's not likely to change. But we could quite easily make them fairer. Rather than waste countless hours of debate and media sensationalism when the time inevitably comes for the next bracket creep claw back, we could follow Treasury's advice by indexing personal income tax thresholds to average taxable income, thereby offsetting the effect of inflation and productivity. As Treasury reports:

"This leads to an unchanged average tax rate over time and does not change the progressivity of the tax system."

Pick your progressive tax thresholds, link them to average taxable income, and this whole circus goes away. If a future politician wanted to raise income taxes or change the progressivity of the system, they would have to explicitly do so, and be held accountable to the electorate accordingly.

In that alternate reality, instead of debating how to best roll back bracket creep every decade or two, elected officials might have the time and spare political capital to work on reforms to our incredibly inefficient tax system itself. Doing so would increase the size of the entire economy, raise incomes for everyone, and help to lift productivity off its multi-decade lows to boot.

Member discussion