Friday Fodder (1/24)

Here are a few short takes for you to chew over on the weekend, from the week's happenings that probably didn't need a full post.

1. A lot happens at sea that we don't know about

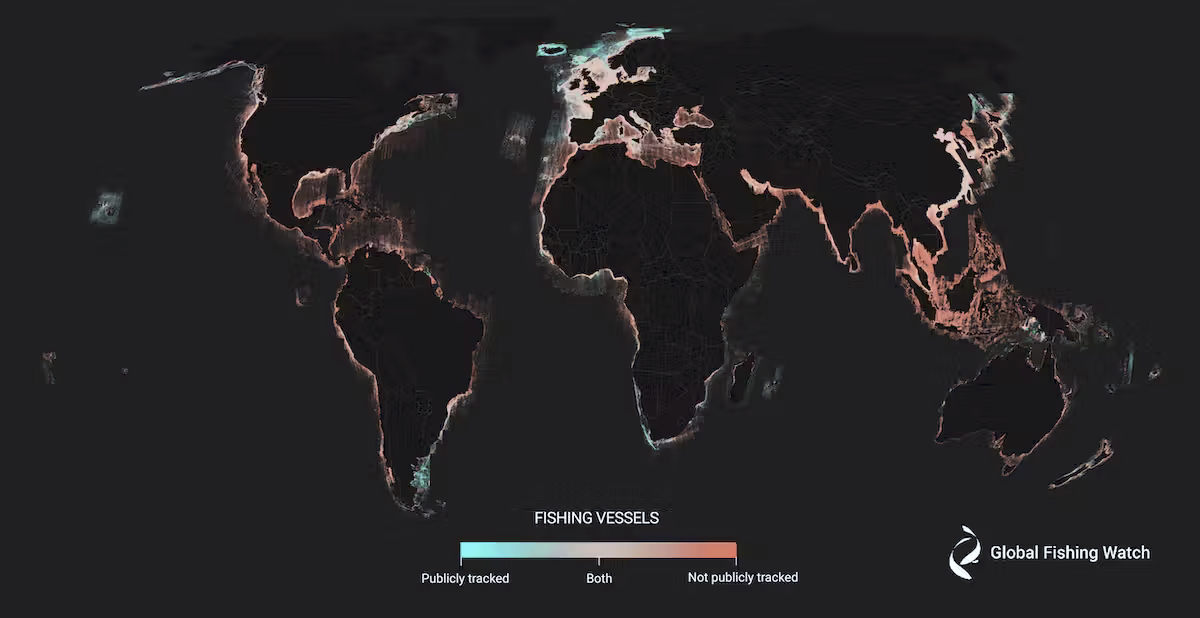

A new study in Nature used satellite mapping to track ocean vessel traffic around the world. They found:

"[T]hat about 75 percent of the world's industrial fishing vessels are not publicly tracked, with much of that fishing taking place around Africa and south Asia. More than 25 percent of transport and energy vessel activity are also missing from public tracking systems."

Most of the world's fishing happens in Asia – around 70%, against just 10% in Europe – although the size of the vessels isn't provided, so it says nothing about the volume of fish being caught.

Nonetheless, it's an interesting discovery that also includes information about offshore structures, such as oil platforms and wind turbines, which was described as "a new industrial revolution... emerging in our seas undetected".

In 2021, wind turbines outnumbered oil platforms for the first time ever, thanks largely to China.

2. Why aren't there more female CEOs?

Is it because of a lack of ability, discrimination, or just because there are few available candidates? Those were the questions asked in a new paper by Li He and Toni Whited, who suggest that it's probably because of the latter:

"Surprisingly, genuine board reluctance toward hiring women as CEOs seems to play a small role. Moreover, our findings indicate negligible actual productivity disparities between male and female CEOs. The primary driver behind the stark gender gap lies in the scarcity of women in candidate pools. This paucity of women implies that search costs are high, and these high search costs are the predominant factor contributing to the underrepresentation of women in CEO roles."

So how do we get more women up the "job ladder"? The paper doesn't have policy solutions, but it's no easy task. Women disproportionately perform tasks such as childcare and tend to self-select away from 'greedy jobs' such as those that lead to a position of CEO, which can demand a lot of time outside of office hours, and often aren't very flexible.

And it's not as simple as paying fathers to stay home – another new study from Sweden found that substituting paternity leave for maternal leave increased the number of separations in families with non-college educated fathers, leading to a decline in the schooling outcomes of boys "and increased intergenerational persistence of human capital by 30 percent".

There's also a documented phenomenon called the gender-equality paradox, where the wealthier we get, the differences between the sexes become more, not less, pronounced.

In other words, it's complicated; no one has an answer that doesn't come with potentially large unintended consequences (and you probably shouldn't believe anyone who says they do!).

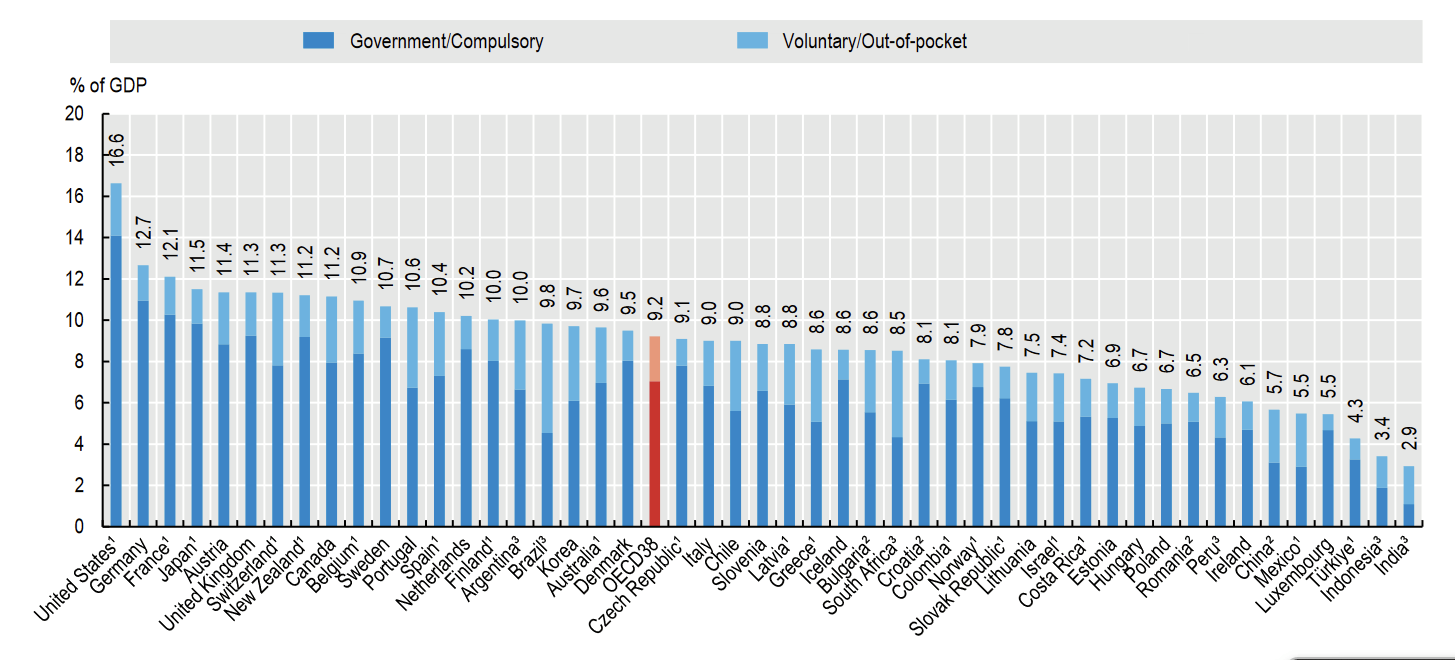

3. How much are we spending on healthcare?

The OECD's health indicators for 2023 provide a nice comparison of healthcare consumption and outcomes between countries. The long and the short of it is, as a share of our economy we spend about the same as the OECD average.

Healthcare in Australia is around 32% more expensive than the average (although it's in-line with our economy-wide price level), but we consume 5% less of it than other countries. We also have some of the best outcomes, such as the 5th lowest rate of avoidable mortality (although that hospital bed count is getting awfully low!), with high rates of survival despite our relatively high cancer levels (thanks, lack of ozone layer).

4. Xi's manufacturing obsession

What do you do when you have an economy that you really, really want to centrally plan, but your last plan blew up in your face? You pivot into something else and hope you can outgrow your previous mistakes:

"Mr Xi’s manufacturing obsession is explained by the need to offset China’s property slump, which is dragging on economic growth. Sales by the country’s 100 largest real-estate developers fell by 17% in 2023, and overall investment in residential buildings dropped by 8%. After a decade in which capital spending in property outstripped economic growth, officials now hope that manufacturing can pick up the slack. State-owned banks—corporate China’s main source of financing—are funnelling cash to industrial firms. In return for an extension of pandemic-era tax breaks and carve-outs for green industries, exporters in powerhouse provinces have been told to expand production. During the first 11 months of 2023 capital spending on smelting metals, manufacturing vehicles and making electrical equipment rose by 10%, 18% and 34%, respectively."

Xi's plans won't do much for the Chinese people; you can be sure that the state-owned banks will funnel a good portion of that cash to their mates' firms, meaning less capital will be available for productive investment in sectors producing things people want.

But with China you have to remember that Xi cares about one thing, and one thing only: ensuring that he, and the Communist Party, remain in power. The best strategy to achieve those ends is not necessarily the one that empowers the middle class.

If Xi is successful – with success here being defined as employing a lot of people by expanding China's 'green' manufacturing output, and exporting most of it to the rest of the world – then China could well usher in another decade or two of disinflationary pressures to the West. The Chinese people will be poorer than they otherwise would have been because of it, but it could make our government's net-zero transition a bit less expensive for Aussie taxpayers (provided we don't do something stupid, like whack tariffs on Chinese goods in 'retaliation').

5. And if you missed it, from Aussienomics

Inflation and Australia's cost-of-living crisis: Stuff is expensive because the RBA kept monetary policy too aggressive for too long, allowing a surge in nominal spending – caused by large, unfunded fiscal spending around the world, including in Australia – to go unchecked. In the near term, the most important thing for Treasurer Jim Chalmers to do is avoid making it worse – stop spending so much and rein in aggregate demand! Alas, the data indicate that he intends to follow the LNP's example by spending as if the country is in a permanent recession.

Are Coles and Woolies ripping us off?: The main reason food is so expensive is because everything is more expensive. Food just happens to be something we spend a lot of our incomes on, and we do it several times a week. When prices go up, we tend to notice. Whatever eventuates from the spotlight being shone at the big supermarkets, I hope the focus stays firmly on the process – that is, ensuring a competitive market for the benefit of consumers. The last thing we need during a cost-of-living crisis is bad policy.

Have a great weekend.

Justin

Member discussion