Friday Fodder (19/24)

1. A glimpse into our Future Made in Australia

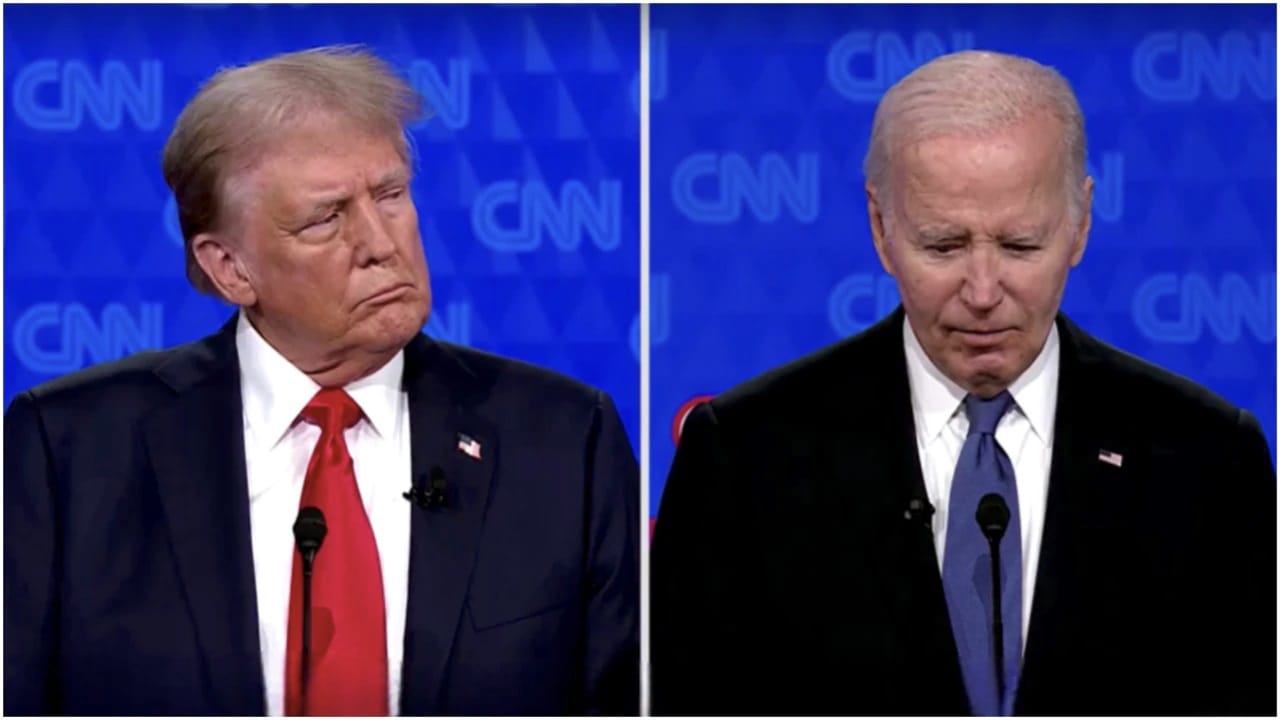

Last week it was Europe, now coming to you from the land of the free is a series of protectionist measures, including 100% tariff on Chinese electric vehicles, courtesy of the tariff man, President Trump Biden:

China's share of the US EV market will fall from a mighty 1% to 0%, given the US already had a prohibitive 27.5% tariff on Chinese EVs, courtesy of Trump.

There is only one word that can explain Biden's move: jobs, because there's certainly no economic justification for these tariffs. And when I say jobs, I mean protecting American manufacturing companies and the union workers they employ in politically strategic regions of the US, at the expense of Chinese producers, American consumers (especially the poor), and in this case, the environment too.

As I've written about previously, it's a good thing we don't make cars in Australia any more. But you can bet your bottom dollar that in a few years, when a Future Made in Australia's biggest losers start realising their business models are unsustainable without taxpayer support, that their cries for protectionism will be just as loud as it is for automakers in the US today. And politicians will comply, either in the name of saving a handful of jobs (Labor government) or local businesses (Liberal government).

But as is always the case with restrictions on trade, consumers will pay for many years to come through being forced to buy more expensive, locally made goods. Everyone (other than the protected industries/their workers) will be worse off.

2. Never write off the Americans

As Adam Smith observed, there's a lot of ruin in a nation. Sure, Biden will raise the cost of cars for Americans, making them just that little bit poorer because they'll never be able to buy a more competitive Chinese EV. But they'll probably still be richer than us, because damn are they innovative:

"Last year applications to form businesses reached 5.5m, a record. Although they have slowed a touch this year, the monthly average is still about 80% higher than during the decade prior to covid, compared with just a 20% rise in Europe. Startups normally play an outsized role in creating employment in America, as elsewhere. By definition, every startup job counts as new, whereas mature companies have more churn. That difference has become even starker. In the four years before the pandemic, established firms added one net job for every four created by startups; in the four years since the pandemic, established firms have actually lost one job for every four created by startups."

Will it last? Time will tell. But I certainly wouldn't write them off.

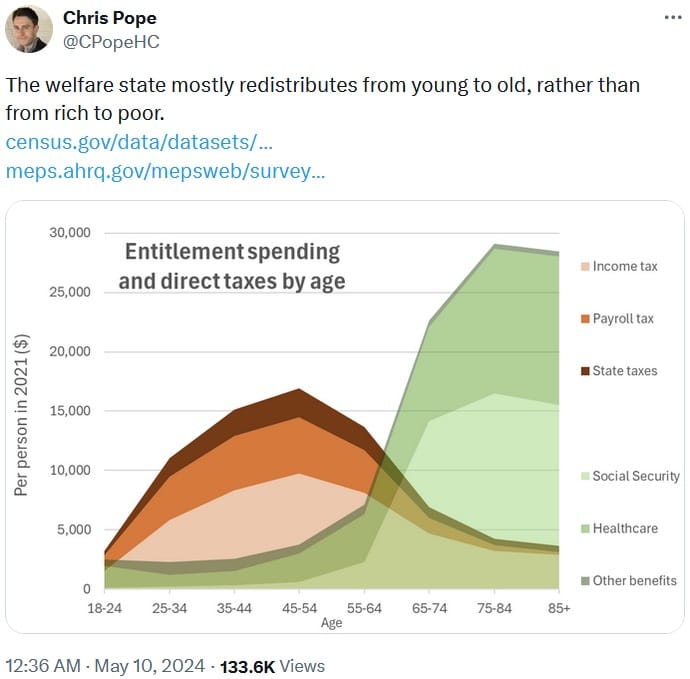

3. The welfare state's beneficiaries

I'm no expert on the welfare state but can only assume that this is also how it works in Australia, given that the Age Pension is ~40% of total welfare spending at the federal level:

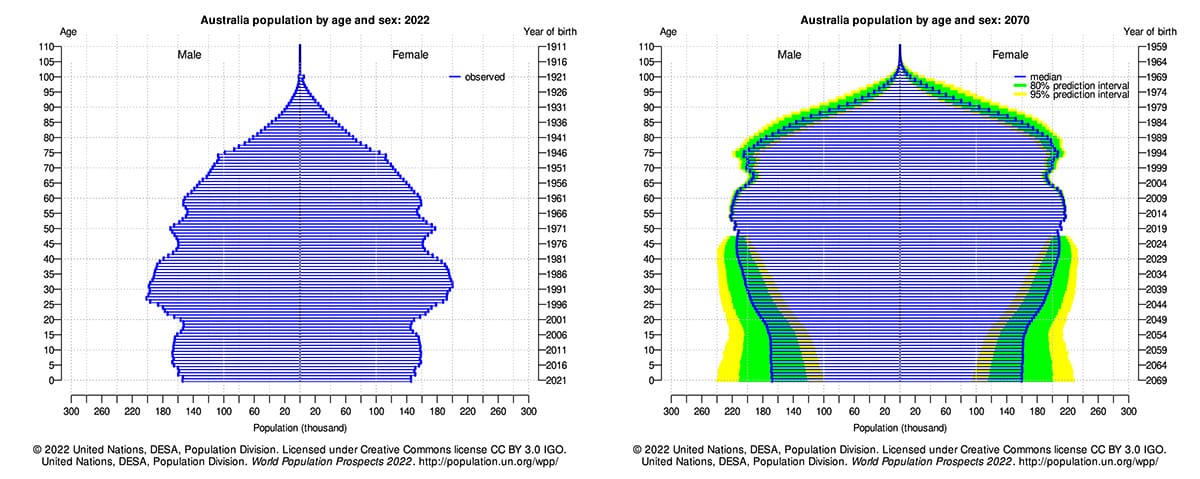

Most of Australia's entitlements – e.g. the Aged Pension, Medicare, Carer, Disability – are funded with general revenue. That's all well and good when the demographic pyramid looks like the left panel below, with most of the population of working (tax-paying) age. But it gets a lot less OK when it begins to look more like the median projections on the right panel.

Food for thought for those considering putting the brakes on migration as a solution to our housing crisis – if we cut that flow off, we're also going to have to cut other things, such as the generous transfers we make to the elderly.

4. The post-pandemic war on prices

In Wednesday's post I nominated Greens housing spokesperson Max Chandler-Mather as the most reckless member of Australia's Club of Bad Ideas. I did that because of his war on prices; specifically, his desire to freeze prices for rentals.

For those wanting to understand why economists hate any kind of price control without having to crawl through some of the journals I linked, there's now an interesting book called The War on Prices, edited by Ryan Bourne, that investigates the essential role of prices in the economy. Containing a collection of essays from no fewer than 19 economists, here is how Bourne describes the rise in popularity of Chandler-Mather-style thinking:

"We've just experienced the first major burst of inflation since the early 1980s. American families are angry that grocery prices rose 21 percent in three years after January 2021, as interest rates for new mortgages and auto loans have surged. Politicians and central bankers have every incentive to blame external forces or greedy businesses, rather than their own macroeconomic stimulus, for these consequences of inflation.

...

Such muddled economic thinking ultimately emboldens calls for more overt price controls. Indeed, we've seen calls for sector-specific price controls and excess profit taxes to deter price hikes, as used in Europe, as well as a congressional anti-price gouging proposal that would have capped prices in the pandemic."

As for Chandler-Mather's rent freeze plan, here's an excerpt from Jeffrey Miron and Pedro Aldighieri's chapter describing what happened when various cities did exactly that:

"In New York City, some old rent-controlled units have become family heirlooms. A woman went viral on TikTok in 2021 after showcasing her redecorated $1,300 a month rent-controlled two-bedroom apartment on the Upper West Side, after inheriting the lease from her parents—a unit that would rent for three to five times as much on the open market. In Stockholm, Sweden, where strict controls have been enforced for decades, the average wait time for a rent-controlled unit was 9 years by 2021 and may now exceed 20 years.

The supply-side response is also consistent with economic theory. In 1994, San Francisco expanded rent control to small multifamily housing, which was previously exempt. One study shows that the supply of rental accommodation from affected landlords fell by 15 percent, with the number of renters living in such units falling by a quarter. The lower profitability of rental units saw many landlords sell such units as owner-occupied condos instead. A 2007 study of the Boston metropolitan area by economist David P. Sims found the flip side: ending rent controls increased the supply of rental housing."

One can't help but wonder if Chandler-Mather's actual goal is to completely destroy the market for housing so that the government can 'step in' and take full control...

5. The Jevons Paradox in artificial intelligence

Large language models (LLM) may not be on the road to sentience but that doesn't mean they're not going to be very useful. Google, for example, is "testing a new feature that uses Gemini Nano to provide real-time alerts during a call if it detects conversation patterns commonly associated with scams".

The LLM is run completely locally on your phone, so it can't 'call home', i.e. there aren't any privacy issues. Australians lost $3.1 billion to scammers last year, so if it works that's certainly a nice little dividend. According to Wharton management Professor Ethan Mollick, such examples are evidence that the text box AI's we're familiar with "are increasingly going to be only one way in which we talk to increasingly ubiquitous AIs":

"I suspect that personal AI use will actually be centred on our phone, though not necessarily through apps. Small, local AIs running on your phone's hardware (something both Microsoft and Apple have demonstrated) can already do much better than Siri at basic assistant tasks, and they can connect to more powerful AIs over the network to handle more difficult requests. For most people, this will be all the AI they need. They can make a request of their local phone AI, and the system will decide how much computing power to put into it. It is a model of ubiquitous AI that does not actually require most users to change habits or devices."

But according to tech entrepreneur and investor Marc Andreesen in a recent interview with Ben Horowitz, artificial intelligence may not reduce the cost of the software powering these and other kinds of gadgets because of what is known as the Jevons Paradox, with a common example being energy: improvements in energy efficiency tend to increase energy use, because lower costs raise demand (e.g. people find more uses for it).

LLMs make software development more efficient, so people will demand more and better software. At some point, all software and all devices may need to have an LLM inside.

6. If you missed it, from Aussienomics

An independent RBA is better than the alternative – An independent Reserve Bank of Australia is crucial for economic stability and low inflation. However, a big-spending Budget and attempts to politicise the central bank would jeopardise its independence, leading to higher inflation.

Let's not make the housing crisis even worse – The government's Budget is unlikely to solve Australia's current housing crisis, which stems from both long-term zoning issues and a recent spike in construction costs. But it could be worse - at least they've avoided reckless ideas like rent freezes, which would devastate the housing market.

Have a great weekend.

Member discussion