Miles off the mark

The Reserve Bank of Australia (RBA) meets tomorrow and is widely expected to keep rates unchanged (markets are pricing in a ~95% chance of no change). Growth in consumer prices may have slowed again, rising 4.1% in the December quarter from a year prior and just 0.6% from the September quarter – on an annualised basis, that would equate to an increase of just 2.4% – but it's still too early for the RBA to claim victory: no one wants to be remembered as the next Arthur Burns!

The slowdown is also slightly misleading. From 20 September, the federal government increased the Commonwealth Rent Assistance by 15% (covering ~1.3 million households), and various federal/state electricity subsidies worked to suppress measured energy prices. The RBA will be well aware of these temporary effects, which were spelled out clearly by the ABS.

"The introduction of the Energy Bill Relief Fund rebates from July 2023 has moderated the increase in electricity bills for households. Electricity prices have risen 5.7 per cent since the June 2023 quarter. Excluding the Energy Bill Relief rebates, electricity prices would have increased 17.6 per cent over this period.

...

Rents rose 0.9 per cent in the December 2023 quarter with the increase moderated by changes to Commonwealth Rent Assistance. Excluding the changes to CRA, rents would have increased by 2.2 per cent in the December quarter 2023."

Rate cuts are coming, just not any time soon

I've previously written that we're unlikely to get a rate cut before the end of this year. Of course, a lot can and will change over the coming months, but with strong fiscal spending at all levels of government, services inflation and nominal wages still growing at over 4% annually, and inflation expectations still at an elevated 4.5% a year from now, it could be quite a while before the RBA feels comfortable enough to change its stance.

Even the Canadian central bank – which is trying to bring down inflation in an economy around 6 months ahead of where we're at (I explained why here) – only last week suggested that "demand pressures have abated", hinting that rate cuts could be coming sometime this year:

"If new developments push inflation higher, we may still need to raise rates. But what it does mean is that if the economy evolves broadly in line with the projection we published last week, I expect future discussions will be about how long we maintain the policy rate at 5%."

But facts rarely stop politicians from opening their mouths, so it was no surprise when some of them called for an immediate cut in Australia's cash rate. The Premiers of three states, Queensland, Victoria, and Western Australia, all hit the media circuit late last week imploring the RBA to act now and cut rates. The most vocal of the three was Queensland's new 46-year-old Premier Steven Miles, who made the below comments on social media.

There are multiple facts wrong with Miles' claims. First, the RBA's cash rate is still high largely because of demand-driven inflation. The RBA erred during the pandemic, leaving monetary conditions too easy for too long. Tighter monetary policy is now working to reduce inflation and ease the pressure on many households.

That's not to say there won't be winners and losers from tighter monetary policy, just as there were winners and losers from the policy of easy money. Generally speaking, those with a large amount of debt at variable rates – such as Miles himself, owner of 3 investment properties in addition to his primary residence, and so one of the biggest beneficiaries of the recent inflation – tend to be worse off when conditions normalise. Starting to see the picture here (incentives matter!)?

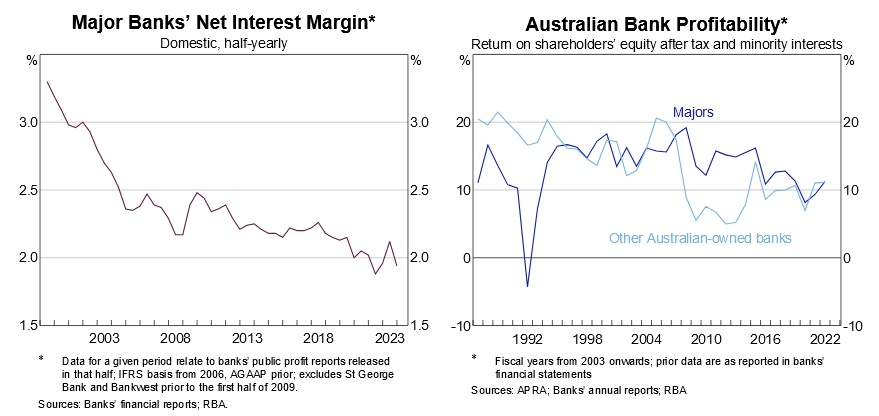

Second, while it's true that banks can cut rates independently of the RBA by reducing their margins, their first responsibility is to their shareholders. The record profits notched up by the banks are in nominal dollars, i.e., not adjusted for inflation, and their margins are at historic lows. Australian banks just aren't that profitable these days.

Not one to stop there, Miles also plans to launch his very own supermarket probe:

"Queensland's state government will launch an inquiry into alleged grocery price gouging – despite the jurisdiction having few powers to combat the issue, the premier said.

The premier, Steven Miles, said terms of reference are being drafted and the committee will be formed in the first sitting week of parliament for the year, next month.

Executives of major supermarkets Woolworths, Coles and Aldi have agreed to appear at hearings after meeting the premier on Thursday, he said."

That's despite the federal government already committing to its own ACCC inquiry into supermarket prices, and the lack of evidence that any gauging has even occurred. But unlike Miles' government, at least the feds have the power to actually do something about it!

Focus on what you can control

Steven Miles is clearly a talented politician: he was elected to Parliament just four years after finishing his PhD on the trade union movement and became Deputy Premier five years later. I get that Miles has only been Premier for a little over a month and has an election coming up in October; he's trailing in the polls and wants to be seen "doing something".

But so far, his policy talk and actions have been quite inadequate. Instead of wasting scarce resources on issues over which he has no control – and could be causing harm by firing up the mob against independent institutions such as the RBA, which needs all the credibility it can get right now – he should really try to stay in his lane a bit more.

After all, it's not as if there aren't plenty of issues in Queensland he can solve! Like other states and territories, Queensland has a housing affordability problem. Yesterday, Miles announced a package that:

- bans landlords from accepting higher rental bids than the advertised price and applies an annual limit for rent increases to the rental property not the tenancy;

- provides $160 million rental relief over five years, such as bond loans, rental grants and rental security subsidies;

- devises as portable bond scheme, allowing tenants to transfer their bonds when relocating; and

- creates a framework to allow landlords and tenants to agree to modifications as well as a prescribed form for rental applications and 48 hours entry notice.

Only 3 and 4 are good ideas that will improve the efficiency and equity of the rental market in Queensland.

Point 1 might sound good to those looking for a property to rent, but it's not going to help. For example, to compensate for the lack of 'rent bidding', landlords may respond by listing properties at higher prices to begin with. They may start to discriminate in ways other than price (character, up-front payments, pay to view, pay to apply), making harder for 'difficult' tenants (e.g., those with pets, disabilities, or limited savings) to find a place. Some landlords might just decide it's all too hard, or they're too far behind the annual rental increase limit to make a new lease worthwhile, and withdraw from the long-term rental market entirely, with the reduction in supply raising average rents for everyone else.

Finally, these changes will decrease the efficiency of the entire market, leading to higher average listing durations. Some landlords will inevitably incorrectly price their properties too high, and Miles has removed a key way to maintain equilibrium (match supply and demand) in the housing market. Just like how all tenants are different, rental properties aren't all Big Mac's; they're all unique, even those in the same price range. Price discovery has an important role to play in the tenant:landlord matching process.

Point 2 is a pure demand-side measure, which will raise average rental prices as landlords seek to capitalise on the heightened demand. You must remember that housing supply doesn't scale up quickly; the response will take time, if it comes at all (zoning laws make housing supply quite inelastic in this country). For every person that receives these rental benefits and can now afford a slightly better rental property, there will be someone just above their income level who is not eligible and is now displaced. Worse, most of the benefits will accrue to landlords, not tenants, given it does nothing to address supply constraints.

It shouldn't be this hard

Look, I don't want to be too harsh on Miles for doing something about housing, even if many of his recent policy decisions won't... do anything to improve the housing market. It's better than him weighing in on monetary policy or supermarket prices!

Incidentally, the above package followed from last week's 20% funding increase for specialist homelessness services. At the time, Miles also launched an independent review to "look at opportunities for improvement across the sector". Better than nothing? Sure. But Queensland doesn't need yet another rental, housing or homelessness review. The reason there's a rental crisis and homelessness issue at all is because state and local governments haven't allowed people to build enough housing, so demand has rapidly outpaced supply.

I'll save Miles some time and tell him what the expensive review should report back: let people build more housing! It really shouldn't be this hard.

Member discussion