Friday Fodder (28/24)

The Olympics are here, but are they worth it; it's time to stop flogging the greedflation horse; why real wages haven't risen; the future of AI; nuclear is back everywhere except Australia; and an accidental experiment in geoengineering.

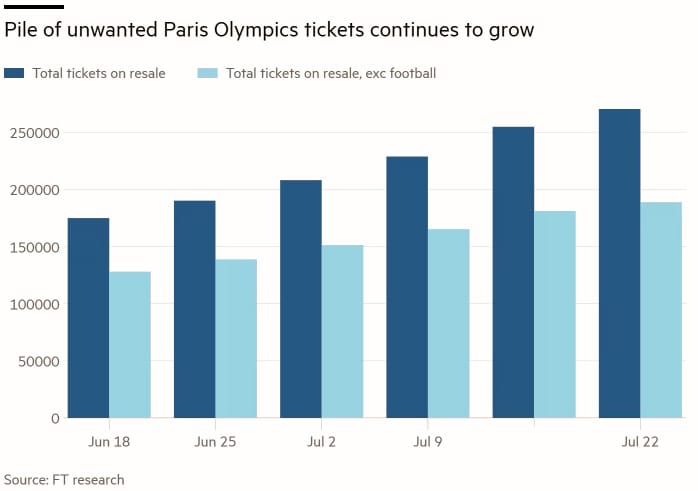

The Paris Olympics have officially kicked off amidst a flurry of stories about athletes, fans and media being assaulted and robbed throughout the city. Apparently, organisers have also been having trouble getting people to show up to many events:

"The number of unwanted Paris Olympics tickets available for resale has hit more than a quarter of a million, as lack of demand increases concerns just days before Friday’s opening ceremony that many athletes will compete against a backdrop of empty seats."

It's not working out all that well for Paris, which as the host city forked out an estimated €8.9 billion for the privilege:

"Although organisers expect 15mn visitors during the Games, hotels and apartment owners looking to capitalise on Olympic demand have already been forced to temper their expectations. Many began lowering prices earlier this year to drum up bookings, while airlines have warned that the Games had suppressed the usual summer appetite for holiday trips to the French capital. Meanwhile, millions of Parisians are expected to flee the city during the Games."

French businesses are also struggling, with Air France expecting to lose about €200 million, and according to reports, "just 24 hours before the opening ceremony the French capital's streets and restaurants remain empty as more residents work remotely or have left the city, while tourists have yet to show up".

Look, I love sports as much as the next bloke. But I'm also keenly aware of trade-offs; sometimes it just doesn't make sense to host something, even if it's the Olympics. So, here's your friendly reminder that it's not too late to pull out of hosting Brisbane 2032!

Firms are less greedy again

It looks like businesses have stopped being so greedy:

"Overall prices fell in June from a month earlier. And burger lovers may soon especially benefit from this largesse, because fast-food chains have begun mobilising for the 'value menu wars'."

Phew! But in all seriousness, that's exactly what any decent economist would have predicted following the pandemic's fiscal and monetary policy splurge:

"During the pandemic, consumers were unusually flush with cash. This was a consequence of forced savings (people were stuck at home, forgoing travel and fine dining) as well as generous fiscal policy (e.g., stimulus checks from both the Trump and Biden administrations). When that high household demand collided with stuck supply chains, businesses raised prices.

That is, businesses of all types, from mum-and-pop shops to multinationals, reacted to long lines of customers combined with higher costs by raising what they charged. If they hadn't, they'd have been left with endless empty shelves.

The aggregate amount of greed in the economy hadn't suddenly spiked. Companies didn't start caring about making money again. The explanation is more banal: Demand exceeded supply."

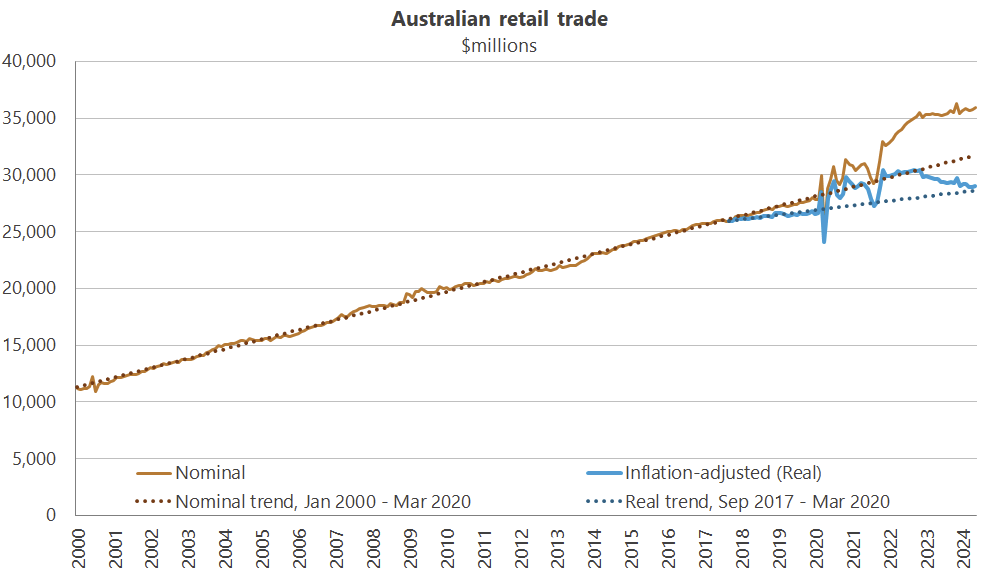

We're a bit behind the US, but inflation-adjusted retail spending in Australia has now fallen back to the pre-pandemic trend:

The level of nominal spending remains elevated because of the one-time increase to the price level caused by discretionary fiscal and monetary policy. The RBA doesn't want to cause deflation, so it will remain at that higher level and probably continue marching forward on something resembling the pre-2020 trend.

These data are yet another signal that inflation is behind us and the RBA should hold steady, even if measured inflation ticks up a bit in the coming months due to various lags. It should also put to bed the idea that 'greedflation' caused the post-pandemic inflationary surge, even though some – such as the Australia Institute – continue to flog that dead horse.

Where did the wages go

While I'm on the subject of inflation and the pandemic, Stanford's Steven Davis recently published a new working paper looking at wages in 2022-23. Specifically, the recent "sharp disinflation" and lack of real wage growth despite a tight labour market. It's especially interesting because the same thing basically happened in Australia, although the magnitude of the slowdown depends on how you measure it.

According to Davis, one reason why real wages didn't grow is because they weren't being measured properly. Working from home (WFH) is very valuable to many people, both financially (less travel costs, cheaper housing) and in terms of utility (flexibility, care-giving), so they were willing to accept a lower monetary wage in exchange for the privilege. For example:

"[T]he relaxation of locational constraints afforded by WFH can simultaneously raise real worker wages and lower real product wages. To see this point, consider an employee who accepts a ten percent nominal wage cut in exchange for performing his job remotely and re-locating to another city with living costs that are twenty percent lower. In this example, the employee's real wage rises by about ten percent and the employer's real cost of securing his labour services falls by ten percent. Both employer and employee benefit."

According to Davis, such exchanges explain some of the "restraints" on real wage growth over the past few years:

"[T]he big shift to WFH lowered average wage growth by two percentage points from spring 2021 to spring 2023, and it likely exerted downward pressure on wage growth outside of this time interval as well.

...

By exerting downward pressure on wages and other labour-related costs, these developments eased the way for a sharp reduction in inflation with no rise in unemployment – even before the effects of monetary policy tightening added to the disinflationary pressures."

I'm speculating, but this could also be one reason why most of the measured real wage growth since the pandemic has been among the lowest-wage workers, most of whom probably aren't working from home.

Open sourcing the future

Facebook owner Meta has been flying solo in its approach to AI, opting to open source its model weights in the hope that its model – known as Llama – will be the platform on top of which people build products:

"Our vision is to go beyond the foundation models to give developers access to a broader system that gives them the flexibility to design and create custom offerings that align with their vision."

This week it released Llama 3.1, which is competitive against closed source frontier models, including GPT-4o. Mark Zuckerberg wrote an accompanying essay explaining his thinking:

"We want to invest in the ecosystem that’s going to be the standard for the long term. Lots of people see that open source is advancing at a faster rate than closed models, and they want to build their systems on the architecture that will give them the greatest advantage long term."

Zuck also gave an interview on X, in which he elaborates on that reasoning, specifically how he has been burned on mobile by Apple who "apply different rules to limit what we can do".

Basically, Zuck doesn't want an Apple to control the AI ecosystem like it does on the iPhone. He wants companies to be free to build and experiment, shipping what they want – not what an Apple equivalent tells them is acceptable.

As for the security risks of open sourcing AI, or giving rivals like China a leg up? Zuck believes the bigger risk is to keep it all closed:

"The United States' advantage is decentralized and open innovation. Some people argue that we must close our models to prevent China from gaining access to them, but my view is that this will not work and will only disadvantage the US and its allies. Our adversaries are great at espionage, stealing models that fit on a thumb drive is relatively easy, and most tech companies are far from operating in a way that would make this more difficult. It seems most likely that a world of only closed models results in a small number of big companies plus our geopolitical adversaries having access to leading models, while startups, universities, and small businesses miss out on opportunities."

I'd be shaking in my boots if I were OpenAI, although it seems like founder Sam Altman will be just fine no matter what happens. Who knew running a non-profit would pay so well!

By the way, you can try Llama 3.1 for free here, or via a mirror here (no sign in required on the latter).

Nuclear is back

Everywhere except Australia, that is:

"It's a remarkable turnaround. A few years back, nuclear power in America was comatose: there weren't many approvals for new plants, and the few projects that got greenlit faced huge cost overruns. During this century, only three new nuclear reactors have been built. Some projects cost billions and were never finished. Some ended up with their executives facing criminal charges following allegations of financial misconduct.

...

Wind and solar power enjoy excellent PR, no doubt, but they've failed to show they can reliably decarbonise grids. The administration is right that only nuclear power can offer enough power affordably enough to make the 'energy transition' more than a slogan."

That's from an essay by Guido Núñez-Mujica, who was full of praise of the Biden administration's (remember, Biden is still President until January!) recently-signed comprehensive nuclear energy bill.

But the comeback looks like it could be thwarted by the "older generation of Democratic party activists [that] cut its environmental teeth on the anti-nuclear beat", who are "denying permits to companies seeking to build new plants".

So, basically today's Labor party in Australia, and the Liberal party until recently. I imagine that we'll have similar issues here even if Peter Dutton secures a majority at the next federal election (unlikely). Our state governments are all against it, and I can only imagine local governments – which are generally opposed to more housing, let alone a nuclear power plant – will fight it to the bitter end, raising uncertainty so much that nuclear remains prohibitively expensive.

It's a well-trodden and entirely predictable strategy:

"There's no end of rhetorical tricks you can turn to if you're dead-set against nuclear. Critics harp on the long delays and substantial cost overruns those few recent nuclear projects have faced, never quite accepting that it's their own NIMBYism that, in many cases, causes the delays and forces the cost overruns. Too often, opponents have pushed regulations that make nuclear projects much more expensive than they need to be, then turn around and use the expense as an argument against nuclear power."

Yeah, that's basically how politics works in Australia, too. It's perhaps the biggest argument against nuclear: that we'll just bicker and self-sabotage so much that it's uneconomic, so why bother?

Meanwhile, even the prospect of nuclear is reportedly slowing down Labor's renewables transition, which itself has suffered from NIMBYism and environmentalists blocking the roll-out, including by its own Ministers:

"Erwin Jackson, policy director at the Investor Group on Climate Change, said he had also heard concerns from investors.

'The recent lack of bipartisanship on the least-cost pathway to net zero is causing investors to re-evaluate projects and also potentially put on hold new investment', he said."

I'm not so sure; the Liberal party has said that its plan for nuclear is for it "to work in partnership with renewable energy and gas as part of a balanced energy mix".

I think what any investor trepidation shows is just how dependent renewables are on subsidies. Renewables out-compete coal and nuclear when they are able to produce (almost zero short-run marginal costs), so there's no reason why investors would be pulling the plug just because nuclear might be on the horizon. If anything, it would mean less competition – fewer renewable generators to compete when the sun is shining and the wind is blowing.

It's more likely that the reason for their nervousness is they're worried a Liberal-led government will cut their generous production subsidies.

An accidental experiment in geoengineering

If you had a policy that reduced pollution but worsened climate change, would you pass it? The International Maritime Organisation (IMO) did just that in 2020, perhaps unaware of the trade-off, in what was the world's first major accidental experiment in geoengineering:

"The regulation, shorthanded as IMO 2020, cut the maximum level of sulphur in shipping fuels for all vessels, container ships, and cruise ships alike, from 3.5 percent to 0.5 percent with the goal of cleaning the air in ports and the communities around them, potentially saving hundreds of thousands of lives each year.

It worked. Measurably lower levels of ammonia and sulphur dioxide dirty the air around many ports, and the majority of shipping fuel tested by the organisation comply with the limits. Yet, it's had the unintended consequence of ramping up near-term global warming."

It turns out we were accidentally cooling the planet by emitting sulphur dioxide from ships, which created "aerosols that reflect sunlight while also making clouds brighter". By stopping that practice, we reversed that bit of accidental geoengineering, causing the "clouds [to] darken. The planet absorbs more sunlight, and land, air, and water heat even faster than before".

Advocates have written the IMO asking it to amend the regulations, including "to consider allowing vessels to burn dirtier fuel on the high seas, far from population centres". That way lives are still saved, but the impact on climate change is lessened. Alas for its part, the IMO "only considers regulations when they are raised by member states", so it looks like the planet will just have to get a little bit warmer.

As economist Thomas Sowell would say, there are no solutions, only trade-offs!

If you missed it, from Aussienomics

Where's the efficiency? – A post in which I dig into everything efficiency-related, such as health care and the NDIS, productivity, the recent employment report, the Critical Minerals Strategy, green hydrogen, what it all means for inflation and what can be done to improve it.

Don't bet against betting markets – Betting markets may lean towards Trump over Harris, but it's so close that it could still go either way. Lots discussed in this one, including that each Presidential candidate actually have a lot of similarities but also a few key differences, and what it all means for Australia.