A sticky, stagflationary mess

The Swiss National Bank (SNB) became the first advanced economy central bank to cut its cash rate last week, from 1.75% to 1.5%, after its "the fight against inflation" had proven to be "effective":

"For some months now, inflation has been back below 2% and thus in the range the SNB equates with price stability. According to the new forecast, inflation is also likely to remain in this range over the next few years."

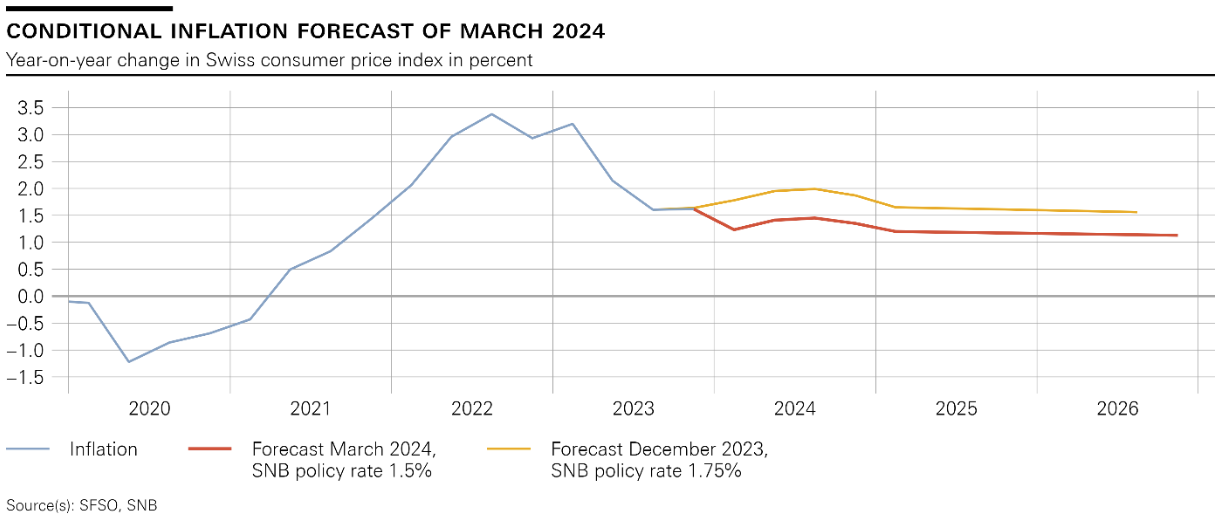

Here's a helpful chart showing the SNB's latest inflation forecast (red line), which it expects to remain below 2% despite the reduction in the cash rate:

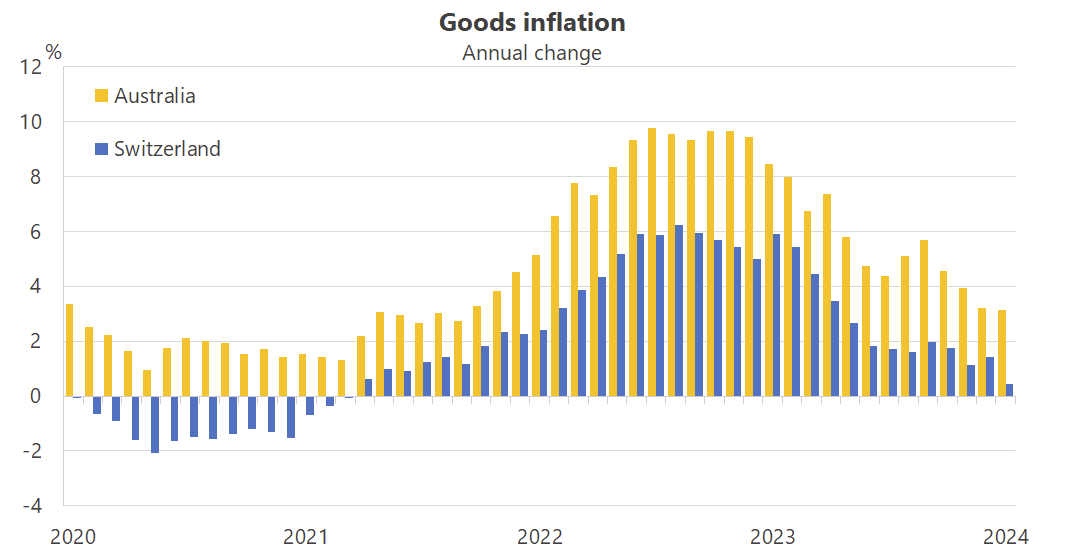

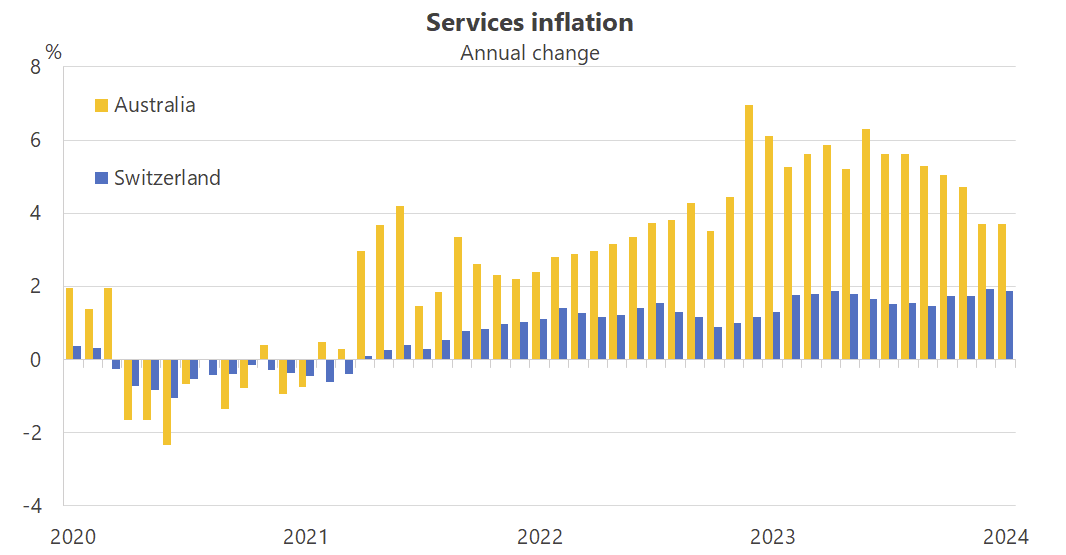

According to the SNB, the slowdown in goods inflation has driven headline inflation back below 2%, while "higher prices for domestic services" remain an upward force. The appreciation of the Swiss franc in real terms, due in part because the SNB had been actively selling its large holding of foreign exchange, also helped to moderate inflation:

"Tightening monetary conditions in this way had various advantages. First, the appreciation of the Swiss franc significantly weakened the transmission of inflation from abroad. The increase in inflation in Switzerland was therefore considerably smaller than in other countries. Second, we had to raise our policy rate only moderately by international comparison. This also prevented a stronger rise in the mortgage reference interest rate."

To give you an idea of how that compares with Australia, over the past two years the Australian dollar has gone from buying around 69.5 Swiss francs to 58.4, or a depreciation of 16% – similar to what we've lost against the US dollar (about 15%). The stronger exchange rate in Switzerland was one reason why goods inflation didn't take off to the same extent as it did in Australia: a weaker currency in an economy such as Australia, according to the RBA, "will contribute to a higher level of consumer prices in Australia".

But Switzerland also experienced considerably less services inflation than Australia. Compared to January 2020 (i.e. pre-pandemic), services prices are just 3.9% higher in Switzerland compared with an 11.8% rise in Australia. In other words, prices here rose around three times faster than they did for the Swiss. That ratio was similar for goods inflation, with 19.4% growth in Australia versus 8.2% for the Swiss, making our increase around 2.4 times greater.

Australia's inflation was inevitable

For me, that's a tick for the fiscal theory of the price level: the additional pandemic spending done by governments in Australia was about 18.5% of GDP (as at September 2021), while Switzerland's governments spent less than 8% of their GDP – or a ratio of roughly 2.3 to 1. When you spend nearly 20% of your GDP on cash handouts or equivalents (e.g. JobKeeper), much of it financed with newly printed money, you shouldn't be surprised when you get inflation.